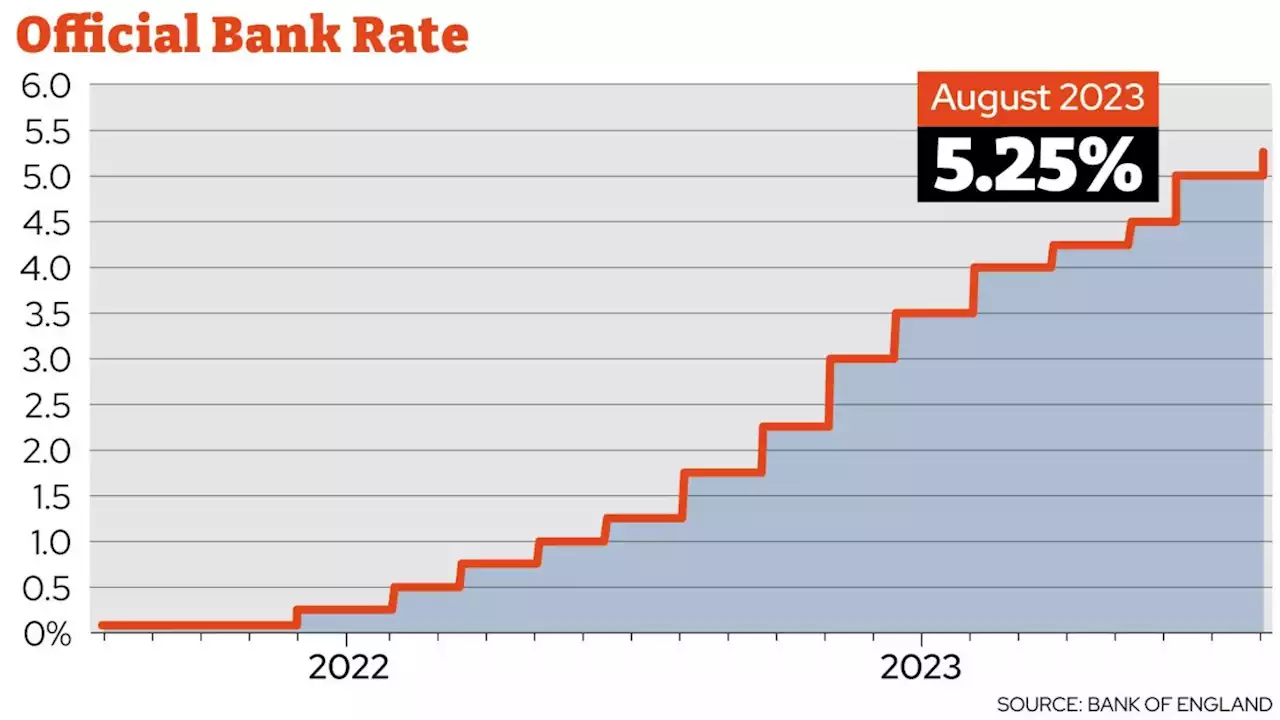

MILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

The slowing market has had a knock-on effect on a number of housebuilders and builders’ merchants who have flagged much weaker demand for properties.

Lloyds Banking Group, the UK's biggest lender, said its customers who will be fixing to a mortgage deal over the rest of the year could face an average £360 increase in their monthly repayments.There are 639,000 residential tracker mortgages outstanding. But rates for any future loan could be higher, and lenders could increase the rate on credit cards and overdrafts - although they must let you know beforehand.The averageSavers could get some further relief as banks continue to battle it out by offering market-leading interest rates., especially after a long stretch of getting very low rates on their money.

Right now, savers can get up to 4.55% in easy-access savings accounts and up to 6.1% in certain fixed bond accounts, according to MoneyFactsCompare.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Rishi Sunak tells homeowner facing £2,700 monthly mortgage repayments: 'Talk to your bank'The Prime MInister has told a father-of-four facing a huge hike in his mortgage payments to simply “talk to your bank.”

Rishi Sunak tells homeowner facing £2,700 monthly mortgage repayments: 'Talk to your bank'The Prime MInister has told a father-of-four facing a huge hike in his mortgage payments to simply “talk to your bank.”

Weiterlesen »

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Weiterlesen »

Sarah Breeden appointed deputy Bank of England governor\n\t\t\tGet local insights from Lisbon to Moscow with an unrivalled network of journalists across Europe,\n\t\t\texpert analysis, our dedicated ‘Brussels Briefing’ newsletter. Customise your myFT page to track\n\t\t\tthe countries of your choice.\n\t\t

Weiterlesen »

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Weiterlesen »

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

Weiterlesen »

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Weiterlesen »