The IRS devotes little effort to targeting federal nonfilers, according to the Treasury Inspector General for Tax Administration.

can share with other federal agencies, so they’re limited in their ability to prod or punish the employees, the audit found.“Repeatedly not filing a tax return when a taxpayer is required to do so is a brazen form of noncompliance. Federal civilian employees with tax delinquencies have a legal and ethical requirement to be current with their tax obligations,” the inspector general said in the report Thursday.

TIGTA found that tax compliance among federal employees has been trending down in recent years. As recently as 2017, just 108,000 employees were delinquent in filing or paying. But in 2021, that rose to 149,000 cases, out of a federal workforce of 3 million.More striking were the persistent cheats. The audit found 42,047 employees who missed multiple years of filing or payment over the review period. That works out to about 1.4% of federal employees.

The Postal Service had the most offenders, with more than 9,000 employees who missed at least two years. The Veterans Affairs Department was runner-up with nearly 6,600 employees.Most of the nonfilers were at the low end of the income scale, with earnings under $100,000. Some 738 of them had incomes of $200,000 or more.

The delinquents generally avoid punishment, the inspector general said, though the exact number of cases referred for criminal investigation was redacted in the new report.Lia Colbert, the commissioner of the ’ small business and self-employed division, said nearly 80% of the delinquencies the audit found were “resolved” by last September.“However, in recent years, severe staffing shortages, the pandemic and challenges in

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Biden dreams of more taxes, more IRS agents in his big-spending budgetPresident Biden’s new $6.8 trillion budget would impose a whopping $5.5 trillion in tax hikes and push federal spending roughly 55% higher than pre-pandemic levels, including a 15% boost for the IRS that would be added on top of the agency’s current massive funding increase.

Biden dreams of more taxes, more IRS agents in his big-spending budgetPresident Biden’s new $6.8 trillion budget would impose a whopping $5.5 trillion in tax hikes and push federal spending roughly 55% higher than pre-pandemic levels, including a 15% boost for the IRS that would be added on top of the agency’s current massive funding increase.

Weiterlesen »

Senate poised to confirm Biden IRS nominee as agency announces upgradesThe IRS said it can now scan information from tax returns rather than forcing employees to enter data by hand.

Senate poised to confirm Biden IRS nominee as agency announces upgradesThe IRS said it can now scan information from tax returns rather than forcing employees to enter data by hand.

Weiterlesen »

IRS to open San Antonio Taxpayer Assistance Center on SaturdayIf you have an income tax issue that needs to be resolved, the Internal Revenue Service is opening its San Antonio Taxpayer Assistance Center on Saturday to provide assistance.

IRS to open San Antonio Taxpayer Assistance Center on SaturdayIf you have an income tax issue that needs to be resolved, the Internal Revenue Service is opening its San Antonio Taxpayer Assistance Center on Saturday to provide assistance.

Weiterlesen »

Manchin to oppose Biden's nominee to head IRSSen. Manchin, embroiled in a nasty fight with the administration over electric vehicle credits, said today that he'll oppose Biden's pick to lead the IRS.

Manchin to oppose Biden's nominee to head IRSSen. Manchin, embroiled in a nasty fight with the administration over electric vehicle credits, said today that he'll oppose Biden's pick to lead the IRS.

Weiterlesen »

Medical debt affects millions, and advocates push IRS, consumer agency for reliefMore than 50 consumer and patient groups want the Biden Administration to aggressively protect Americans from medical bills and debt collectors. The effort follows a KHN/NPR investigation.

Medical debt affects millions, and advocates push IRS, consumer agency for reliefMore than 50 consumer and patient groups want the Biden Administration to aggressively protect Americans from medical bills and debt collectors. The effort follows a KHN/NPR investigation.

Weiterlesen »

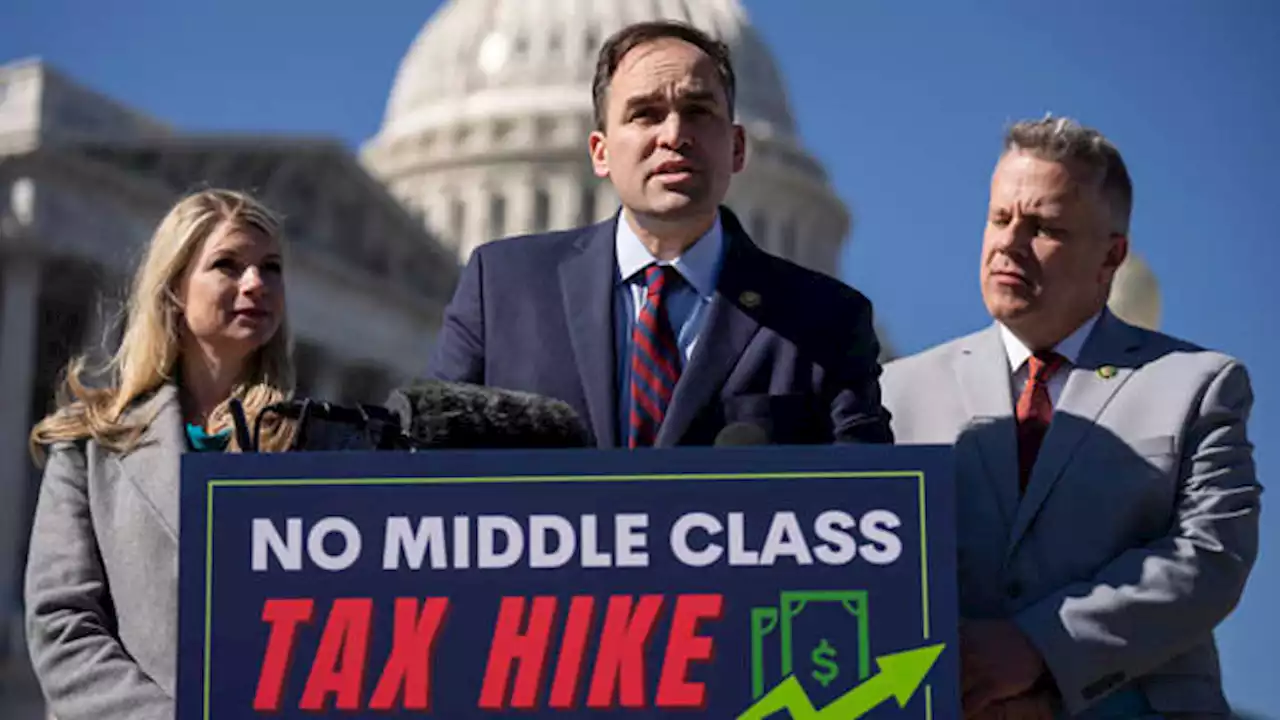

House Democrats push back against GOP bill to abolish IRS, impose national sales taxDemocratic Reps. Eric Sorensen of Illinois, Wiley Nickel of North Carolina and Brittany Pettersen of Colorado push back against the GOP's national sales tax.

House Democrats push back against GOP bill to abolish IRS, impose national sales taxDemocratic Reps. Eric Sorensen of Illinois, Wiley Nickel of North Carolina and Brittany Pettersen of Colorado push back against the GOP's national sales tax.

Weiterlesen »