US: Recent apparent strength may overstate the health of the factory sector – Wells Fargo – by MSalordFX Manufacturing UnitedStates Banks

estimate and the preliminary September Durable Goods Orders. Analysts at Wells Fargo point out that considering a big picture from all the data and what it means for manufacturing is that recent apparent strength in the data may overstate the health of the factory sector.“After accounting for revisions, durable goods orders actually came in a bit better than expected. The September increase was 0.4% versus the 0.6% expected by consensus, but last month got revised from -0.2% to +0.

“The Federal Reserve raises rates aggressively and manufacturing ramps up? Our take is that this is more emblematic of new demand crumbling under higher“Nondefense capital goods shipments fell 0.6% in September, but that was on the heels of an upward revision that lifted August's gain to 3.1% from the 1.8% increase initially reported. This upward revision helped support the large gain in Q3 equipment spending growth.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Gold Price Forecast: XAU/USD displays lackluster performance above $1,660 ahead of US GDP dataGold Price Forecast: XAU/USD displays lackluster performance above $1,660 ahead of US GDP data – by Sagar_Dua24 Gold XAUUSD Fed GDP RiskAppetite

Gold Price Forecast: XAU/USD displays lackluster performance above $1,660 ahead of US GDP dataGold Price Forecast: XAU/USD displays lackluster performance above $1,660 ahead of US GDP data – by Sagar_Dua24 Gold XAUUSD Fed GDP RiskAppetite

Weiterlesen »

US economy expected to have grown significantly, ending 6 months of shrinkingThe GDP data would defy Fed efforts to slow the economy and slash inflation.

US economy expected to have grown significantly, ending 6 months of shrinkingThe GDP data would defy Fed efforts to slow the economy and slash inflation.

Weiterlesen »

US economy grows significantly, ending 6 months of shrinkingThe GDP data would defy Fed efforts to slow the economy and slash inflation.

US economy grows significantly, ending 6 months of shrinkingThe GDP data would defy Fed efforts to slow the economy and slash inflation.

Weiterlesen »

US economy grew significantly in 3rd quarter, ending 6 months of shrinkingBREAKING: The U.S. economy expanded significantly to kick off the second half of the year, marking a dramatic reversal from the contraction experienced over the first six months, per government data.

US economy grew significantly in 3rd quarter, ending 6 months of shrinkingBREAKING: The U.S. economy expanded significantly to kick off the second half of the year, marking a dramatic reversal from the contraction experienced over the first six months, per government data.

Weiterlesen »

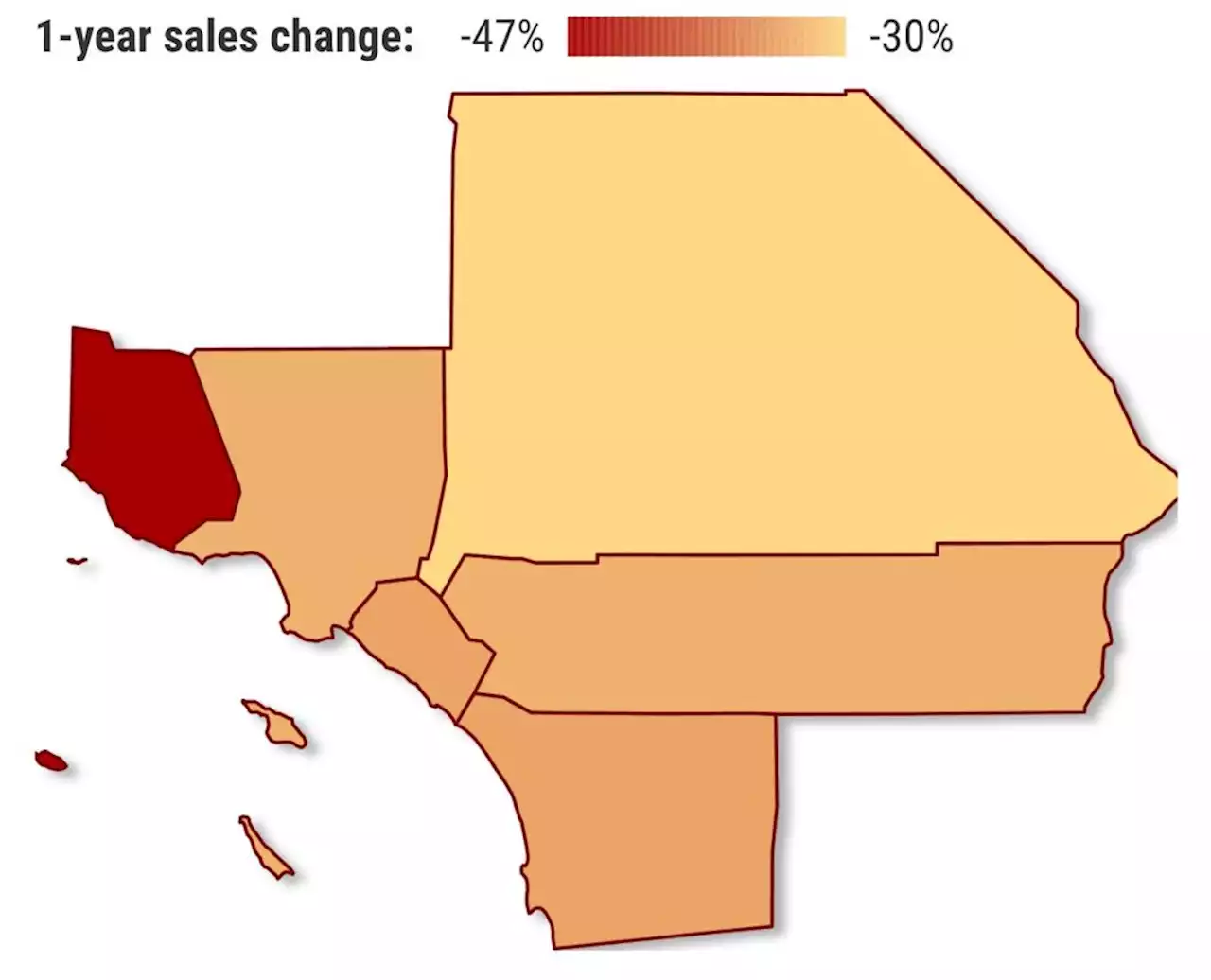

LA vs. Orange County: Where’s homebuying slowing faster?Two counties had 7,501 closed transactions — down 3,727 from September 2021, according to data from CoreLogic.

LA vs. Orange County: Where’s homebuying slowing faster?Two counties had 7,501 closed transactions — down 3,727 from September 2021, according to data from CoreLogic.

Weiterlesen »

Treasury yields rise as traders scan economic data for hints about Fed policyTreasury yields climbed on Thursday as traders looked to the release of GDP growth and other economic data for hints about future Federal Reserve policy.

Treasury yields rise as traders scan economic data for hints about Fed policyTreasury yields climbed on Thursday as traders looked to the release of GDP growth and other economic data for hints about future Federal Reserve policy.

Weiterlesen »