Column: Fund capitulation on record short US equity bet pays off

In the two months since hedge funds began bailing on their record net short position in S&P 500 futures their equity returns have accelerated, narrowing the yawning year-to-date underperformance versus the broader market.

The question now is do funds have the appetite to go outright long, bearing in mind how high the S&P 500 index is, how expensive U.S. stocks are, and how high nominal and real bond yields are? Just two months ago, at the end of May, funds were net short to the tune of 434,000 contracts, the largest net short position on record since these contracts were launched in 1997.

Not coincidentally, the S&P 500 rose 10% in that period and hedge funds essentially tripled their year-to-date equity returns - the HFRI Equity Hedge Index at the end of July was up 7.83% YTD compared with 2.51% at the end of May.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Stock-index futures advance after worst week for the S&P 500 since MarchBuyers are reasserting their dominance early Monday, after the S&P 500 shed 2.3% last week, its biggest weekly decline since March.

Stock-index futures advance after worst week for the S&P 500 since MarchBuyers are reasserting their dominance early Monday, after the S&P 500 shed 2.3% last week, its biggest weekly decline since March.

Weiterlesen »

S&P 500 in danger of breaching support as tech momentum wanes, says analystA change of tone in the stock market leaves the S&P 500 eyeing important support levels, and energy will have to pick up the baton as tech momentum wanes.

S&P 500 in danger of breaching support as tech momentum wanes, says analystA change of tone in the stock market leaves the S&P 500 eyeing important support levels, and energy will have to pick up the baton as tech momentum wanes.

Weiterlesen »

S&P 500 quarterly earnings have been upbeat; revenue not so muchS&P 500 companies have been reporting upbeat bottom lines for the June quarter, but not such impressive increases in their revenue.

S&P 500 quarterly earnings have been upbeat; revenue not so muchS&P 500 companies have been reporting upbeat bottom lines for the June quarter, but not such impressive increases in their revenue.

Weiterlesen »

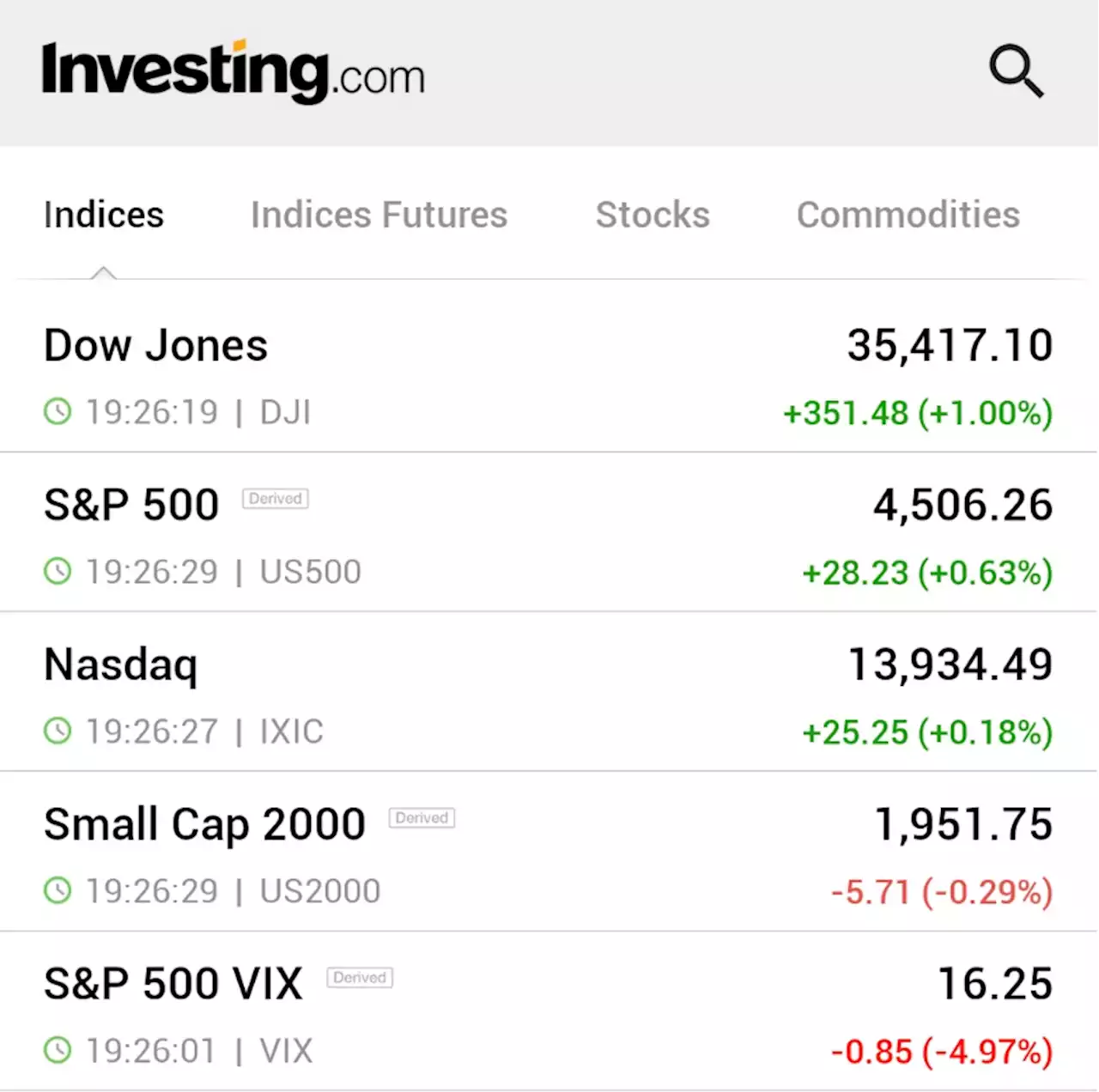

S&P 500, Dow kick off week higher; U.S. inflation in focusThe benchmark S&P 500 and the Dow climbed higher on Monday as investors anticipate a highly awaited U.S. inflation report that could impact the market's recovery.

S&P 500, Dow kick off week higher; U.S. inflation in focusThe benchmark S&P 500 and the Dow climbed higher on Monday as investors anticipate a highly awaited U.S. inflation report that could impact the market's recovery.

Weiterlesen »

S&P500 Futures Retreat as Central Bank Signals and Light Calendar Cause Mixed Market SentimentS&P500 Futures experience mild losses as traders await second-tier statistics from China and the US. Mixed signals from major central bankers and a lack of major data/events contribute to the cautious market sentiment. The futures retreat towards the monthly low after a brief bounce off.

S&P500 Futures Retreat as Central Bank Signals and Light Calendar Cause Mixed Market SentimentS&P500 Futures experience mild losses as traders await second-tier statistics from China and the US. Mixed signals from major central bankers and a lack of major data/events contribute to the cautious market sentiment. The futures retreat towards the monthly low after a brief bounce off.

Weiterlesen »

S&P 500 to Benefit from Spending Wave, but Challenges Remain in US Economy: O'LearyKevin O'Leary predicts that the S&P 500 will experience significant growth due to a $500 billion spending and tax breaks plan. However, he also warns that certain sectors of the US economy may face challenges.

Weiterlesen »