The Fed is expected at its latest meeting to raise its key short-term rate by a substantial three-quarters of a point for the third consecutive time.

WASHINGTON — Federal Reserve Chair Jerome Powell bluntly warned in a speech last month that the Fed’s drive to curb inflation by aggressively raising interest rates would “bring some pain.” On Wednesday, Americans may get a better sense of how much pain could be in store.

Short-term rates at that level would make a recession likelier next year by sharply raising the cost of mortgages, car loans and business loans. The Fed intends those higher borrowing costs to slow growth by cooling off a still-robust job market to cap wage growth and other inflation pressures. Yet the risk is growing that the Fed may weaken the economy so much as to cause a downturn that would produce job losses.

The inflation report also documented just how broadly inflation has spread through the economy, complicating the the Fed’s anti-inflation efforts. Inflation now appears increasingly fueled by higher wages and by consumers’ steady desire to spend and less by the supply shortages that had bedeviled the economy during the pandemic recession.

“He’s not going to say that,” Bostjancic said. But, referring to the most recent Fed meeting in July, when Powell raised hopes for an eventual pullback on rate hikes, she added: “He also wants to make sure that the markets don’t come away and rally. That’s what happened last time.”

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Biggest Fed rate hike in 40 years? 5 things to know in Bitcoin this weekBitcoin tanks as BTC price action prepares for a 'sledgehammer' Fed rate hike.

Biggest Fed rate hike in 40 years? 5 things to know in Bitcoin this weekBitcoin tanks as BTC price action prepares for a 'sledgehammer' Fed rate hike.

Weiterlesen »

ECB’s Lange, Nagel signal higher rates, more pain ahead“The European Central Bank (ECB) could raise interest rates into next year, causing pain for consumers as it tries to depress demand that is now incre

ECB’s Lange, Nagel signal higher rates, more pain ahead“The European Central Bank (ECB) could raise interest rates into next year, causing pain for consumers as it tries to depress demand that is now incre

Weiterlesen »

How much 'pain'? Fed to signal more rate hikes aheadFederal Reserve Chair Jerome Powell bluntly warned in a speech last month that the Fed’s drive to curb inflation by aggressively raising interest rates would “bring some pain.”.

How much 'pain'? Fed to signal more rate hikes aheadFederal Reserve Chair Jerome Powell bluntly warned in a speech last month that the Fed’s drive to curb inflation by aggressively raising interest rates would “bring some pain.”.

Weiterlesen »

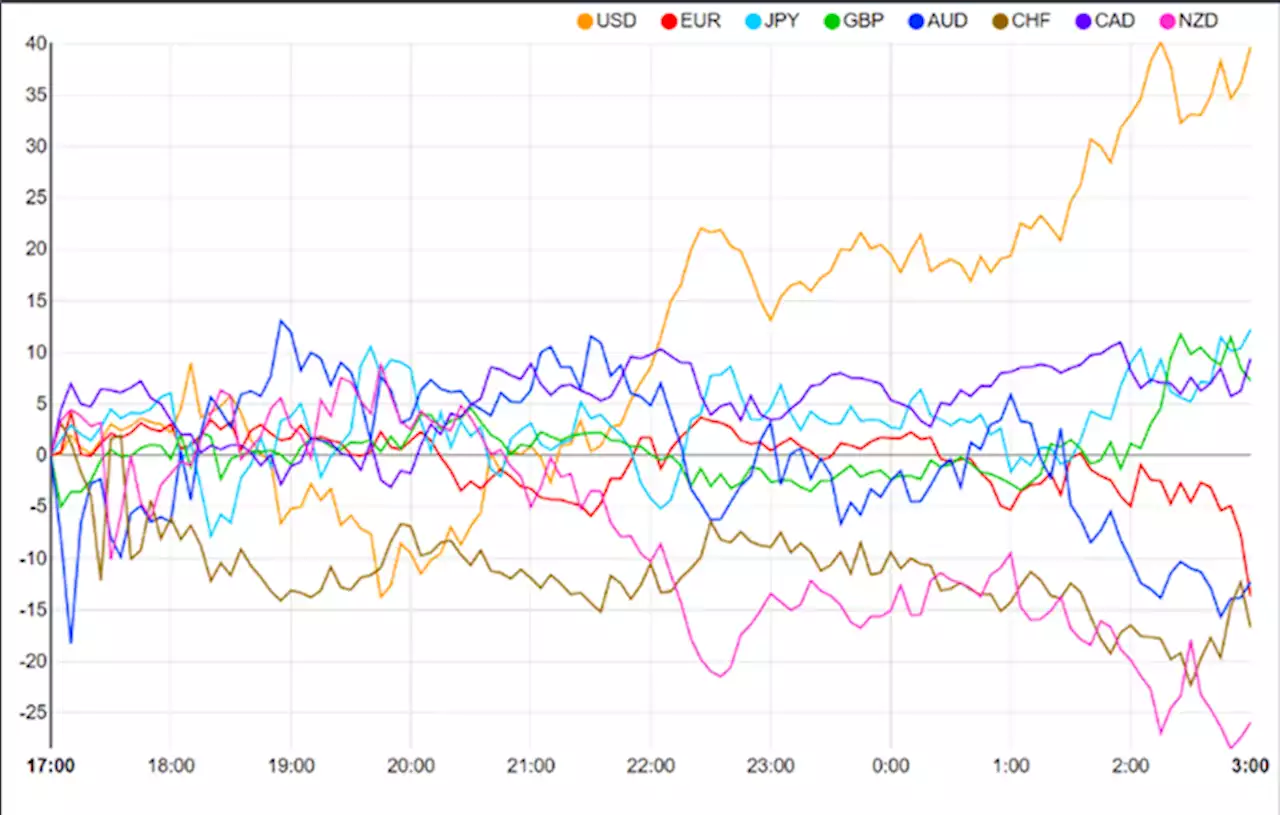

EUR/USD Dips Below Parity with Dollar Index Leading the WayEURUSD surrendered parity once more in early trade, failing to take out Fridays high. Get your market update from zvawda here:

EUR/USD Dips Below Parity with Dollar Index Leading the WayEURUSD surrendered parity once more in early trade, failing to take out Fridays high. Get your market update from zvawda here:

Weiterlesen »

Federal Reserve expected to raise rates againThe Fed's rate hikes could ultimately lead to the economy cooling off more than the central bank would like, experts say.

Federal Reserve expected to raise rates againThe Fed's rate hikes could ultimately lead to the economy cooling off more than the central bank would like, experts say.

Weiterlesen »

Stocks sink as investors brace for another big rate hike'Markets have good reason to be braced for headwinds,' one analyst said of expectations that the Fed will hike rates again this week.

Stocks sink as investors brace for another big rate hike'Markets have good reason to be braced for headwinds,' one analyst said of expectations that the Fed will hike rates again this week.

Weiterlesen »