EUR/CHF has moved sharply lower following the outbreak of war in the Middle East between Israel and Hamas. Economists at Danske Bank analyze the pair’

s outlook. Upside potential if the SNB decides to stop intervening We expect FX intervention to continue to limit imported inflation and thus keep a cap on EUR/CHF in the near term.

We forecast a sustained move lower in EUR/CHF on the back of fundamentals and continued tight financial conditions. In light of the lower spot, we lower our entire forecast profile. We target the cross at 0.93 in 6-12M. If the SNB decides to fully stop intervening, we see upside potential to EUR/CHF in the near term.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

EUR/USD rises amid escalating Middle East conflict and lower US bond yieldsEUR/USD climbs for the third straight day, even though the Middle East conflict continues to escalate, as troops of the United States (US) were attack

EUR/USD rises amid escalating Middle East conflict and lower US bond yieldsEUR/USD climbs for the third straight day, even though the Middle East conflict continues to escalate, as troops of the United States (US) were attack

Weiterlesen »

China's economy hinges on a peaceful Middle EastChina is 'highly exposed to the current instability in the Middle East.'

China's economy hinges on a peaceful Middle EastChina is 'highly exposed to the current instability in the Middle East.'

Weiterlesen »

Oil dips as economic concerns offset Middle East supply worriesOil dips as economic concerns offset Middle East supply worries

Oil dips as economic concerns offset Middle East supply worriesOil dips as economic concerns offset Middle East supply worries

Weiterlesen »

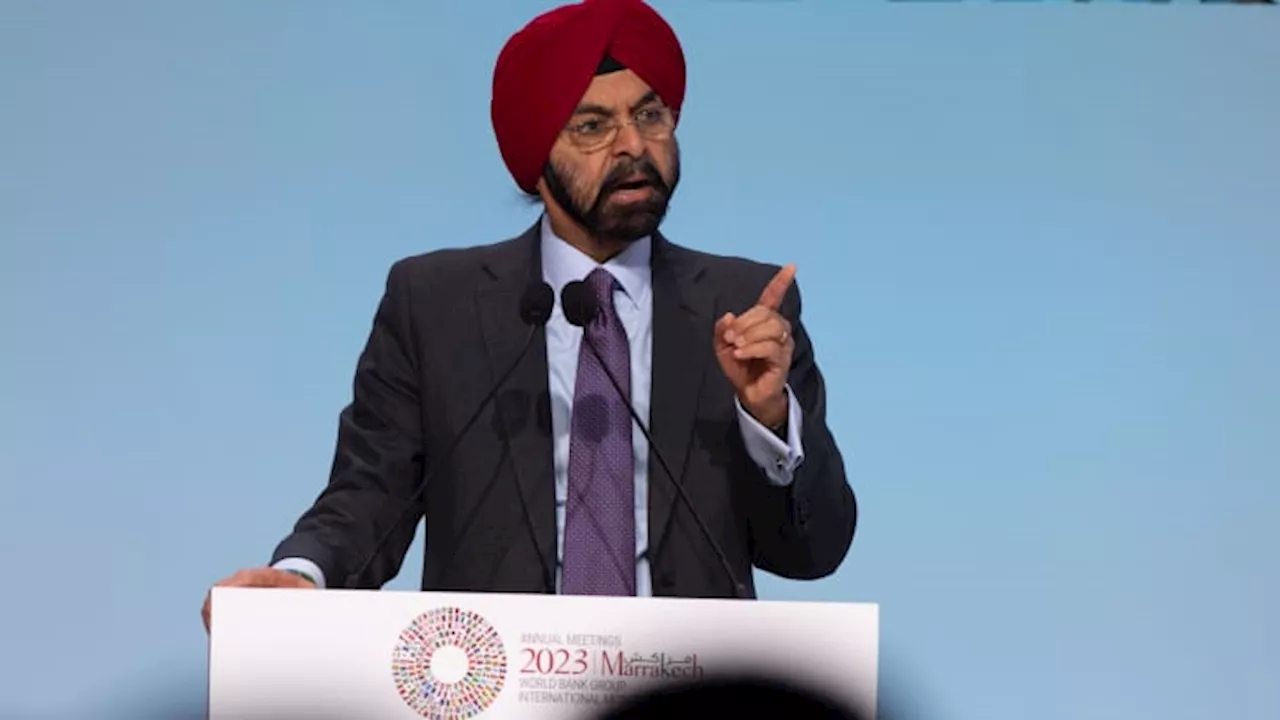

Peace talks in the Middle East will take time to resume, World Bank chief saysThe president of the World Bank said Tuesday that it will be some time before progress toward a more peaceful Middle East can resume in earnest.

Peace talks in the Middle East will take time to resume, World Bank chief saysThe president of the World Bank said Tuesday that it will be some time before progress toward a more peaceful Middle East can resume in earnest.

Weiterlesen »

Peace talks in the Middle East will take time to resume, World Bank chief saysThe president of the World Bank said Tuesday that it will be some time before progress toward a more peaceful Middle East can resume in earnest.

Peace talks in the Middle East will take time to resume, World Bank chief saysThe president of the World Bank said Tuesday that it will be some time before progress toward a more peaceful Middle East can resume in earnest.

Weiterlesen »