Saturday's front page: High street banks must do more for savers, says BoE Governor TomorrowsPapersToday Latest by jessiehewitson:

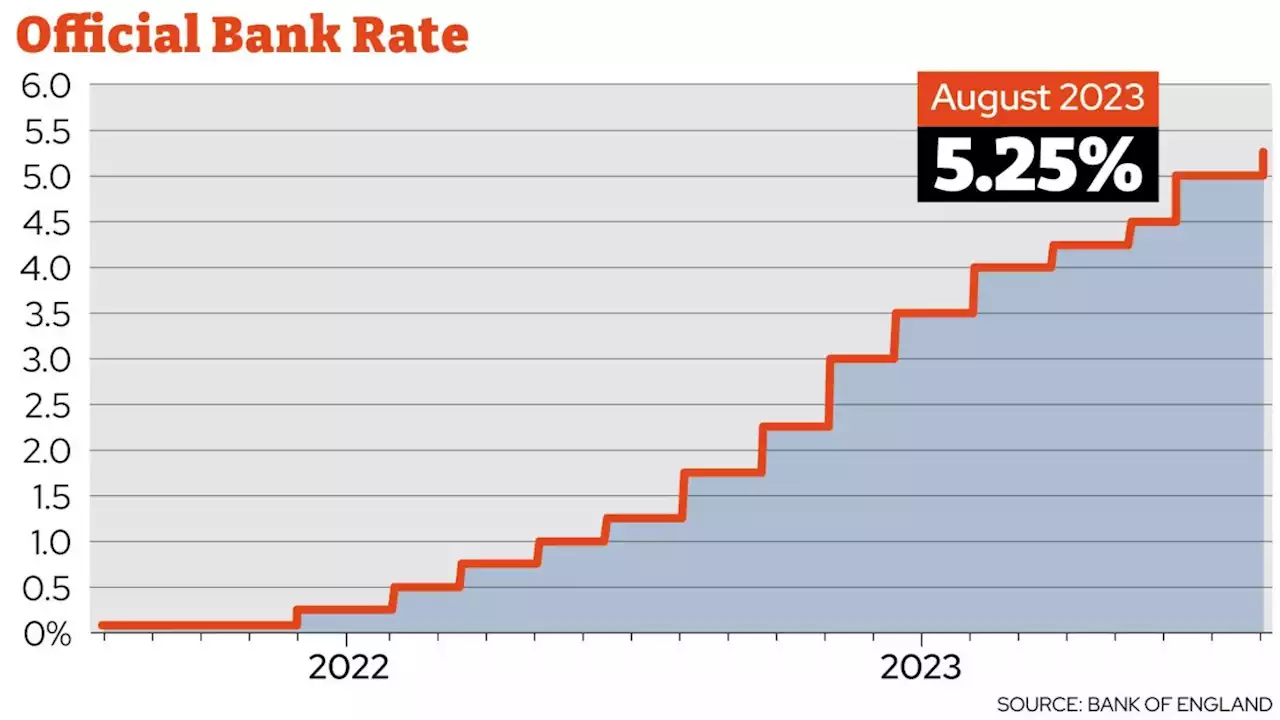

for the 14th consecutive time, to 5.25 per cent, Andrew Bailey backed the FCA’s action against banks and building societies.readers, the Governor said the lenders’ failures to pass on rising rates to savers “raised a question about fairness to customers” and that “there needs to be effective competition for deposits”.

Mr Bailey said: “The rates offered for fixed-term savings have risen by much more than those for instant access savings accounts. It came after high street banks and building societies, including NatWest, Lloyds, Barclays and HSBC were summoned to a meeting with the regulator over their savings rates.

HSBC chief executive, Noel Quinn, said the group was “trying to get the balance right between savings and mortgages”. A Barclays spokesperson said: “With just a few taps on the Barclays app, customers can open a Rainy Day Saver at five per cent and/or a Blue Rewards Saver at three per cent.” Conservative chair of the Treasury Select Committee, Harriet Baldwin, said the earnings figures revealed this week show major lenders are not doing enough for savers.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Interest rates will stay high for three years Bank of England warns, piling on mortgage painHomeowners face three years of sustained mortgage pressure due to years of projected high interest rates, with Chancellor Jeremy Hunt leaving the door open to more support for families

Interest rates will stay high for three years Bank of England warns, piling on mortgage painHomeowners face three years of sustained mortgage pressure due to years of projected high interest rates, with Chancellor Jeremy Hunt leaving the door open to more support for families

Weiterlesen »

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Weiterlesen »

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

Weiterlesen »

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Weiterlesen »

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Weiterlesen »

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Weiterlesen »