The USD/CAD pair jumps to 1.3550 in Tuesday’s European session after breaking above the two-day consolidation formed in a range of 1.3510-1.3550.

USD/CAD climbs above 1.3550 amid uncertainty ahead of key events. Canadian inflation is forecasted to have accelerated in February. Investors will keenly focus on the Fed’s interest rate guidance. The Loonie asset advances as uncertainty ahead of key events has dampened risk appetite of market participants. S&P500 futures have generated nominal losses in the London session, indicating a risk-aversion mood.

The upward-sloping border of the aforementioned pattern is placed from December 27 low at 1.3177. The chart pattern exhibits a sharp volatility contraction. The near-term appeal is bullish, as the 20-day Exponential Moving Average near 1.3520 continues to support the US Dollar bulls. The 14-period Relative Strength Index oscillates inside the 40.00-60.00 range, indicating indecisiveness among investors. The Loonie asset would observe a fresh upside if it breaks above December 7 high at 1.3620.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

USD/CAD Price Analysis: Stabilizes above 1.3500 ahead of Canada Inflation, Fed policyThe USD/CAD pair seems comfortable above the psychological resistance of 1.3500 in the European session on Monday.

USD/CAD Price Analysis: Stabilizes above 1.3500 ahead of Canada Inflation, Fed policyThe USD/CAD pair seems comfortable above the psychological resistance of 1.3500 in the European session on Monday.

Weiterlesen »

USD/CAD Price Analysis: Reaches higher to near 1.3480 ahead of nine-day EMAUSD/CAD retraces its recent losses from the previous session, edging upwards to near 1.3480 during Thursday's European session.

USD/CAD Price Analysis: Reaches higher to near 1.3480 ahead of nine-day EMAUSD/CAD retraces its recent losses from the previous session, edging upwards to near 1.3480 during Thursday's European session.

Weiterlesen »

USD/CAD Price Analysis: Air-kissing the Ascending Wedge goodbyeUSD/CAD has recently broken out of the Ascending Wedge pattern which it has been forming since January.

USD/CAD Price Analysis: Air-kissing the Ascending Wedge goodbyeUSD/CAD has recently broken out of the Ascending Wedge pattern which it has been forming since January.

Weiterlesen »

