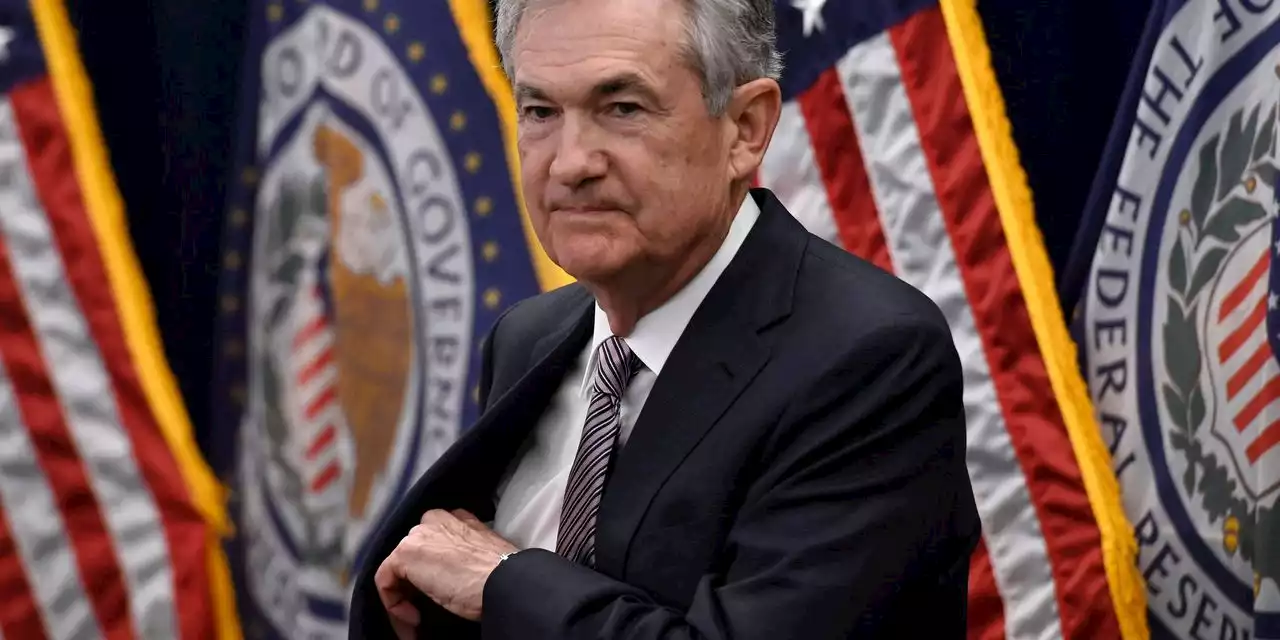

The move the Fed announced after its latest policy meeting will increase its benchmark short-term rate, which affects many consumer and business loans, to a range of 1.5% to 1.75%.

Wall Street entered a bear market Monday as the S&P 500 sank 3.9%, bringing it more than 20% below the record high it set in January.

Expectations for larger Fed hikes have sent a range of interest rates to their highest points in years. The yield on the 2-year Treasury note, a benchmark for corporate bonds, has reached 3.3%, its highest level since 2007. The 10-year Treasury yield, which directly affects mortgage rates, has hit 3.4%, up nearly a half-point since last week and the highest level since 2011.

Other central banks around the world are also acting swiftly to try to quell surging inflation, even with their nations at greater risk of recession than the U.S. The European Central Bank is expected to raise rates by a quarter-point in July, its first increase in 11 years. It could announce a larger hike in September if record-high levels of inflation persist.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

Weiterlesen »

US Dollar Index retreats from 20-year high as yields brace for Fed meetingUS Dollar Index (DXY) bulls take a breather after refreshing a two-decade top, dropping back to 105.00 during early Tuesday morning in Europe, amid th

US Dollar Index retreats from 20-year high as yields brace for Fed meetingUS Dollar Index (DXY) bulls take a breather after refreshing a two-decade top, dropping back to 105.00 during early Tuesday morning in Europe, amid th

Weiterlesen »

Fed Likely to Consider 0.75-Percentage-Point Rate Rise This WeekA string of troubling inflation reports is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected interest-rate increase at their meeting this week.

Fed Likely to Consider 0.75-Percentage-Point Rate Rise This WeekA string of troubling inflation reports is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected interest-rate increase at their meeting this week.

Weiterlesen »

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

Weiterlesen »

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

Weiterlesen »