Credit Suisse customers feel anger, worry and relief after the Swiss government pushed rival UBS to take over the troubled bank amid global financial turmoil. Customers and workers caught in the middle of the frantic sale aren't sure what comes next.

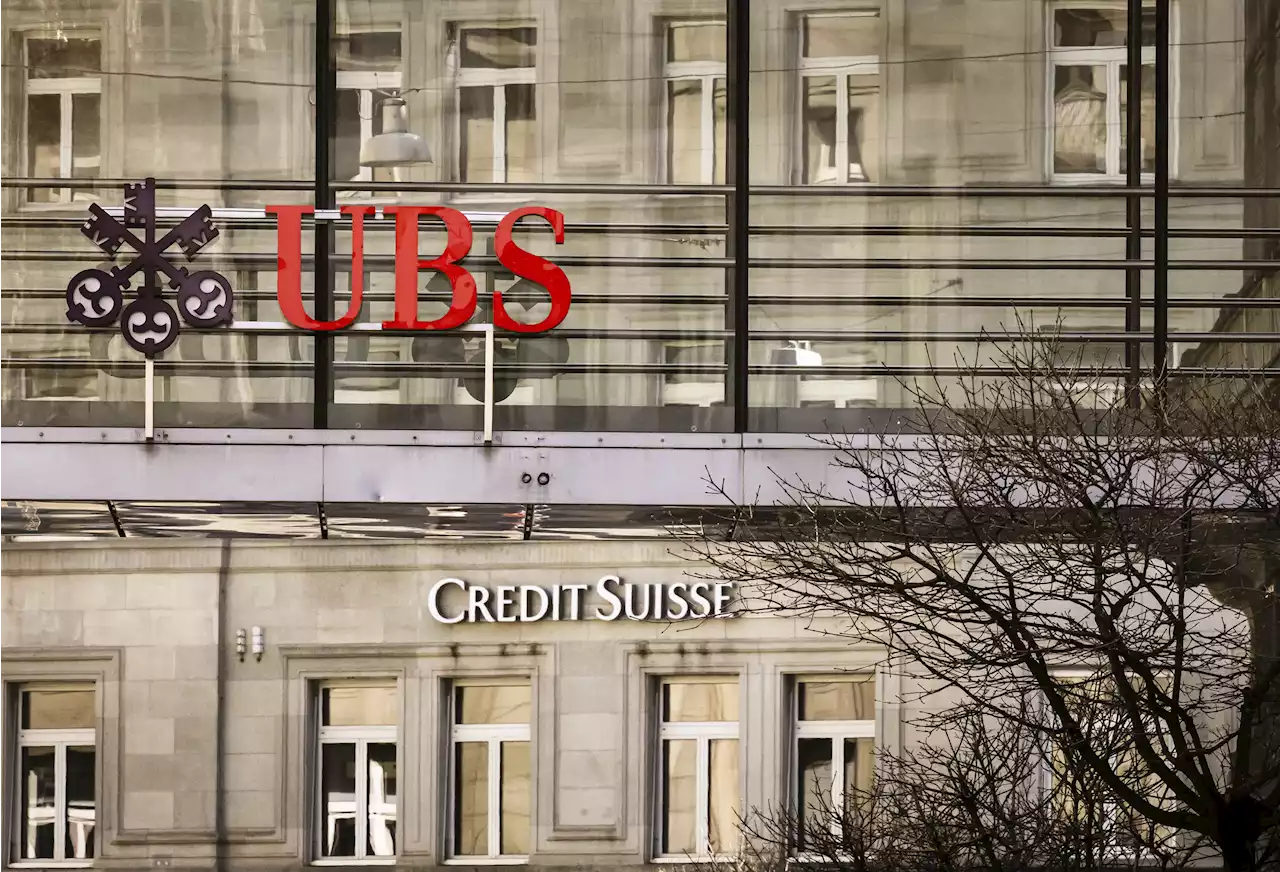

Logos of the Swiss banks Credit Suisse and UBS are seen on two buildings in Zurich, Switzerland, Saturday, March 18, 2023. Logos of the Swiss banks Credit Suisse and UBS are seen on two buildings in Zurich, Switzerland, Saturday, March 18, 2023.

