Fed's Williams: Fed needs to be data dependent, adjust policy actions as circumstances warrant By Frank_Macro Fed Inflation InterestRate

President and influential FOMC member John Williams on Tuesday said that the Fed needs to be data-dependent and adjust its policy actions as the circumstances warrant, report Reuters. The Fed will move expeditiously to bring the Federal Funds target range back to more normal levels this year, he said, echoing Fed Chair Jerome Powell's message in the post-FOMC meeting press conference last week. War and the pandemic have brought a tremendous amount of uncertainty and complexity.

The ongoing pandemic and war in Ukraine are exacerbating near-term inflation pressures and global economic uncertainty. The Fed's task to return balance and price stability to the US economy is difficult, but not insurmountable. Some of the Fed's rebalancing will be accomplished through increases in supply."I am confident the Fed has the right tools to achieve our dual mandate goals.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Fed survey finds new fear on Wall Street: Foreign divestment of U.S. assetsWall Street has started to worry about foreign divestment of U.S. assets, according to a Federal Reserve survey released Monday.

Fed survey finds new fear on Wall Street: Foreign divestment of U.S. assetsWall Street has started to worry about foreign divestment of U.S. assets, according to a Federal Reserve survey released Monday.

Weiterlesen »

The Fed raised interest rates – what to do now with your retirement portfolioAs the Federal Reserve has announced the largest increase in the federal funds rate since 2000, here are two investments to take a look at if you are looking to retire soon or have already retired.

The Fed raised interest rates – what to do now with your retirement portfolioAs the Federal Reserve has announced the largest increase in the federal funds rate since 2000, here are two investments to take a look at if you are looking to retire soon or have already retired.

Weiterlesen »

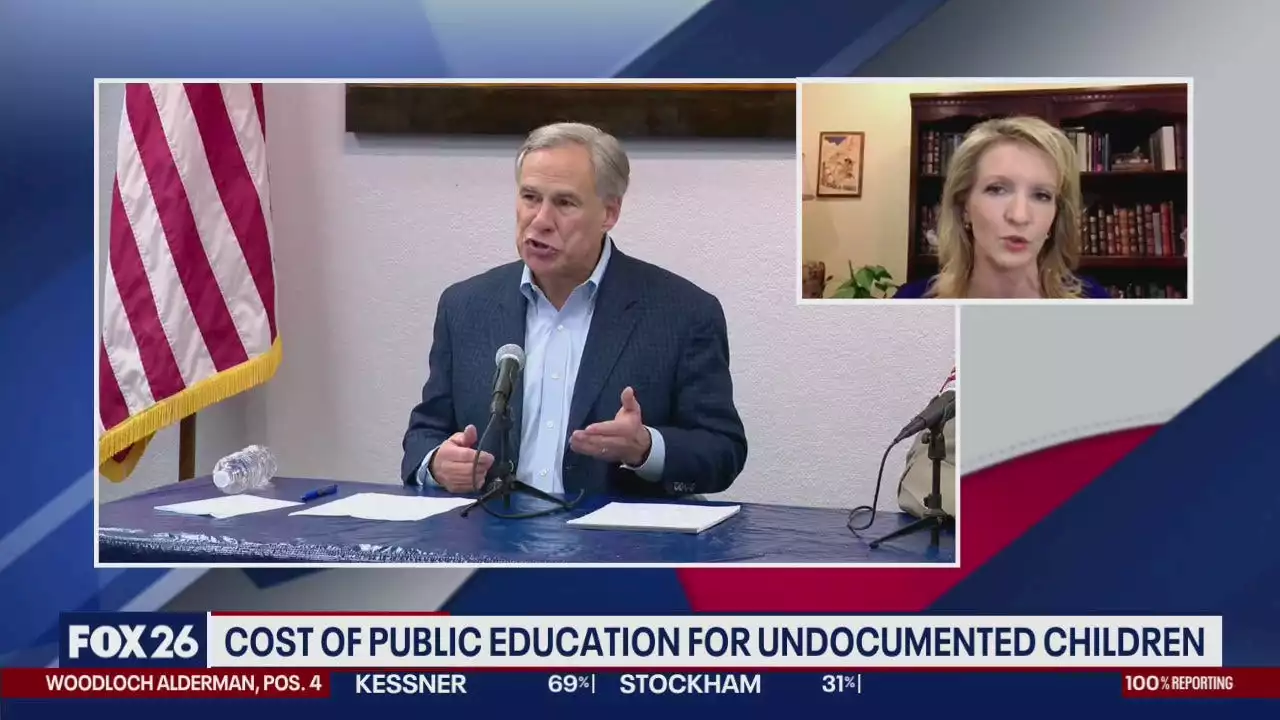

Gov. Abbott Wants Fed Gov To Pay For Education Of Undocumented KidsPanel discusses the Supreme Court's decision on mandating states to educate all children; even those who are undocumented.

Gov. Abbott Wants Fed Gov To Pay For Education Of Undocumented KidsPanel discusses the Supreme Court's decision on mandating states to educate all children; even those who are undocumented.

Weiterlesen »

Inflation Outlook for Consumers Falls From Record High, Fed Survey ShowsInflation expectations over the next year fell to a median 6.3% in April, a 0.3 percentage point decrease from the record high the previous month.

Inflation Outlook for Consumers Falls From Record High, Fed Survey ShowsInflation expectations over the next year fell to a median 6.3% in April, a 0.3 percentage point decrease from the record high the previous month.

Weiterlesen »

Credibility Concerns — Gallop Poll Shows Fed Chair’s Confidence Ratings Slid by Double Digits – News Bitcoin NewsAccording to a Gallop poll published on May 2, the public’s confidence in America’s current economic leaders has been deteriorating.

Credibility Concerns — Gallop Poll Shows Fed Chair’s Confidence Ratings Slid by Double Digits – News Bitcoin NewsAccording to a Gallop poll published on May 2, the public’s confidence in America’s current economic leaders has been deteriorating.

Weiterlesen »

Fed rate hike will impact farmers' bottom lineIndiana farmers, like farmers across the United States, can expect to feel a financial fallout from the recent federal rate hike.

Fed rate hike will impact farmers' bottom lineIndiana farmers, like farmers across the United States, can expect to feel a financial fallout from the recent federal rate hike.

Weiterlesen »