How the Fed handled the March 10 failure of Silicon Valley ban, could offer clues how willing Fed chair Jerome Powell is to intervene in the event of a default.

Traders react as Federal Reserve Chair Jerome Powell is seen delivering remarks on a screen, on the floor of the New York Stock Exchange in New York City, U.S., May 3, 2023. REUTERS/Brendan McDermid/File Photo

Unsaid, however, is that just over seven weeks ago Powell showed - again - how willing he is to race beyond the red flags of central banking if the moment calls for it.possible debt default responses Accepting defaulted securities as collateral for Fed loans, or swapping "good" federal debt already held by the Fed for impaired debt held by private investors, would be an extreme variation on the theme - yet one that may prove less "loathsome" than the alternative economic collapse some predict would follow a default.

"They are just not going to be specific about what they will do because it validates a hypothetical they don't want to consider," he said.Powell joined the Fed in 2012 from a think tank where he focused on debt and deficit issues.

QE is now integral to the Fed's playbook, and its $7.8 trillion balance sheet central to how the Fed manages interest rates and monetary policy. On the eve of what would prove a disruptive outbreak of inflation, Powell in the summer of 2020 adopted a years-in-the making effort to shift the Fed's policy focus to put less weight on its price mandate and more on its goal of full employment, correcting what he had come to believe was a policy bias that kept more people out of work than was needed to keep inflation stable.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Fed Statement: March vs MayMarch 22May 03, 2023 Recent indicators point to Economic activity expanded at a modest growthpace in spending and production.the first quarter. Job ga

Fed Statement: March vs MayMarch 22May 03, 2023 Recent indicators point to Economic activity expanded at a modest growthpace in spending and production.the first quarter. Job ga

Weiterlesen »

Fed playbook: Which stocks to buy or sell depending on what the Fed doesCNBC Pro screened for names screened that are the most sensitive to interest rates by looking at the 100-day correlation between each S&P 500 stock and SHY ETF.

Fed playbook: Which stocks to buy or sell depending on what the Fed doesCNBC Pro screened for names screened that are the most sensitive to interest rates by looking at the 100-day correlation between each S&P 500 stock and SHY ETF.

Weiterlesen »

Fed's Powell: don't assume Fed can shield U.S. economy from debt limit defaultThe U.S. Federal Reserve is unlikely to be able to protect the U.S. economy from the damage caused by a failure to raise the federal debt ceiling, Fed Chair Jerome Powell said on Wednesday, adding that the government should never be in a position where it is unable to pay all of its bills.

Fed's Powell: don't assume Fed can shield U.S. economy from debt limit defaultThe U.S. Federal Reserve is unlikely to be able to protect the U.S. economy from the damage caused by a failure to raise the federal debt ceiling, Fed Chair Jerome Powell said on Wednesday, adding that the government should never be in a position where it is unable to pay all of its bills.

Weiterlesen »

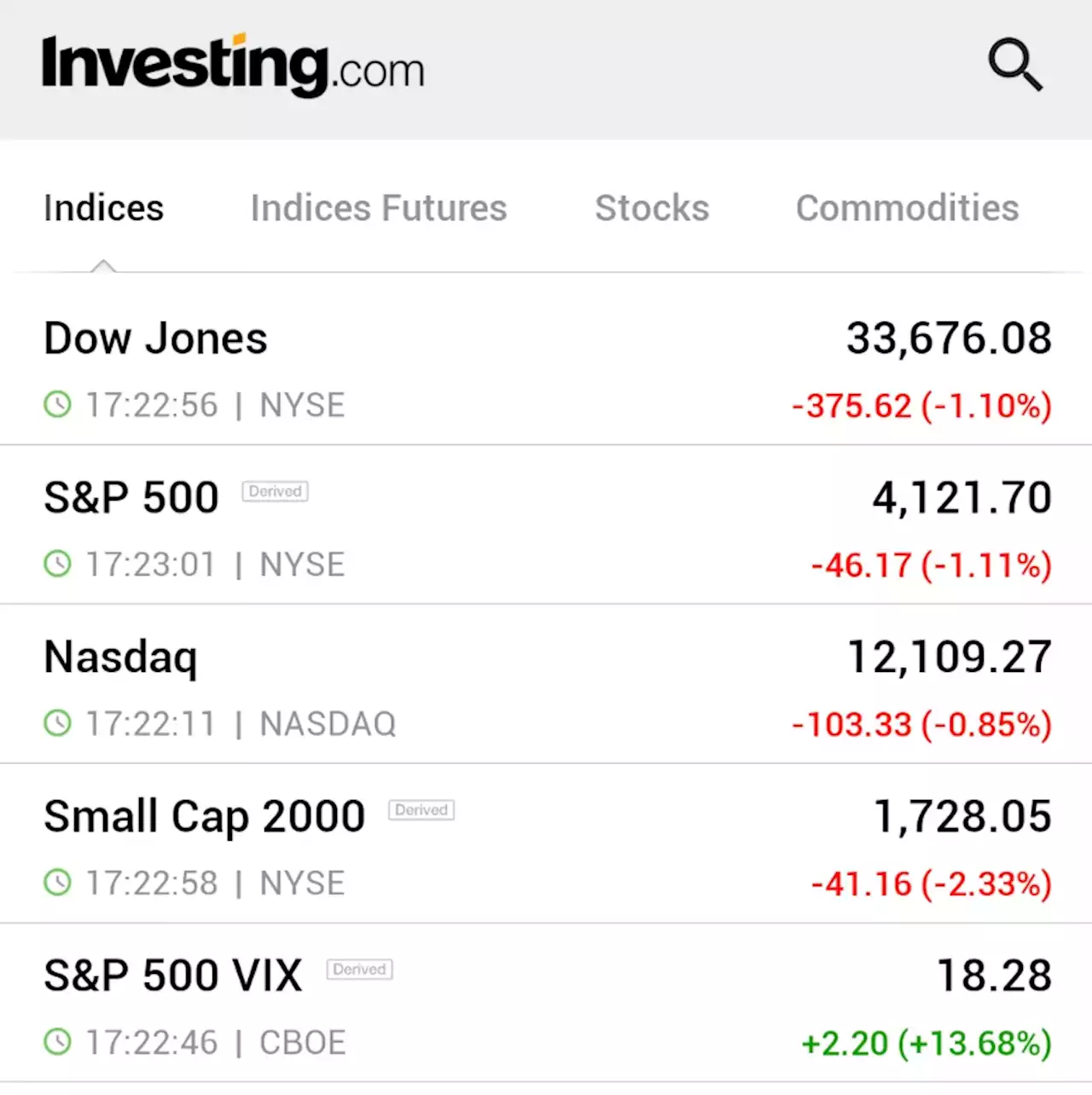

U.S. stocks fall as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *U.S. STOCKS TUMBLE, VIX SPIKES AS WALL STREET BRACES FOR FED DECISION $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

U.S. stocks fall as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *U.S. STOCKS TUMBLE, VIX SPIKES AS WALL STREET BRACES FOR FED DECISION $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Weiterlesen »

U.S. stocks sink as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *DOW DROPS MORE THAN 500 POINTS AS BANK SHARES SLIDE, FED DECISION LOOMS $DIA $SPY $QQQ $IWM

U.S. stocks sink as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *DOW DROPS MORE THAN 500 POINTS AS BANK SHARES SLIDE, FED DECISION LOOMS $DIA $SPY $QQQ $IWM

Weiterlesen »