GENEVA — Fury at top Credit Suisse managers. Lament over damage to Switzerland’s image as a stable, reliable banking center. Relief that

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Credit Suisse customers feel mix of anger, relief after saleFury at top Credit Suisse managers. Lament over damage to Switzerland’s image as a stable, reliable banking center. Relief that authorities stepped in to help protect deposits, but worry about keeping cash invested in a bank that failed to manage its own money adequately.

Credit Suisse customers feel mix of anger, relief after saleFury at top Credit Suisse managers. Lament over damage to Switzerland’s image as a stable, reliable banking center. Relief that authorities stepped in to help protect deposits, but worry about keeping cash invested in a bank that failed to manage its own money adequately.

Weiterlesen »

Why $17 billion in Credit Suisse bonds became worthlessCredit Suisse’s “CoCo” bonds did exactly what they were designed to do: Transfer all the risk of debt from the bank to bondholders. Here’s what we know about the “CoCo” bonds and what their evaporation may mean for the banking sector.

Why $17 billion in Credit Suisse bonds became worthlessCredit Suisse’s “CoCo” bonds did exactly what they were designed to do: Transfer all the risk of debt from the bank to bondholders. Here’s what we know about the “CoCo” bonds and what their evaporation may mean for the banking sector.

Weiterlesen »

Fed, US banks in focus as mood improves on Credit Suisse rescueInvestors on Tuesday took some heart from the rescue of troubled lender Credit Suisse by its Swiss rival UBS , though concerns lingered about the risk of shockwaves further damaging credit markets and smaller U.S. banks.

Fed, US banks in focus as mood improves on Credit Suisse rescueInvestors on Tuesday took some heart from the rescue of troubled lender Credit Suisse by its Swiss rival UBS , though concerns lingered about the risk of shockwaves further damaging credit markets and smaller U.S. banks.

Weiterlesen »

PIMCO lost $340 mln with Credit Suisse AT1 bonds write-off - sourceBond giant PIMCO lost about $340 million on a category of Credit Suisse bonds that were wiped out by the takeover by UBS , with the American investment manager's overall exposure to the Swiss lender running into billions, a source familiar with the situation said.

PIMCO lost $340 mln with Credit Suisse AT1 bonds write-off - sourceBond giant PIMCO lost about $340 million on a category of Credit Suisse bonds that were wiped out by the takeover by UBS , with the American investment manager's overall exposure to the Swiss lender running into billions, a source familiar with the situation said.

Weiterlesen »

Dollar languishes as bank crisis fears ebb on Credit Suisse rescueThe dollar regained some ground on Tuesday but was pinned near a five-week low as traders tiptoed back into riskier assets after UBS' state-backed takeover of Credit Suisse allayed some fears of a widespread, systemic banking crisis.

Dollar languishes as bank crisis fears ebb on Credit Suisse rescueThe dollar regained some ground on Tuesday but was pinned near a five-week low as traders tiptoed back into riskier assets after UBS' state-backed takeover of Credit Suisse allayed some fears of a widespread, systemic banking crisis.

Weiterlesen »

Breakingviews - Credit Suisse reinforces Japan’s offshore anxietyOn Breakingviews: The Credit Suisse crisis has traders wondering who’s next. Japanese lenders, with staid depositor bases, look like unlikely targets for bank runs. Yet their collective overseas bond portfolio is in focus. So it should be: petesweeneypro

Breakingviews - Credit Suisse reinforces Japan’s offshore anxietyOn Breakingviews: The Credit Suisse crisis has traders wondering who’s next. Japanese lenders, with staid depositor bases, look like unlikely targets for bank runs. Yet their collective overseas bond portfolio is in focus. So it should be: petesweeneypro

Weiterlesen »