ETH stakers bucked many analysts' predictions by not causing a mass sell off. This bodes well for the future of Ethereum's growing staking economy, danielgkuhn writes for 'The Node' newsletter. Opinion.

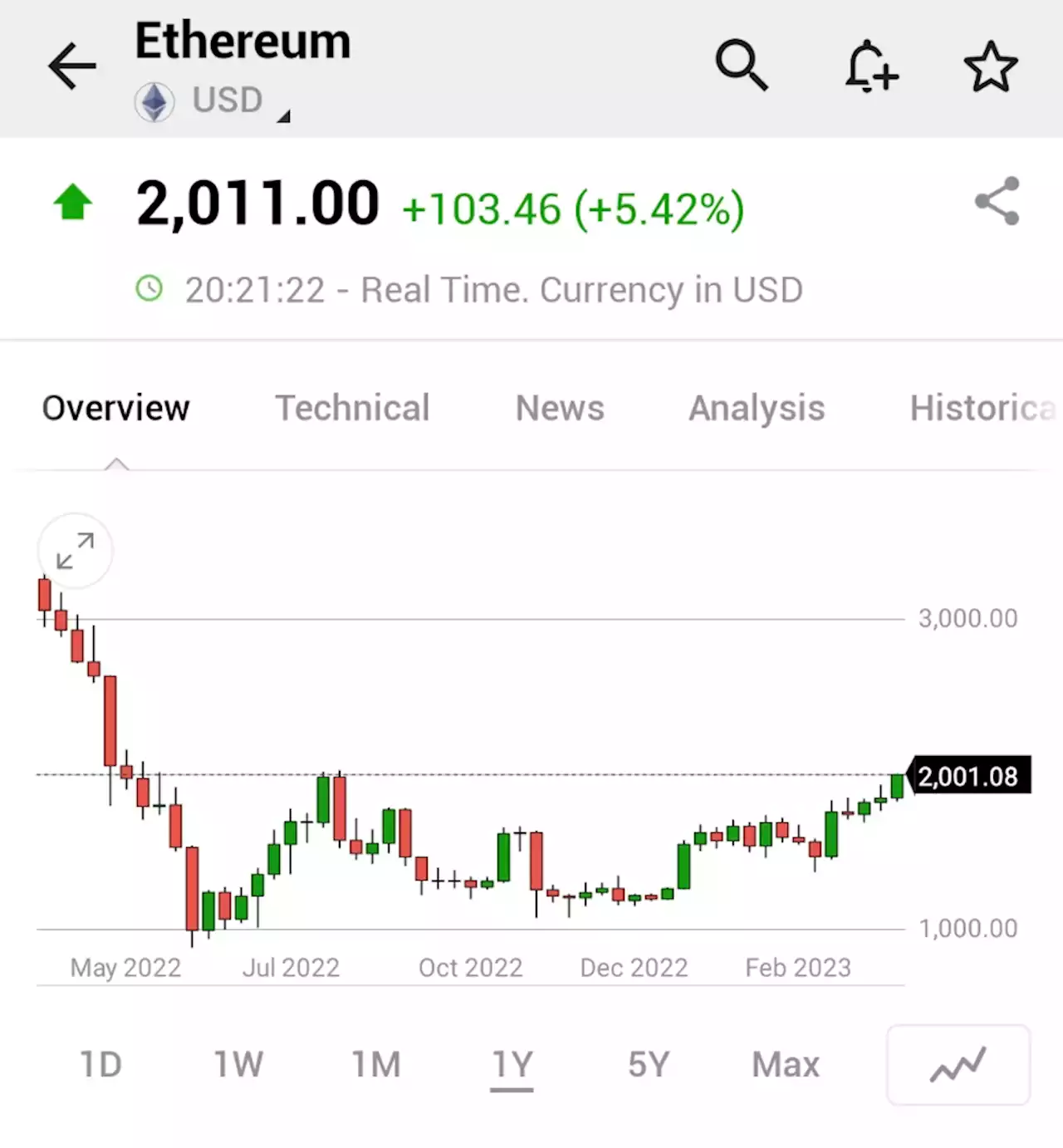

Going by the numbers, it seems like many ether stakers have decided to hold onto their coins. Although several analysts predicted the just-completed Ethereum Shanghai hard fork would be a “sell-the-news” moment, ETH has actually climbed to eight-month highs. The second-largest crypto by market capitalization was trading above $2,000 for the first time since last summer, after gaining ~3% during trading hours in Asia.

