Homeowners are 'suffering' from what the Urban Institute calls the 'I hate my house, but I love my mortgage' syndrome.

A homeowner might ideally want to buy another house with different features, but either can't afford a higher mortgage rate or doesn't want to give up their 3% bargain.

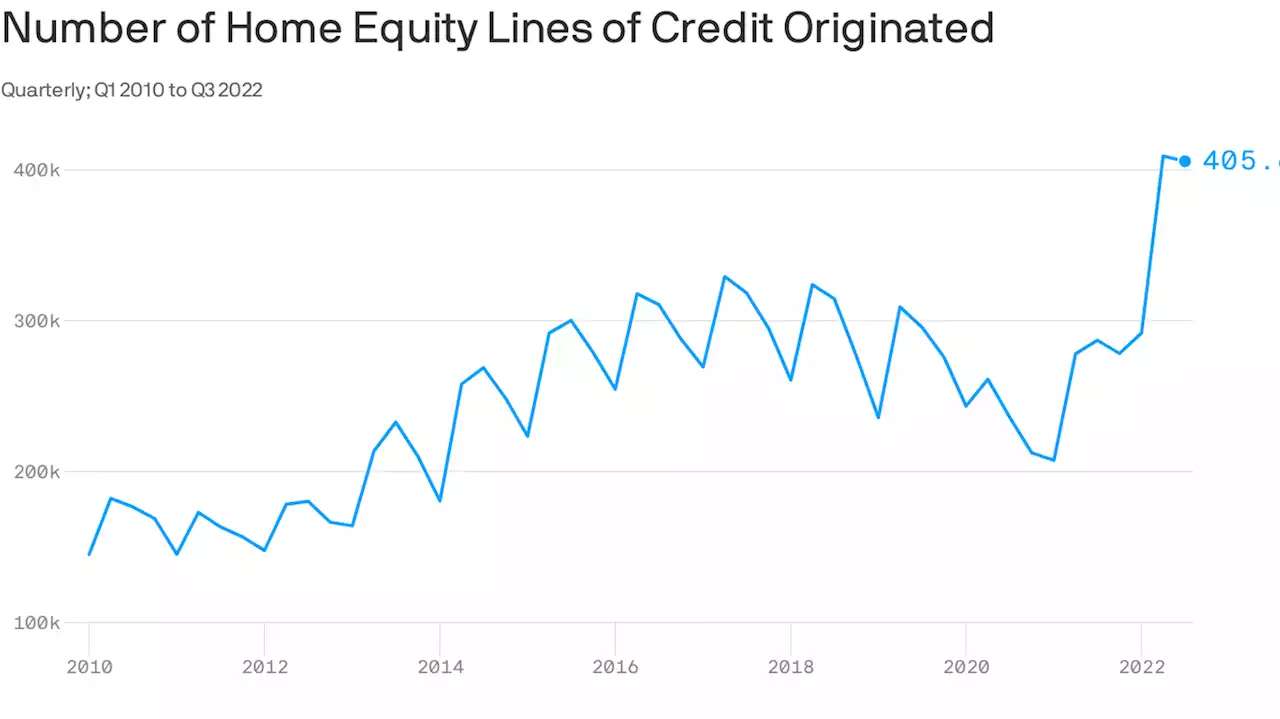

Maybe back in the day, these folks would do a cash-out refinance. But that would be nuts right now — you'd wind up paying a higher mortgage rate. Enter the home equity line of credit , which lets homeowners borrow some amount of money — less than the value of the whole house, as with a refiTo put it in fancier parlance, "Borrowers can preserve the low rate on their first mortgage while tapping equity to meet cash needs," write the authors of the Urban Institute report.Because banks tend to hold HELOCs on their balance sheets rather than sell them, borrowers need very high credit scores to qualify.

With consumers looking to consolidate high-interest credit card debt, and lenders looking to gin up business in the wake of the lackluster first mortgage market, "HELOCs will likely remain a popular option in 2023," said Andy Walden, VP of enterprise research at Black Knight.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Yakima Police: Homeowners shot, killed armed intruder outside their houseYakima homeowners shot and killed an intruder who came to their house with a gun. FOX13

Yakima Police: Homeowners shot, killed armed intruder outside their houseYakima homeowners shot and killed an intruder who came to their house with a gun. FOX13

Weiterlesen »

Colorado homeowners' Ring camera captures 2 mountain lions strolling across yard togetherHomeowners in Boulder Canyon, Colorado, are left 'pleasantly surprised' after capturing footage of two mountain lions wandering together – as recorded on a Ring camera.

Colorado homeowners' Ring camera captures 2 mountain lions strolling across yard togetherHomeowners in Boulder Canyon, Colorado, are left 'pleasantly surprised' after capturing footage of two mountain lions wandering together – as recorded on a Ring camera.

Weiterlesen »

Helping homeowners: California expands mortgage reliefWith $300 million already given out to 10,000 homeowners, as much as $700 million worth of aid remains available for borrowers who qualify for the program, which was created in December 2021 using federal dollars from the American Rescue Act.

Helping homeowners: California expands mortgage reliefWith $300 million already given out to 10,000 homeowners, as much as $700 million worth of aid remains available for borrowers who qualify for the program, which was created in December 2021 using federal dollars from the American Rescue Act.

Weiterlesen »

California offers help for more homeowners who missed mortgage or tax paymentsThe state is expanding its federally funded mortgage relief program to help more Californians. In addition to reaching people who fell behind on their payments in 2022 and early 2023, it is offering to cover up to $80,000 in back debt.

California offers help for more homeowners who missed mortgage or tax paymentsThe state is expanding its federally funded mortgage relief program to help more Californians. In addition to reaching people who fell behind on their payments in 2022 and early 2023, it is offering to cover up to $80,000 in back debt.

Weiterlesen »

Replacing Gas Appliances Would Be Free for Some DC Homeowners Under Proposed Bill - WashingtonianWeeks after an oddly heated debate on gas vs. electric stoves erupted online, more than half of DC City Council members co-sponsored a bill that would incentivize gas appliance owners to make the switch to electric. The bill—titled the “Healthy Homes and Residential Electrification Amendment Act of 2023' and first introduced last year—would specifically help

Replacing Gas Appliances Would Be Free for Some DC Homeowners Under Proposed Bill - WashingtonianWeeks after an oddly heated debate on gas vs. electric stoves erupted online, more than half of DC City Council members co-sponsored a bill that would incentivize gas appliance owners to make the switch to electric. The bill—titled the “Healthy Homes and Residential Electrification Amendment Act of 2023' and first introduced last year—would specifically help

Weiterlesen »

Opinion | Steph Curry's affordable housing dispute is much more complicated than it looksNed Resnikoff: Rich homeowners like Steph Curry aren’t the problem in California's housing crisis. State laws are.

Opinion | Steph Curry's affordable housing dispute is much more complicated than it looksNed Resnikoff: Rich homeowners like Steph Curry aren’t the problem in California's housing crisis. State laws are.

Weiterlesen »