Excessive USD weakness seems unjustified – Commerzbank DollarIndex Fed UnitedStates InterestRate Banks

It would probably be too early though to write off the Dollar at this stage. The labor market report on Friday was not that bad after all. We assume that the labor market remains too tight for the liking of the Fed and that it will therefore hike its key rate once again at the end of July. It remains to be seen whether that will be the end of the rate hike cycle; and it is still uncertain how quickly rate cuts really will follow.

At present USD seems beleaguered and that might well continue for some time, but as long as the economic data paints a picture of a robust US economy, the uncertainty about when the US central bank might begin its rate cutting cycle remains high, and excessive USD weakness seems unjustified.Information on these pages contains forward-looking statements that involve risks and uncertainties.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

USD/JPY: Two scenarios for the Yen, levels around 160 can be imaginable – CommerzbankUlrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, imagines mainly two scenarios for the Yen. USD/JPY levels in the area of 160? One

USD/JPY: Two scenarios for the Yen, levels around 160 can be imaginable – CommerzbankUlrich Leuchtmann, Head of FX and Commodity Research at Commerzbank, imagines mainly two scenarios for the Yen. USD/JPY levels in the area of 160? One

Weiterlesen »

USD/TRY seen drifting up to 30.00 during 2024 – CommerzbankThe Turkish Lira broke out of its tight range after this year’s election, which saw President Tayyip Erdogan retain his power. Economists at Commerzba

USD/TRY seen drifting up to 30.00 during 2024 – CommerzbankThe Turkish Lira broke out of its tight range after this year’s election, which saw President Tayyip Erdogan retain his power. Economists at Commerzba

Weiterlesen »

USD/JPY rebounds from monthly low, climbs to mid-142.00s amid reviving USD demandThe USD/JPY pair attracts some buyers near the 142.00 round figure during the Asian session on Monday and recovers a part of Friday's heavy losses to

USD/JPY rebounds from monthly low, climbs to mid-142.00s amid reviving USD demandThe USD/JPY pair attracts some buyers near the 142.00 round figure during the Asian session on Monday and recovers a part of Friday's heavy losses to

Weiterlesen »

GBP/USD trades below the YTD top amid modest USD strength, holds above 1.2800The GBP/USD pair kicks off the new week on a subdued note and consolidates its recent gains to the highest level since April 2022, around mid-1.2800s

GBP/USD trades below the YTD top amid modest USD strength, holds above 1.2800The GBP/USD pair kicks off the new week on a subdued note and consolidates its recent gains to the highest level since April 2022, around mid-1.2800s

Weiterlesen »

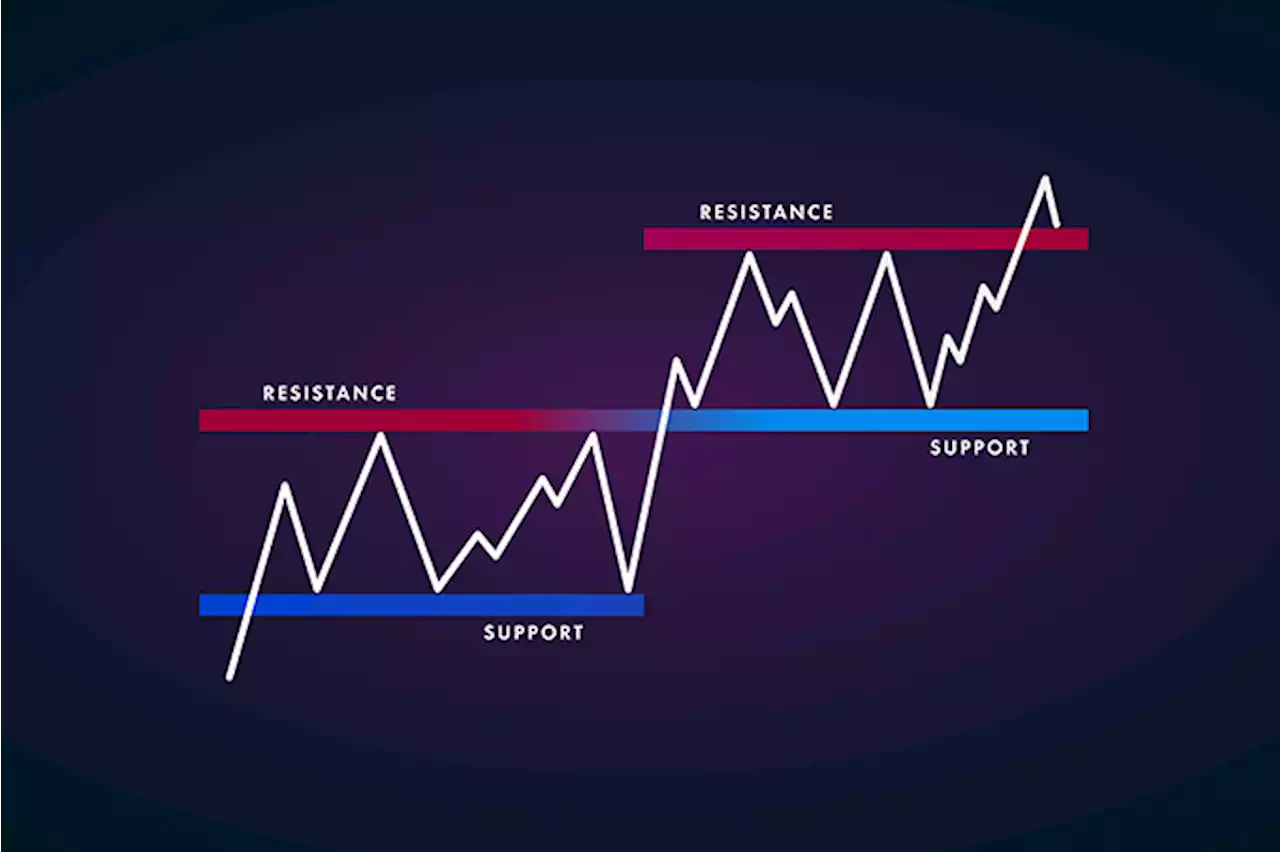

Trading Support and Resistance \u2013 AUD/USD, USD/CADLast week was dominated by relative strength in the Japanese Yen, and relative weakness in the US Dollar. Find out which currency pairs are going to be worth watching this week here:

Trading Support and Resistance \u2013 AUD/USD, USD/CADLast week was dominated by relative strength in the Japanese Yen, and relative weakness in the US Dollar. Find out which currency pairs are going to be worth watching this week here:

Weiterlesen »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, GBP/USD, USD/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction. Get our weekly Forex forecast here:

Weekly Forex Forecast \u2013 NASDAQ 100 Index, GBP/USD, USD/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction. Get our weekly Forex forecast here:

Weiterlesen »