Gold price (XAU/USD) extends its downside and trades in negative territory for the sixth consecutive day during the early Asian trading hours on Monda

y. The renewed US Dollar demand exerts some selling pressure on USD-denominated Gold price. The precious metal currently trades near $1,846, losing 0.12% on the day. Meanwhile,, a measure of the value of the USD relative to a basket of foreign currencies, holds above 106.25 after retracing the low of 105.65 on Friday.reported on Friday that the Personal Consumption Expenditures Price Index climbed 3.5% YoY in August from 3.4% in July, meeting market expectations.

Furthermore, the US passed bills to prevent a government shutdown following Friday's session, extending funding until November 17. This, in turn, lifts the US Dollar and drags XAU/USD lower.Chair Powell’s speech could offer hints about potential interest rate hikes. Traders will take cues from these events and find trading opportunities around the gold price.Information on these pages contains forward-looking statements that involve risks and uncertainties.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.The AUD/USD pair trades sideways below the mid-0.6400s during the early Asian session on Monday. The Australian Dollar sell-off pauses due to the upbeat Chinese PMI data. However, the stronger UD Dollar might cap the upside of the pair. The EUR/USD plummeted to 1.0487 on Wednesday, its lowest since early March, as investors continued to seek refuge in the US Dollar.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Gold/Silver Q4 Technical Forecast: Tide Remains Against XAU/USD & XAG/USDDevelopments on longer-term charts suggest that rally since late 2022 in gold and silver was corrective, and not the start of a new bull market. And now precious metals appear to be breaking lower. What is the outlook and the key levels to watch?

Weiterlesen »

Solana Price Forecast: SOL big picture to flip bullish soon, all eyes on $26Solana (SOL) price seems to be undoing the bearish pressure that has kept it subdued all this time. The recent spike in buying pressure has pushed SOL

Solana Price Forecast: SOL big picture to flip bullish soon, all eyes on $26Solana (SOL) price seems to be undoing the bearish pressure that has kept it subdued all this time. The recent spike in buying pressure has pushed SOL

Weiterlesen »

Floki Inu Price Forecast: FLOKI sets stage for 30% rallyFloki Inu (FLOKI) price has triggered a quick but explosive uptrend in the last 24 hours. The uptrend has pushed the meme coin above a key hurdle and

Floki Inu Price Forecast: FLOKI sets stage for 30% rallyFloki Inu (FLOKI) price has triggered a quick but explosive uptrend in the last 24 hours. The uptrend has pushed the meme coin above a key hurdle and

Weiterlesen »