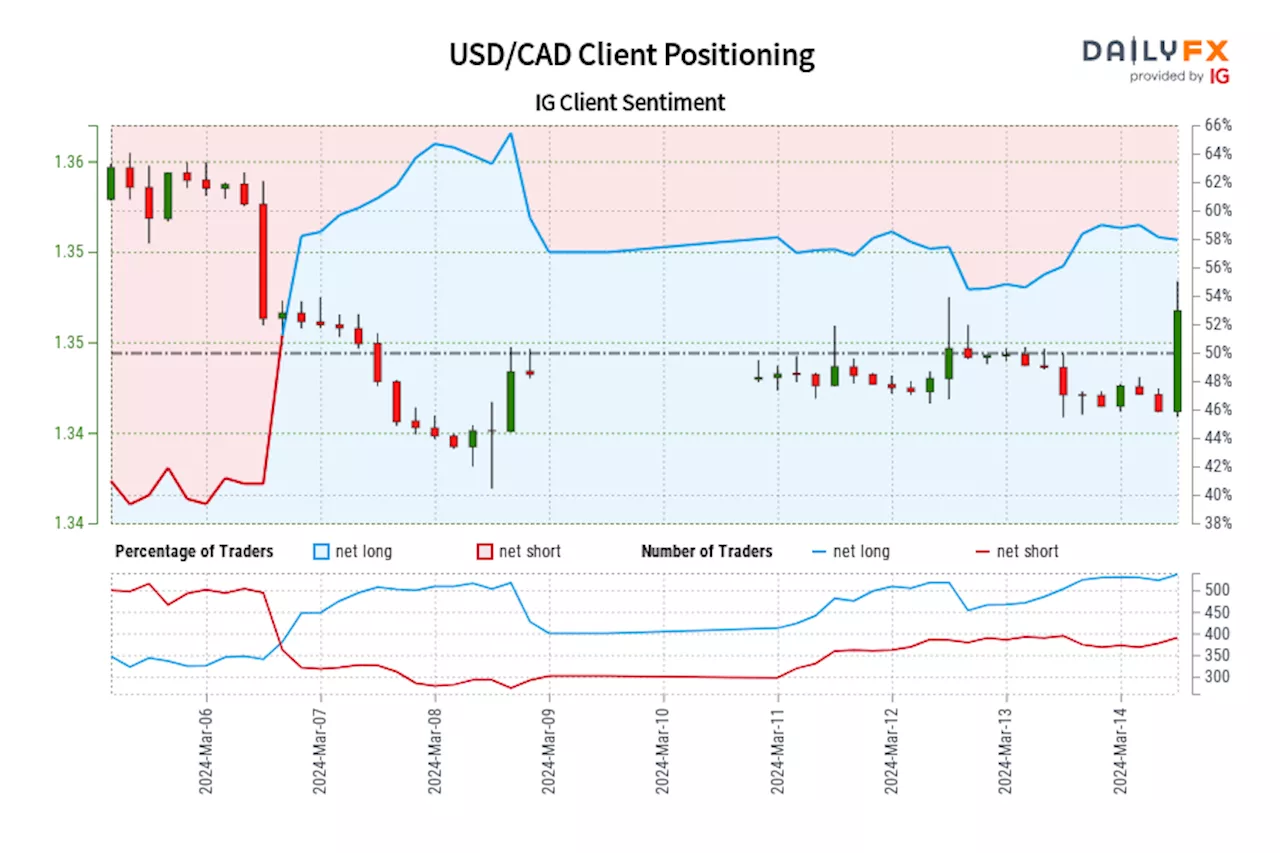

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Mar 06, 2024 15:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Mar 06, 2024 15:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

Weiterlesen »

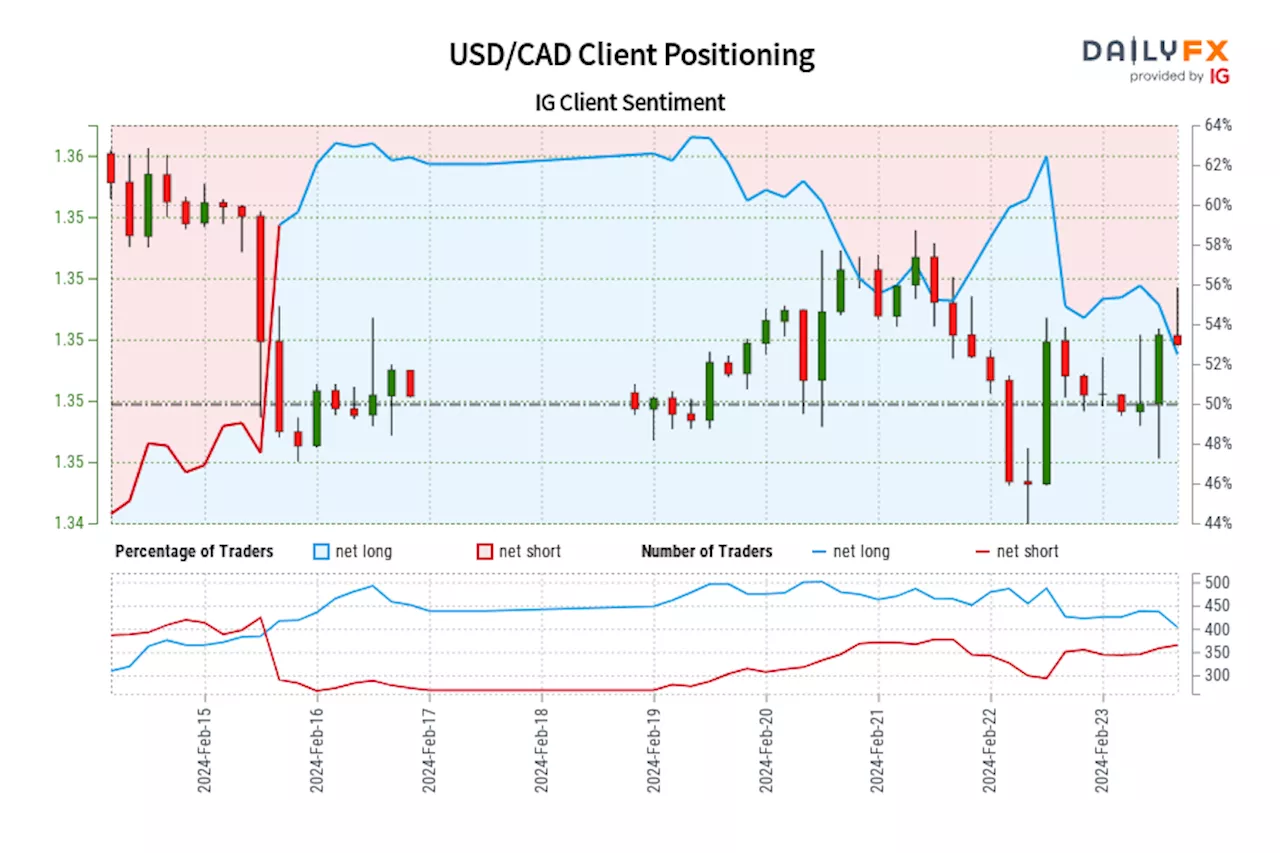

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Feb 15, 2024 14:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-short USD/CAD for the first time since Feb 15, 2024 14:00 GMT when USD/CAD traded near 1.35.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bullish contrarian trading bias.

Weiterlesen »

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

Weiterlesen »