SPX500 gets hammered in a complete reversal of momentum

The rally late in the day on Wednesday was a false one, perhaps a bit of short covering. After all, most of it was based upon the idea that the Federal Reserve has taken the idea of a 75 basis points rate hike off of the table. That being said, the market continues to see tighter financial conditions, and that is going to continue to work against the market.

Another thing that you need to pay close attention to is the fact that this massive candlestick is closing towards the bottom of the range, so that does suggest that we will continue to go lower.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

2023 Cadillac Lyriq AWD trim makes 500 hp, tows 3,500 lbsDetails are revealed in a live Instagram discussion about the more powerful all-wheel-drive Lyriq

2023 Cadillac Lyriq AWD trim makes 500 hp, tows 3,500 lbsDetails are revealed in a live Instagram discussion about the more powerful all-wheel-drive Lyriq

Weiterlesen »

Snake Pit and coolers are coming back to the 2022 Indianapolis 500It looks like coolers will be allowed at the Snake Pit concerts during the 2022 Indianapolis 500 after all.

Snake Pit and coolers are coming back to the 2022 Indianapolis 500It looks like coolers will be allowed at the Snake Pit concerts during the 2022 Indianapolis 500 after all.

Weiterlesen »

S&P 500, Nasdaq 100 Forecasts – Hold or Fold on FOMC Decision?Financial markets are currently pricing in a 50 basis point interest rate hike and the start of quantitative tightening, with further 50bp increases expected at the June and July meeting. Get your market update from nickcawley1 here:

S&P 500, Nasdaq 100 Forecasts – Hold or Fold on FOMC Decision?Financial markets are currently pricing in a 50 basis point interest rate hike and the start of quantitative tightening, with further 50bp increases expected at the June and July meeting. Get your market update from nickcawley1 here:

Weiterlesen »

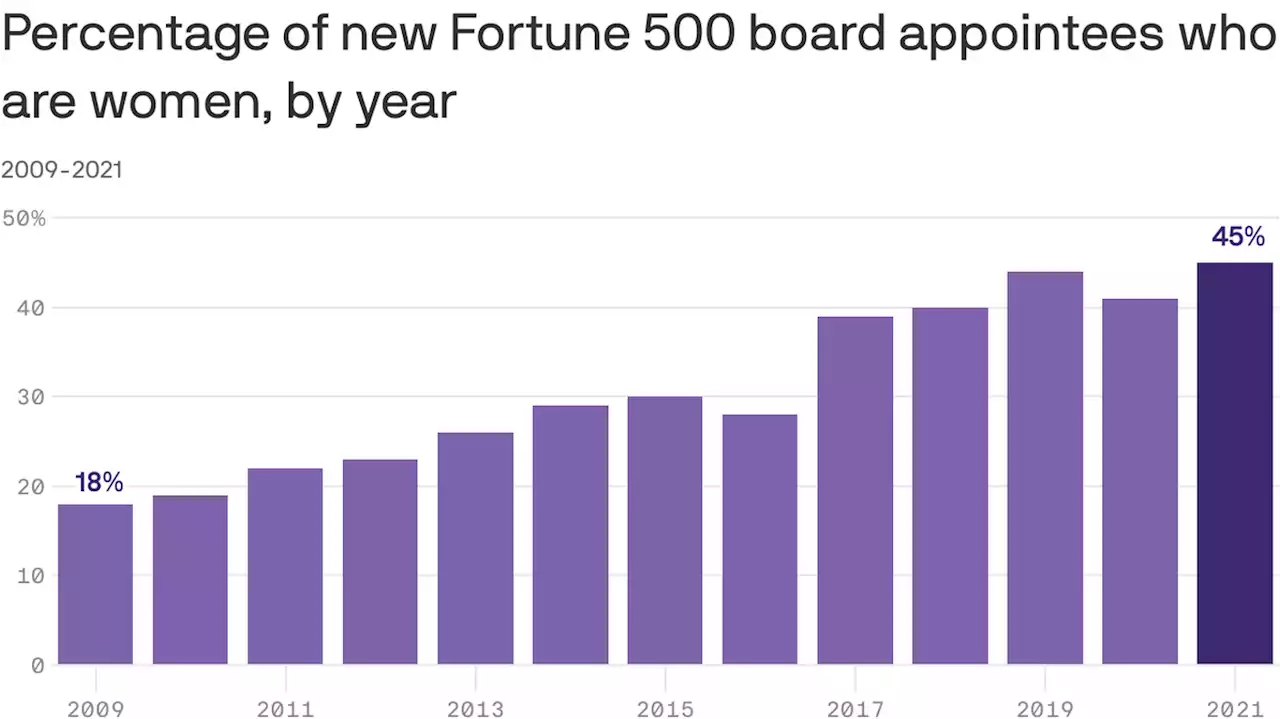

Record number of women appointed to Fortune 500 boardsThe yearslong push to diversify boardrooms appears to be paying off.

Record number of women appointed to Fortune 500 boardsThe yearslong push to diversify boardrooms appears to be paying off.

Weiterlesen »

Dow, S&P 500 Slide More Than 3% as Investors Reassess Fed CommentsThe Dow fell more than 1,000 points, led by technology and other growth stocks, as investors assessed the implications of Fed’s most aggressive tightening of monetary policy in more than two decades.

Dow, S&P 500 Slide More Than 3% as Investors Reassess Fed CommentsThe Dow fell more than 1,000 points, led by technology and other growth stocks, as investors assessed the implications of Fed’s most aggressive tightening of monetary policy in more than two decades.

Weiterlesen »

S&P 500 reverses Wednesday’s post-Fed gains, back under 4,200 as yield rally batters techWednesday’s post-Fed jubilation has proven short-lived, with all three of the major US equity indices having already given back the lion’s share of We

S&P 500 reverses Wednesday’s post-Fed gains, back under 4,200 as yield rally batters techWednesday’s post-Fed jubilation has proven short-lived, with all three of the major US equity indices having already given back the lion’s share of We

Weiterlesen »