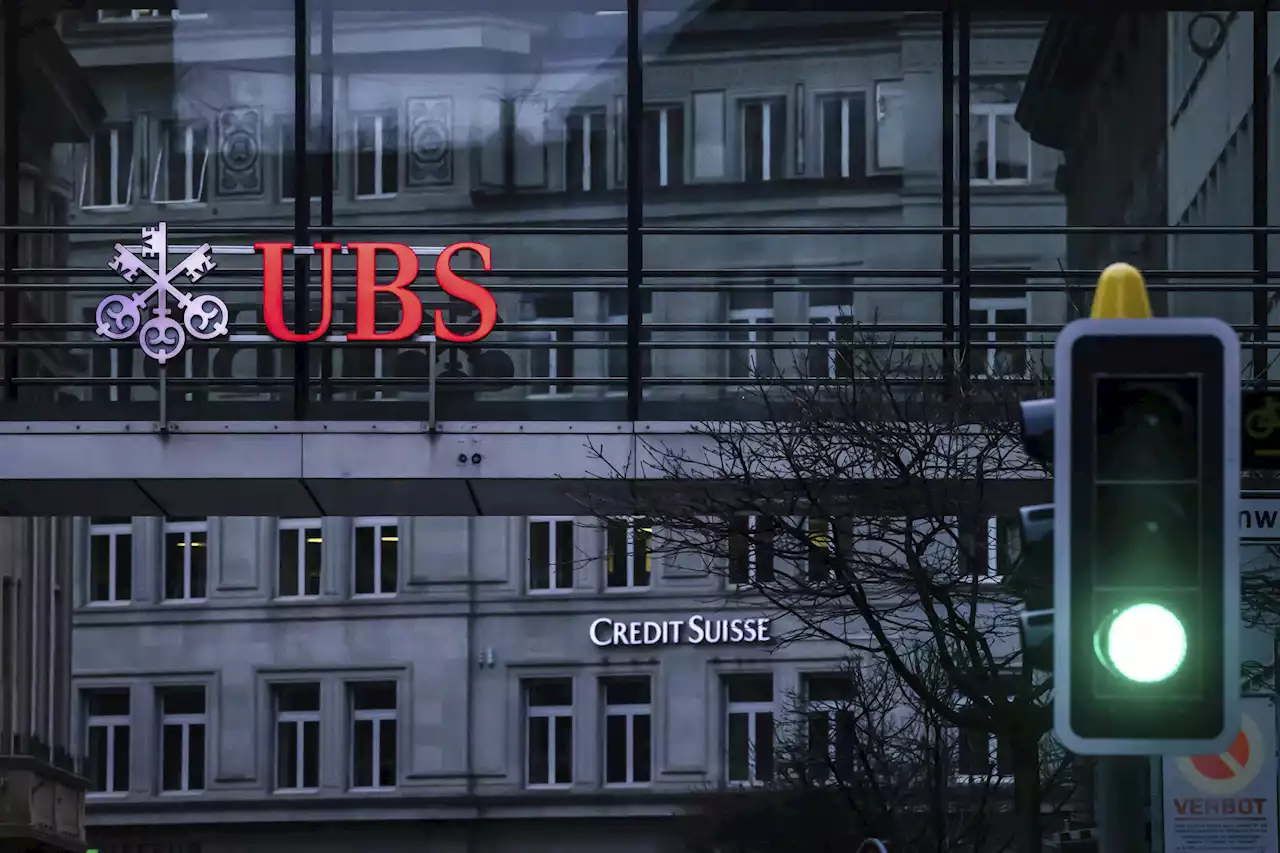

The UBS takeover of embattled rival Credit Suisse has shaken Switzerland's self-image and dented its reputation as a global financial center, analysts say, warning that the country's prosperity could grow too dependent on a single banking behemoth.

“For me, the debate nowadays is not ‘too big to fail’ - it’s rather ‘too small to survive,’” Ermotti said at a news conference this week. ”And we want to be a winner out of this.”

