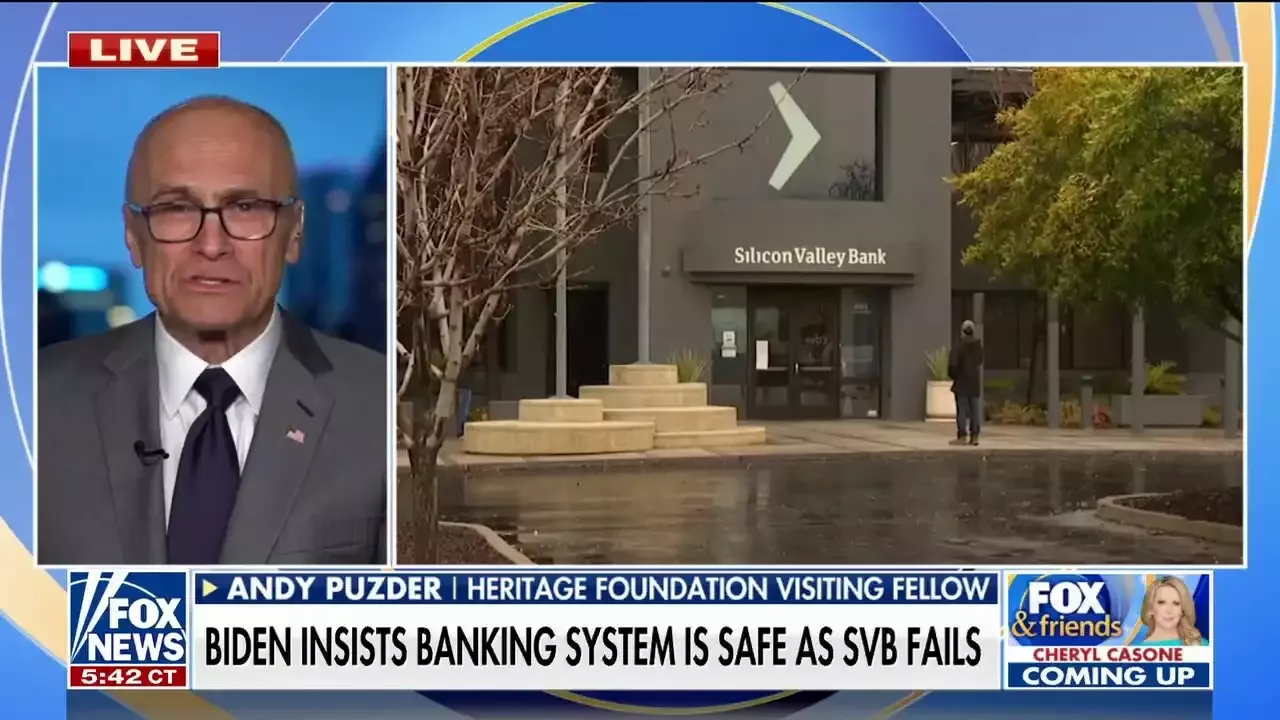

Andy Puzder discusses Silicon Valley Bank's board, their reported lack of banking experience and the company's 'woke' management.

What the G in ESG is supposed to be is governance. And if all you're focused on is climate change and trying to hire people for your qualifications other than their merit, their qualifications, or their character, if you're not focused on how your company is governed and run, if you're just focused on being woke, you're going to have problems. And these are the kinds of problems that arise.

They misjudged the impact of interest rates on their investment portfolio and their customers, they misinterpreted their companies, their customers' needs. They were woke and they had a regulator that was woke and really didn't do its job. So it was a perfect storm for a bank failure and that's what we ended up with.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

Weiterlesen »

U.S. FDIC shifts SVB deposits to new bridge bank, names CEOThe U.S. Federal Deposit Insurance Corporation has transferred all deposits of Silicon Valley Bank to a newly created bridge bank and all depositors will have access to their money beginning Monday morning, the financial regulator said.

U.S. FDIC shifts SVB deposits to new bridge bank, names CEOThe U.S. Federal Deposit Insurance Corporation has transferred all deposits of Silicon Valley Bank to a newly created bridge bank and all depositors will have access to their money beginning Monday morning, the financial regulator said.

Weiterlesen »

SVB collapse: CEO Greg Becker should return gains from stock sale, Ro Khanna saysRep. Ro Khanna (D-CA) is calling for the CEO of Silicon Valley Bank to return the millions of dollars worth in stock sale gains he reaped before the company's collapse.

SVB collapse: CEO Greg Becker should return gains from stock sale, Ro Khanna saysRep. Ro Khanna (D-CA) is calling for the CEO of Silicon Valley Bank to return the millions of dollars worth in stock sale gains he reaped before the company's collapse.

Weiterlesen »

CEO Greg Becker Was There for SVB’s Quick Rise and Even Quicker FallSilicon Valley Bank CEO Greg Becker and two top lieutenants were at the helm of the bank as it rode a wave of low rates and easy-money policies. When the Federal Reserve started raising rates at its fastest pace in decades, they all but ignored it.

CEO Greg Becker Was There for SVB’s Quick Rise and Even Quicker FallSilicon Valley Bank CEO Greg Becker and two top lieutenants were at the helm of the bank as it rode a wave of low rates and easy-money policies. When the Federal Reserve started raising rates at its fastest pace in decades, they all but ignored it.

Weiterlesen »

Little Spoon CEO says company 'dodged a bullet, discusses what SVB collapse could mean for startupsCEO Ben Lewis said his company Little Spoon “dodged a bullet” in Silicon Valley Bank’s (SVB) shutdown last week but voiced worries about impacts the bank’s collapse could potentially have on the startup and venture capital markets.

Little Spoon CEO says company 'dodged a bullet, discusses what SVB collapse could mean for startupsCEO Ben Lewis said his company Little Spoon “dodged a bullet” in Silicon Valley Bank’s (SVB) shutdown last week but voiced worries about impacts the bank’s collapse could potentially have on the startup and venture capital markets.

Weiterlesen »

UK banks not seeing deposit 'flight to quality' after SVB collapse - Lloyds CEOBritish banks are not yet seeing a 'flight to quality' in deposits among customers nervous about the safe-keeping of their money following the collapse of U.S. lender Silicon Valley Bank last week, Lloyds chief executive Charlie Nunn said on Tuesday.

UK banks not seeing deposit 'flight to quality' after SVB collapse - Lloyds CEOBritish banks are not yet seeing a 'flight to quality' in deposits among customers nervous about the safe-keeping of their money following the collapse of U.S. lender Silicon Valley Bank last week, Lloyds chief executive Charlie Nunn said on Tuesday.

Weiterlesen »