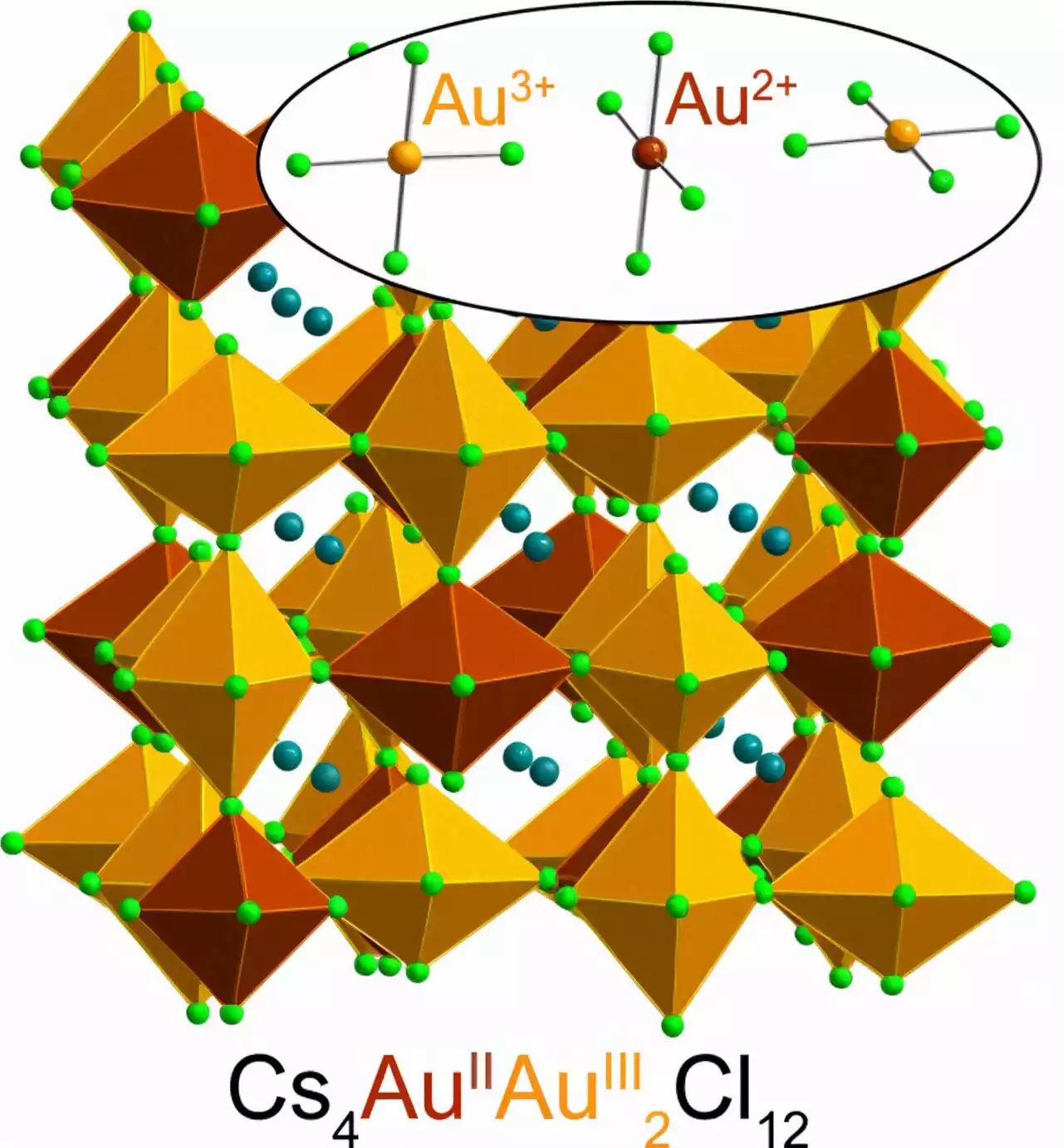

Striking rare gold: Researchers unveil new material infused with gold in an exotic chemical stateFor the first time, Stanford researchers have found a way to create and stabilize an extremely rare form of gold that has lost two negatively charged electrons, denoted Au2+. The material stabilizing this elusive version of the valued element is a halide perovskite—a class of crystalline materials that holds great promise for various applications including more-efficient solar cells, light sources, and electronics components.

Striking rare gold: Researchers unveil new material infused with gold in an exotic chemical stateFor the first time, Stanford researchers have found a way to create and stabilize an extremely rare form of gold that has lost two negatively charged electrons, denoted Au2+. The material stabilizing this elusive version of the valued element is a halide perovskite—a class of crystalline materials that holds great promise for various applications including more-efficient solar cells, light sources, and electronics components.

Weiterlesen »

D.C.-area forecast: Variably cloudy today ahead of a warm and sunny SundayOnce we break free from the clouds, we should see an extended period without them. It’ll be warm into next week.

D.C.-area forecast: Variably cloudy today ahead of a warm and sunny SundayOnce we break free from the clouds, we should see an extended period without them. It’ll be warm into next week.

Weiterlesen »

Gold Prices Collapse the Most Since June 2021 Last Week, Retail Bets Aggressively LongGold prices plunged the most since the summer of 2021 last week and retail traders are not slowing their upside exposure in XAU/USD. Things are not looking good as the new week begins.

Weiterlesen »