Blocher’s protégé, Ueli Maurer - who was finance minister until stepping down in December - championed a hands-off approach to banks like Credit Suisse to let them sort out their own troubles. Swiss diplomats, who have been intermediaries between Iran and Saudi Arabia since the countries broke off ties in 2016, were absent as China brokered an agreement this month to restore relations between the Mideast rivals.who is a former UBS executive in Colorado, upshifted the debate about how the European country interprets its idea of neutrality.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Swiss economists question UBS takeover of Credit Suisse in pollA poll of Swiss economists found that nearly half think the takeover of Credit Suisse by UBS was not the best solution, warning the saga has dented Switzerland's reputation as a banking centre.

Swiss economists question UBS takeover of Credit Suisse in pollA poll of Swiss economists found that nearly half think the takeover of Credit Suisse by UBS was not the best solution, warning the saga has dented Switzerland's reputation as a banking centre.

Weiterlesen »

Analysis: Future for shock-absorbing bank debt uncertain in Credit Suisse aftermathAs the dust settles on a surprise move by Switzerland to write down $17 billion of bonds under Credit Suisse's rescue, the market for debt designed as a shock absorber for banks faces a long haul to regain investor trust.

Analysis: Future for shock-absorbing bank debt uncertain in Credit Suisse aftermathAs the dust settles on a surprise move by Switzerland to write down $17 billion of bonds under Credit Suisse's rescue, the market for debt designed as a shock absorber for banks faces a long haul to regain investor trust.

Weiterlesen »

Credit Suisse takeover hits heart of Swiss banking, identityThe UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center, analysts say.

Credit Suisse takeover hits heart of Swiss banking, identityThe UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center, analysts say.

Weiterlesen »

Credit Suisse takeover hits heart of Swiss banking, identityAnalysts say the UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center. They warn that the country’s prosperity could grow too dependent on a single banking behemoth. The uncertain future of a union of Switzerland’s two global banks comes at a thorny time for Swiss identity, built nearly as much on a self-image of finesse in finance as on know-how with chocolate, watchmaking and cheese. Incoming UBS chief Sergio Ermotti says Switzerland needs a strong globally significant bank if it wants to be a financial hub. He says the issue isn't “too big to fail' but 'too small to survive.”

Credit Suisse takeover hits heart of Swiss banking, identityAnalysts say the UBS takeover of embattled rival Credit Suisse has shaken Switzerland’s self-image and dented its reputation as a global financial center. They warn that the country’s prosperity could grow too dependent on a single banking behemoth. The uncertain future of a union of Switzerland’s two global banks comes at a thorny time for Swiss identity, built nearly as much on a self-image of finesse in finance as on know-how with chocolate, watchmaking and cheese. Incoming UBS chief Sergio Ermotti says Switzerland needs a strong globally significant bank if it wants to be a financial hub. He says the issue isn't “too big to fail' but 'too small to survive.”

Weiterlesen »

Swiss anger will sour UBS’s deal of the centuryPoliticians and citizens are unhappy about job cuts and future risks arising from the bank’s $3 bln state-backed Credit Suisse rescue. Parliament fury may force returning CEO Sergio Ermotti to tweak the deal. Either way, an unsavory domestic whiff could hang over UBS for years.

Swiss anger will sour UBS’s deal of the centuryPoliticians and citizens are unhappy about job cuts and future risks arising from the bank’s $3 bln state-backed Credit Suisse rescue. Parliament fury may force returning CEO Sergio Ermotti to tweak the deal. Either way, an unsavory domestic whiff could hang over UBS for years.

Weiterlesen »

Commodities prices to trend higher in 2023 and beyond – UBSThe global commodities sector has come under pressure in March. But strategists at UBS remain most preferred in this asset class. Playing the long gam

Commodities prices to trend higher in 2023 and beyond – UBSThe global commodities sector has come under pressure in March. But strategists at UBS remain most preferred in this asset class. Playing the long gam

Weiterlesen »