The EUR/USD pair recovers strongly from a weekly low of 1.0670 in Monday’s European session.

EUR/USD rebounds swiftly from 1.0670 as the appeal for risk-perceived assets improves. The US economic outlook appears to be stronger than its peers. Weak preliminary Eurozone PMI boosts hopes of ECB ’s subsequent rate cuts. The major currency pair bounces back as the appeal for risk-sensitive assets improves amid growing speculation that the Fed eral Reserve will start reducing interest rates in the September meetingand will deliver two rate cuts this year.

Where all major economies failed to meeting PMI estimates, the US economy surprisingly expanded at a faster pace than their prior release. Meanwhile, the Euro delivers an upbeat performance against its peers in Monday’s session as investors digest political uncertainty in France ahead of thefirst legislative elections round scheduled for June 30. The Euro recovered despite the preliminary HCOB PMI report for June pointing to a slowdown in the Eurozone economy.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Weiterlesen »

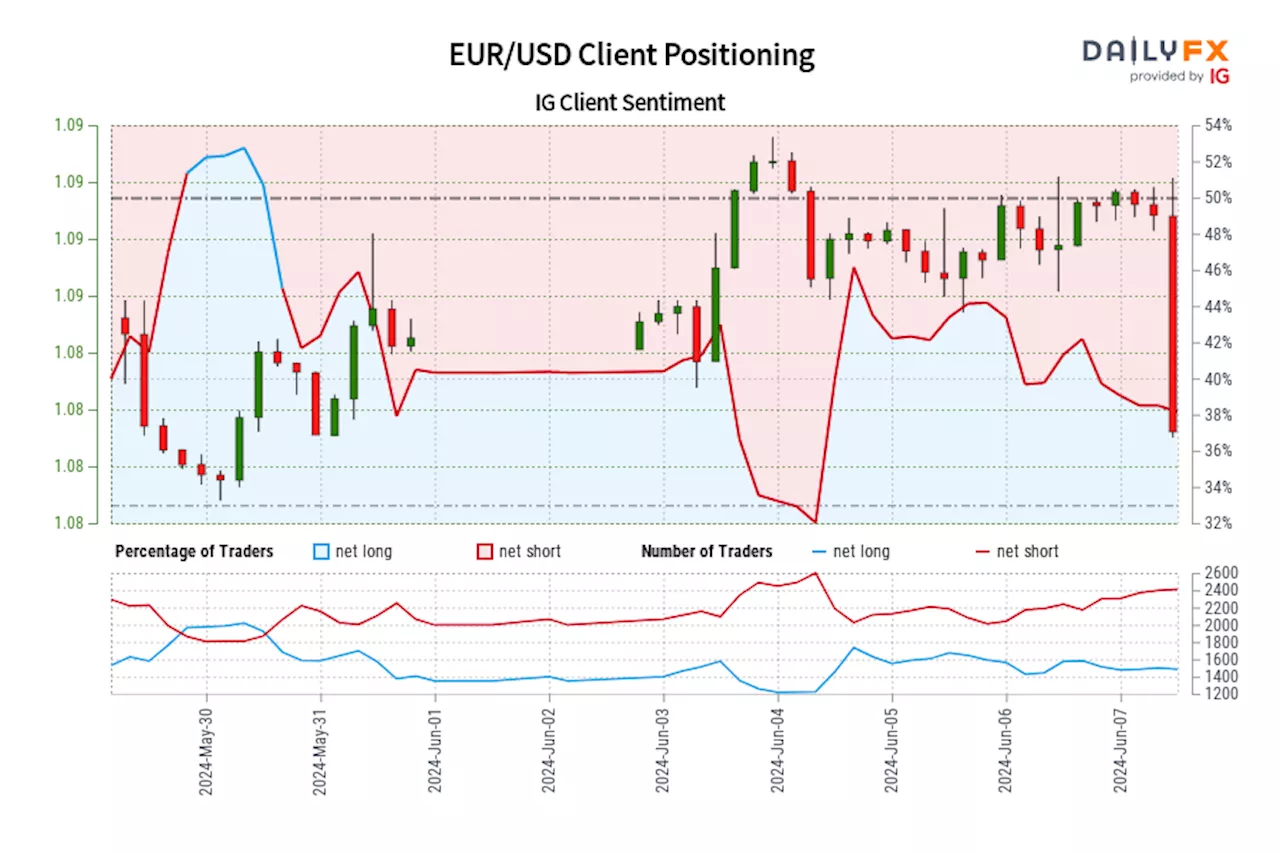

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Weiterlesen »

