Investment legend Seth Klarman went back to his roots at Harvard Business School to declare that the stock market is still too pricey even with its slide...

Investment legend Seth Klarman went back to his roots at the Harvard Business School to declare that the stock market is still too pricey even with its slide this year.

“You’ve got a stock market that’s one of the most expensive ever,” said the chief executive of the value-focused Baupost Group, in an interview posted on Friday. The S&P 500 SPX is now down 23% for the year. “It’s been a 35-year bond bull market, so that’s going to be a big shock that is going to test I think financial institutions who’ve been hedged, who’s been writing derivatives they shouldn’t write, who’s been stepping out to take greater risks in their portfolio, because if you can’t make it in bonds, people try to make it somewhere else.”

“We’ve clearly had worse here,” he said, noting the Great Depression, World War II, and a lack of civil rights. He also pointed to innovation, not just in Silicon Valley, but in Boston for biotechs, New York and Philadelphia, as well as world-class educational institutions.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Millions more homebuyers may be priced out of housing market, as 30-year mortgage rate spikes after Fed’s biggest rate hike since 1994Fed’s 75-basis-point rate hike means millions more homebuyers will be priced out of the housing market: ‘Desperate times call for desperate measures’

Millions more homebuyers may be priced out of housing market, as 30-year mortgage rate spikes after Fed’s biggest rate hike since 1994Fed’s 75-basis-point rate hike means millions more homebuyers will be priced out of the housing market: ‘Desperate times call for desperate measures’

Weiterlesen »

Perspective | 7 ways to lower your credit card debt after the Fed rate hikeThe Federal Reserve interest rate hike will make credit card debt more expensive.

Perspective | 7 ways to lower your credit card debt after the Fed rate hikeThe Federal Reserve interest rate hike will make credit card debt more expensive.

Weiterlesen »

'Lock in that rate:' Housing and financial experts both recommend buying now if you're preparedIf you’re in the market to buy a home, chances are the Federal Reserve’s interest rate hike was disappointing. However, experts in both the housing and financial markets said if a home buyer is prepared, right now could actually be the right time to put in an offer.

'Lock in that rate:' Housing and financial experts both recommend buying now if you're preparedIf you’re in the market to buy a home, chances are the Federal Reserve’s interest rate hike was disappointing. However, experts in both the housing and financial markets said if a home buyer is prepared, right now could actually be the right time to put in an offer.

Weiterlesen »

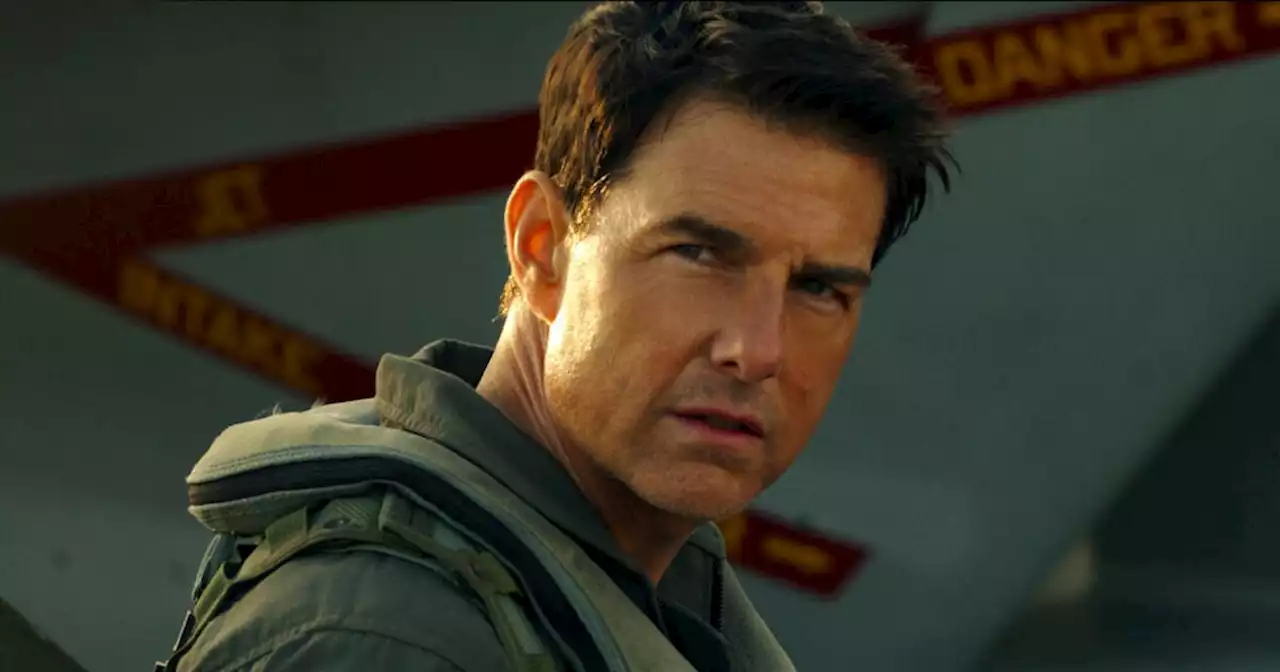

How Top Gun: Maverick cruises by realityWarning: This article may contain spoilers for Top Gun: Maverick.

How Top Gun: Maverick cruises by realityWarning: This article may contain spoilers for Top Gun: Maverick.

Weiterlesen »

Asia-Pacific Stocks Set for Lower Open; China's Latest Benchmark Lending Rate AheadChina’s latest one-year and five-year loan prime rates are set to be announced on Monday.

Asia-Pacific Stocks Set for Lower Open; China's Latest Benchmark Lending Rate AheadChina’s latest one-year and five-year loan prime rates are set to be announced on Monday.

Weiterlesen »

Asia-Pacific stocks mixed; China's latest benchmark lending rate aheadChina's latest one-year and five-year loan prime rates are set to be announced on Monday.

Asia-Pacific stocks mixed; China's latest benchmark lending rate aheadChina's latest one-year and five-year loan prime rates are set to be announced on Monday.

Weiterlesen »