The national average mortgage rate dropped slightly this week, not yet affected by the Federal Reserve’s latest interest rate hike.

CLEVELAND, Ohio —

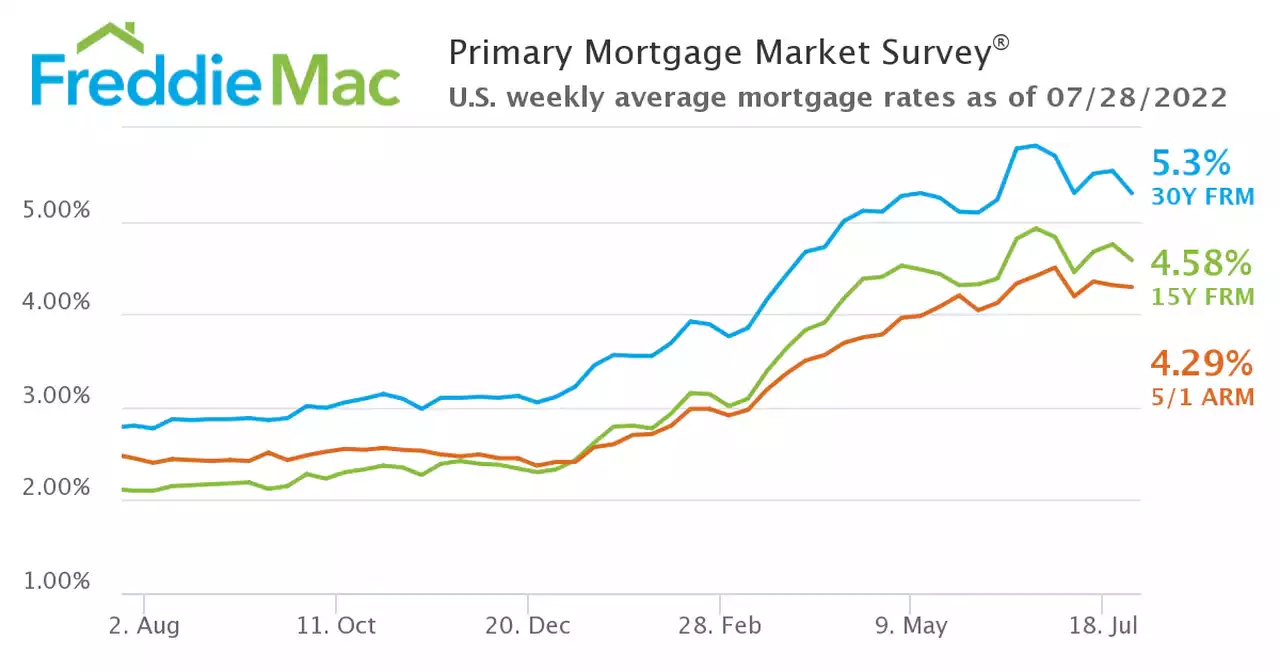

Rates are up more than two percentage points since Jan. 1, but they’ve remained relatively steady over the last few weeks. Data from Freddie Mac comes out on Thursdays. The organization said the average was recorded before the Federal Reserve announced Wednesday afternoon that it would raise its benchmark rates.Freddie Mac economist Sam Khater said the hot housing market is clearly cooling down.

The National Association of Realtors said existing home sales were down in June, according to data released July 18. Sales were down 5.4% compared to May and down 14.2% compared to June 2021.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

How the Federal Reserve's rate hikes affect your financesHigher mortgage rates have sent home sales tumbling.

How the Federal Reserve's rate hikes affect your financesHigher mortgage rates have sent home sales tumbling.

Weiterlesen »

How the Federal Reserve’s rate hikes affect your financesHigher mortgage rates have sent home sales tumbling.

How the Federal Reserve’s rate hikes affect your financesHigher mortgage rates have sent home sales tumbling.

Weiterlesen »

Pending Home Sales Plunge In June As Demand Is Weighed Down By Surging Mortgage RatesPending home sales—a leading indicator for housing market activity—plunged by a more than expected 20% in June compared to a year ago, according to new data from the National Association of Realtors.

Pending Home Sales Plunge In June As Demand Is Weighed Down By Surging Mortgage RatesPending home sales—a leading indicator for housing market activity—plunged by a more than expected 20% in June compared to a year ago, according to new data from the National Association of Realtors.

Weiterlesen »

Mortgage Demand Declines Further, Even as Interest Rates Drop a BitMortgage demand continues to drop, even though interest rates have come down slightly from recent highs.

Mortgage Demand Declines Further, Even as Interest Rates Drop a BitMortgage demand continues to drop, even though interest rates have come down slightly from recent highs.

Weiterlesen »

What can homebuyers expect from today's turbulent mortgage rates?Erika Giovanetti, loans expert at U.S. News & World Report, talks about mortgage rate volatility and how the housing market is responding to the latest housing market trends.

What can homebuyers expect from today's turbulent mortgage rates?Erika Giovanetti, loans expert at U.S. News & World Report, talks about mortgage rate volatility and how the housing market is responding to the latest housing market trends.

Weiterlesen »

Mortgage rates dip as recession fears rattle housing market: Freddie Mac“Purchase demand continues to tumble,” according to Freddie Mac chief economist Sam Khater.

Mortgage rates dip as recession fears rattle housing market: Freddie Mac“Purchase demand continues to tumble,” according to Freddie Mac chief economist Sam Khater.

Weiterlesen »