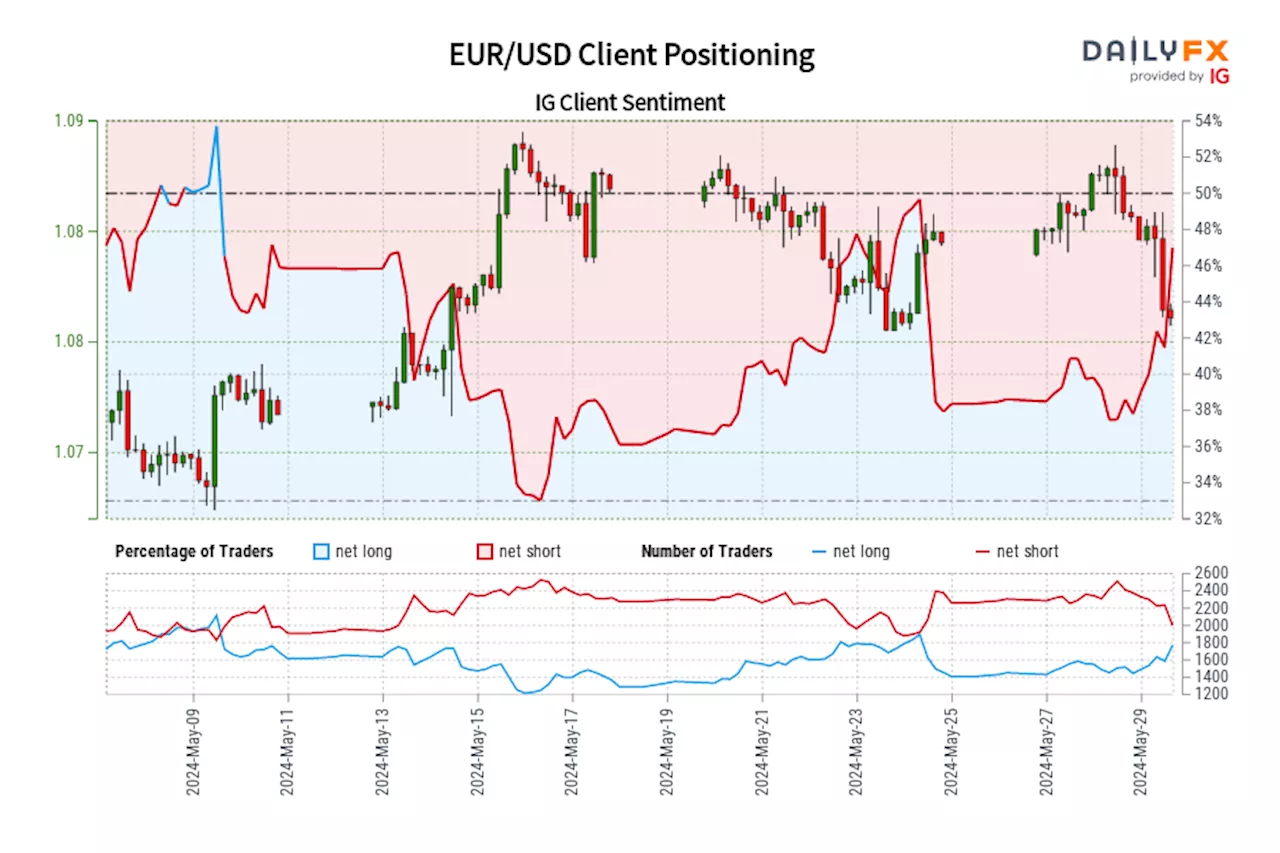

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Weiterlesen »

EUR/USD Forecast: The 1.0800 support holds the downside so farThe US Dollar (USD) managed to extend its weekly recovery, making the risk complex vulnerable and prompting another test of the vicinity of the 1.0800 zone by EUR/USD on Wednesday.

EUR/USD Forecast: The 1.0800 support holds the downside so farThe US Dollar (USD) managed to extend its weekly recovery, making the risk complex vulnerable and prompting another test of the vicinity of the 1.0800 zone by EUR/USD on Wednesday.

Weiterlesen »

![Elliott Wave analysis expects a flat correction as wave two in EUR/USD [Video]](https://i.headtopics.com/images/2024/5/30/fxstreetnews/elliott-wave-analysis-expects-a-flat-correction-as-elliott-wave-analysis-expects-a-flat-correction-as-35A926E68F9C0F342A0746E13EB16076.webp?w=640) Elliott Wave analysis expects a flat correction as wave two in EUR/USD [Video]Short term Elliott Wave in EUR/USD suggests rally from 4.16.2024 low unfolded as a 5 waves impulse Elliott Wave structure.

Elliott Wave analysis expects a flat correction as wave two in EUR/USD [Video]Short term Elliott Wave in EUR/USD suggests rally from 4.16.2024 low unfolded as a 5 waves impulse Elliott Wave structure.

Weiterlesen »

Big moves ahead: ECB’s interest rate cut and the future of EUR/USDThe European Central Bank is set for a major move: an interest rate cut in June.

Big moves ahead: ECB’s interest rate cut and the future of EUR/USDThe European Central Bank is set for a major move: an interest rate cut in June.

Weiterlesen »