GBP/JPY declines towards 162.00 despite odds of widening BOE-BOJ policy divergence – by Sagar_Dua24 GBPJPY BOJ BOE Inflation Energy

arish after a downside break of the consolidation formed in a 162.80-164.47 range. The cross has shifted into the negative trajectory despite accelerating odds of further expansion in Bank of England -Bank of Japan policy divergence.

Price pressures in the UK economy are acting as headwinds for UK households. The latter is forced to make inflation-adjusted payouts with penny-worth increments in earnings. No doubt, the labor market conditions, growth prospects, and energy prices are not supporting a rate hike by the BOE. However, BOE Governor has to swallow the bitter gulp and announce a rate hike by 50 basis points .

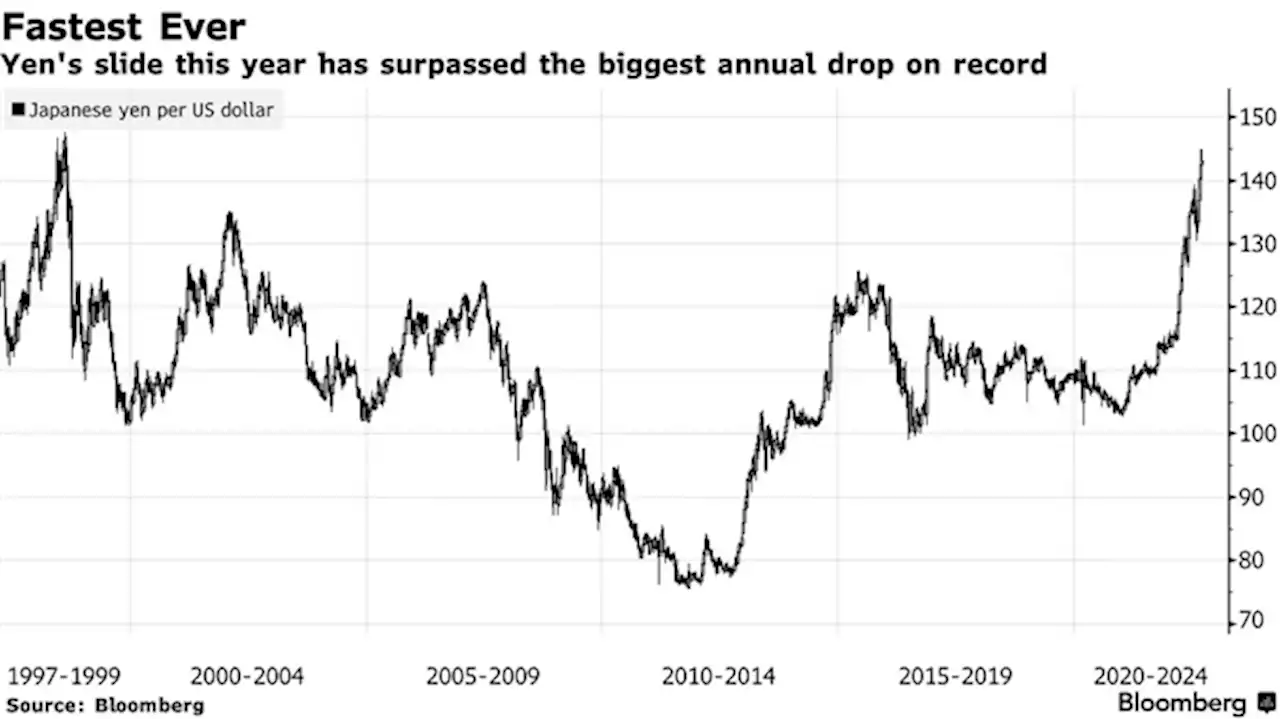

Meanwhile, operations from new UK Prime Minister Liz Truss seem favorable for the economy led by the announcement of a reduction in tax slabs, a cap on energy and electricity prices, and a trade deal with the US. In spite of this fact, the pound bulls are not getting stronger. On the Tokyo front, BOJ's warning o intervention in the currency market is supporting the Japanese yen. Japan’s former Vice FM Tatsuo Yamasaki cited that the Japanese administration is ready to intervene in currency markets at any moment if needed, news wires from Bloomberg. He further added that the government doesn’t need to wait for a green light from the US to support the yen.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Treasury awards $8.2B to financially underserved communitiesTexas is one of five states that received the largest sum of investments from the Emergency Capital Investment Program. Per the White House, the funds went to 'small and minority-owned businesses and consumers.'

Treasury awards $8.2B to financially underserved communitiesTexas is one of five states that received the largest sum of investments from the Emergency Capital Investment Program. Per the White House, the funds went to 'small and minority-owned businesses and consumers.'

Weiterlesen »

NZD/JPY Price Analysis: Stays pressured towards 84.00 after NZ data, BOJ eyedNZD/JPY Price Analysis: Stays pressured towards 84.00 after NZ data, BOJ eyed – by anilpanchal7 NZDJPY BOJ Macroeconomics Technical Analysis ChartPatterns

NZD/JPY Price Analysis: Stays pressured towards 84.00 after NZ data, BOJ eyedNZD/JPY Price Analysis: Stays pressured towards 84.00 after NZ data, BOJ eyed – by anilpanchal7 NZDJPY BOJ Macroeconomics Technical Analysis ChartPatterns

Weiterlesen »

USD/JPY Forecast: Japanese Inflation Unlikely to Sway BoJ into Policy ChangeUSD/JPY rallied higher in European trade as we remain within the range of 141.50 to the 145.00 area which provided some much-needed resistance last week. Get your market update from zvawda here:

USD/JPY Forecast: Japanese Inflation Unlikely to Sway BoJ into Policy ChangeUSD/JPY rallied higher in European trade as we remain within the range of 141.50 to the 145.00 area which provided some much-needed resistance last week. Get your market update from zvawda here:

Weiterlesen »

EUR/JPY concludes short-lived pullback above 143.00, BOJ policy in focusThe EUR/JPY has sensed barricades around 143.40 after a less-confident pullback in the early Asian session. The asset witnessed a steep fall on Tuesda

EUR/JPY concludes short-lived pullback above 143.00, BOJ policy in focusThe EUR/JPY has sensed barricades around 143.40 after a less-confident pullback in the early Asian session. The asset witnessed a steep fall on Tuesda

Weiterlesen »

BOJ Preview: To maintain status quo across all monetary policy parameters – Goldman SachsAccording to economists at Goldman Sachs, the Bank of Japan (BOJ) is unlikely to alter its ultra-loose monetary policy stance, despite the increased p

BOJ Preview: To maintain status quo across all monetary policy parameters – Goldman SachsAccording to economists at Goldman Sachs, the Bank of Japan (BOJ) is unlikely to alter its ultra-loose monetary policy stance, despite the increased p

Weiterlesen »

EUR/GBP oscillates around 0.8760 ahead of BOE policyThe EUR/GBP pair is displaying topsy-turvy moves in a narrow range of 0.8758-0.8767 range as investors are awaiting the announcement of the interest r

EUR/GBP oscillates around 0.8760 ahead of BOE policyThe EUR/GBP pair is displaying topsy-turvy moves in a narrow range of 0.8758-0.8767 range as investors are awaiting the announcement of the interest r

Weiterlesen »