What this says about the viability of Ethereum and the outlook for the price of ETH is an open question. Shanghai, the backwards-compatible hard fork, unlocked the ability for Ethereum stakers to withdraw tokens they pledged to the Ethereum deposit contract used to validate the proof-of-stake network as well as the token payments they received for doing so. Many stakers initially pledged 32 ETH to become validators in 2020, and haven’t really had access to their coins since.

This article is excerpted from The Node, CoinDesk's daily roundup of the most pivotal stories in blockchain and crypto news. You can subscribe to get the fullSo the 18 million-plus ETH currently staked has not led to a torrent of sales. Loyal CoinDesk readers likely knew the. As Amphibian Capital CEO James Hodges wrote on Monday, the vast majority of ETH validators were in the red leading up to the event, making it unlikely they’d cash out at a loss.

What’s most interesting for many is not how ETH tokens trade, but their synthetic counterparts known as “liquid staking derivatives.” These LSDs, as they’re often called are essentially bearer instruments for staked ETH that allow users to trade an ETH proxy while still earning staking rewards. The biggest offerings from Lido, Rocket Pool, Frax and Stakewise all hit the market relatively recently. The question post-Shanghai is what role these assets will play.

The Shanghai update shows that Ethereum developers are continuing to successfully build out a network in real-time. Basic infrastructure is still being built on the main network, leaving opportunities for free-market alternatives to spring up in the wake. Initially allowing ETH stakers to participate in decentralized finance , the total value locked in LSDs actually

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Ethereum Price | Ethereum (ETH) Coin Value - Investing.comLive Ethereum coin price (ETH) including charts, trades and more. Create real-time notifications and alerts to follow any changes in the Ethereum value.

Ethereum Price | Ethereum (ETH) Coin Value - Investing.comLive Ethereum coin price (ETH) including charts, trades and more. Create real-time notifications and alerts to follow any changes in the Ethereum value.

Weiterlesen »

Here's What Ethereum (ETH) Whales Are Doing Hours Ahead Shanghai UpdateOne of biggest updates in history of network is around corner, and professional traders are taking all necessary measures

Here's What Ethereum (ETH) Whales Are Doing Hours Ahead Shanghai UpdateOne of biggest updates in history of network is around corner, and professional traders are taking all necessary measures

Weiterlesen »

Ethereum (ETH) Shanghai Might Have Little Effect on Price: GlassnodeExperts at Glassnode, leading on-chain analytics team, shared their analysis of much-anticipated Shanghai upgrade and its potential effects on ETH price

Ethereum (ETH) Shanghai Might Have Little Effect on Price: GlassnodeExperts at Glassnode, leading on-chain analytics team, shared their analysis of much-anticipated Shanghai upgrade and its potential effects on ETH price

Weiterlesen »

Ethereum price metrics hint that ETH might not sell-off after the Shapella hardforkEthereum price is holding steady going into today’s Shapella hardfork, but noshitcoins says the real signal to keep an eye on are requests to unstake.

Ethereum price metrics hint that ETH might not sell-off after the Shapella hardforkEthereum price is holding steady going into today’s Shapella hardfork, but noshitcoins says the real signal to keep an eye on are requests to unstake.

Weiterlesen »

Ethereum Shanghai Upgrade Will Be a ‘Game Changer’ for ETH Token Holders, RockX CEO Says.rockx_official CEO czhuling says Ethereum's Shanghai upgrade will be a game changer for $ETH token holders and will mark the first time the network will have a long-term market-risk-free yield curve. _franvela reports

Ethereum Shanghai Upgrade Will Be a ‘Game Changer’ for ETH Token Holders, RockX CEO Says.rockx_official CEO czhuling says Ethereum's Shanghai upgrade will be a game changer for $ETH token holders and will mark the first time the network will have a long-term market-risk-free yield curve. _franvela reports

Weiterlesen »

$100 Million Ethereum (ETH) Entered Circulation After Unlock: Here's How Price ReactsDespite significant unlock, $ETH remains unfazed, but the parity between staking inflows and outflows is still not there

$100 Million Ethereum (ETH) Entered Circulation After Unlock: Here's How Price ReactsDespite significant unlock, $ETH remains unfazed, but the parity between staking inflows and outflows is still not there

Weiterlesen »