Vivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter @vivienlouchen.

The key 10-year Treasury yield finally broke through the 5% mark for the first time in 16 years early Monday as traders focused on U.S. economic strength over geopolitics.

Analysts also said the Fed’s hawkish stance and U.S. economic strength are more reasons why yields have climbed. A recession is no longer the consensus view among economists, according to a Wall Street Journal quarterly survey. Geopolitics appeared to be playing less of a role in Monday’s rise in yields as traders monitored diplomatic efforts in the Middle East. Meanwhile, the Bank of Israel opted to hold interest rates at 4.75%, two weeks after the surprise attack by Hamas.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Inflation is following an 'eerily similar' path to the one taken in 1966–82Vivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Inflation is following an 'eerily similar' path to the one taken in 1966–82Vivien Lou Chen is a Markets Reporter for MarketWatch. You can follow her on Twitter vivienlouchen.

Weiterlesen »

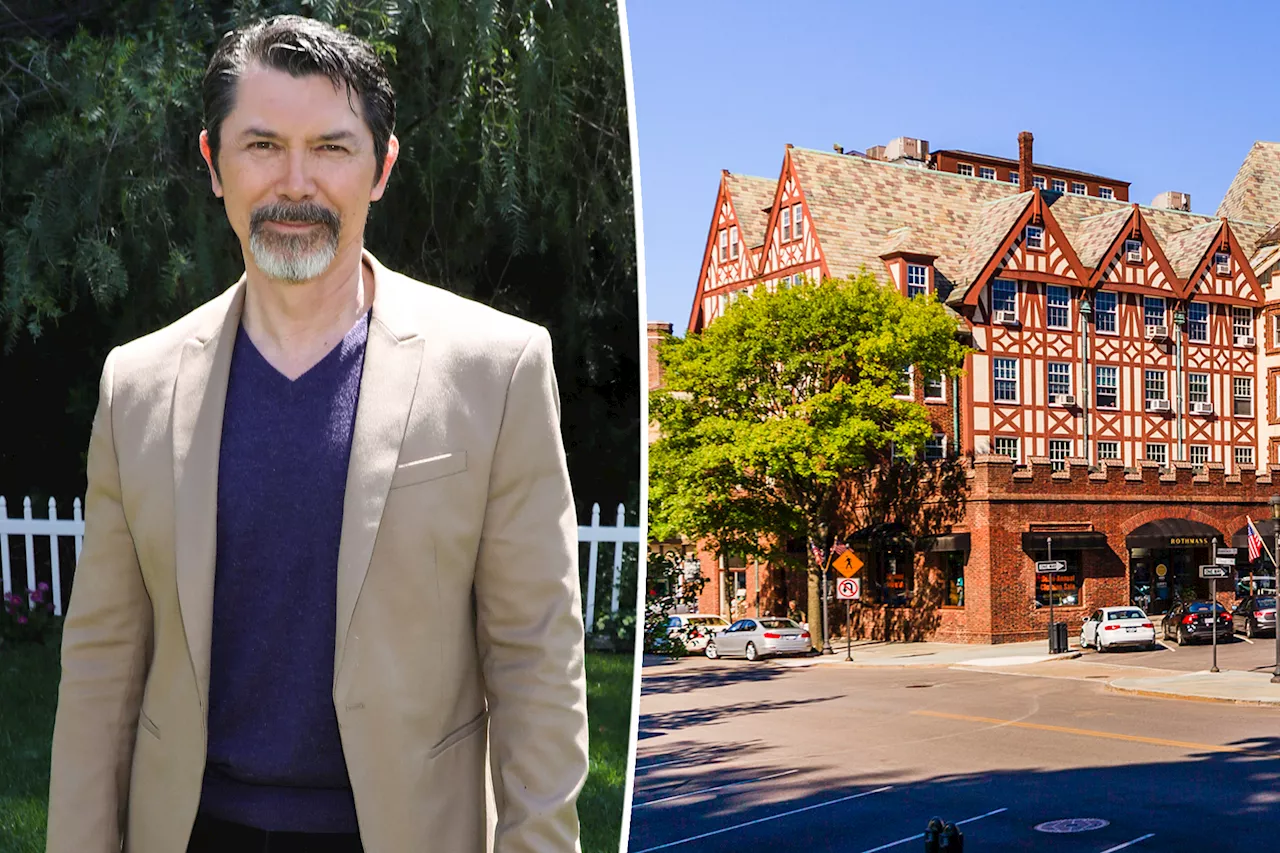

Actor Lou Diamond Phillips returns to UT Arlington to share knowledge with studentsActor and University of Texas at Arlington alumnus Lou Diamond Phillips returned to UTA to teach for a week-long teaching residency at the school's college of liberal arts.

Actor Lou Diamond Phillips returns to UT Arlington to share knowledge with studentsActor and University of Texas at Arlington alumnus Lou Diamond Phillips returned to UTA to teach for a week-long teaching residency at the school's college of liberal arts.

Weiterlesen »

Realtor encourages neighbors to befriend Lou Diamond Phillips with Facebook postThe actor’s real estate agent posted that if people see the “La Bamba” star at the grocery store or Starbucks they should “say ‘hello.'”

Realtor encourages neighbors to befriend Lou Diamond Phillips with Facebook postThe actor’s real estate agent posted that if people see the “La Bamba” star at the grocery store or Starbucks they should “say ‘hello.'”

Weiterlesen »

Julie Chen Moonves Accuses This Strategic Big Brother 25 Player Of Lacking Common SenseBig Brother 25 host Julie Chen Moonves questions some of the houseguests' moves, wondering why they've made certain choices in the game.

Julie Chen Moonves Accuses This Strategic Big Brother 25 Player Of Lacking Common SenseBig Brother 25 host Julie Chen Moonves questions some of the houseguests' moves, wondering why they've made certain choices in the game.

Weiterlesen »

Starfield's Lead Quest Designer Joins Something Wicked GamesWill Chen joins Something Wicked Games to work on Wyrdsong.

Starfield's Lead Quest Designer Joins Something Wicked GamesWill Chen joins Something Wicked Games to work on Wyrdsong.

Weiterlesen »

Top 5 things to watch in markets in the week aheadTop 5 things to watch in markets in the week ahead

Top 5 things to watch in markets in the week aheadTop 5 things to watch in markets in the week ahead

Weiterlesen »