Both the buyer and seller of the Grizzlies lost out on a $10.7 million tax deduction.

... [+]Getty Images

Heisley sought to claim a tax deduction for the deferred compensation, but yesterday the U.S. Tax Court. Why? Deferred compensation is deductible only in the year in which the beneficiaries of the deferred compensation receive it. In this instance, Randolph and Conley had not received the compensation in the year in which the sale took place.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Court Rules Michael Heisley Can’t Get Tax Deduction From Sale Of Memphis Grizzlies To Michael PeraCourt Rules Robert Pera And Michael Heisley Can’t Get Tax Deduction From Sale Of Memphis Grizzlies

Court Rules Michael Heisley Can’t Get Tax Deduction From Sale Of Memphis Grizzlies To Michael PeraCourt Rules Robert Pera And Michael Heisley Can’t Get Tax Deduction From Sale Of Memphis Grizzlies

Weiterlesen »

Opinion: Texas voters, beware of false promises of tax reliefReplacing the property tax with an enhanced sales tax, with no changes to the tax base,...

Opinion: Texas voters, beware of false promises of tax reliefReplacing the property tax with an enhanced sales tax, with no changes to the tax base,...

Weiterlesen »

Suspect charged with killing SUNY student Elizabeth Howell waives hearingA public defender for Michael J. Snow — accused of killing SUNY Potsdam student, Elizabeth Howell — waived the preliminary hearing set for Friday in Massena town court.

Suspect charged with killing SUNY student Elizabeth Howell waives hearingA public defender for Michael J. Snow — accused of killing SUNY Potsdam student, Elizabeth Howell — waived the preliminary hearing set for Friday in Massena town court.

Weiterlesen »

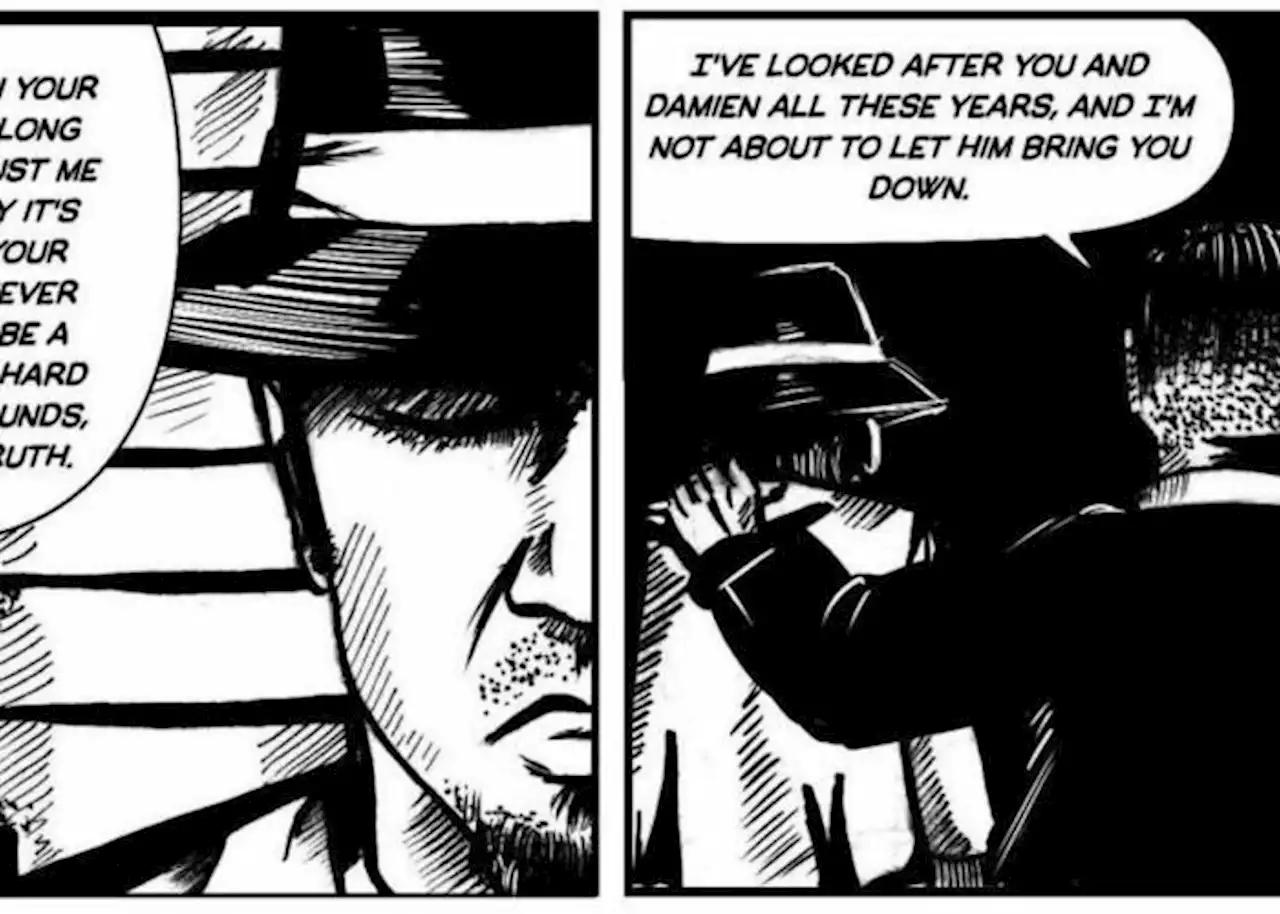

Houston-set graphic novel ‘A Violent New World’ explores the city’s underbellyMichael Cortez's tale takes place in the neighborhoods of Houston's south side.

Houston-set graphic novel ‘A Violent New World’ explores the city’s underbellyMichael Cortez's tale takes place in the neighborhoods of Houston's south side.

Weiterlesen »

The Sopranos Star Michael Imperioli Threw His Emmy in the TrashThough his career started before his appearance on the hit HBO series, actor Michael Imperioli is [...]

The Sopranos Star Michael Imperioli Threw His Emmy in the TrashThough his career started before his appearance on the hit HBO series, actor Michael Imperioli is [...]

Weiterlesen »

Halloween Photo Reveals Michael Myers With Jamie Lee Curtis’ Stunt DoubleA new behind-the-scenes image from 2018's Halloween shows MichaelMyers actor James Jude Courtney on set with Jamie Lee Curtis' stunt double.

Halloween Photo Reveals Michael Myers With Jamie Lee Curtis’ Stunt DoubleA new behind-the-scenes image from 2018's Halloween shows MichaelMyers actor James Jude Courtney on set with Jamie Lee Curtis' stunt double.

Weiterlesen »