This article scrutinizes retail sentiment on the British pound across three key FX pairs: GBP/USD, GBP/JPY and EUR/GBP, while also examining unconventional scenarios that challenge common crowd behaviors in the market.

The key principle is that overly optimistic sentiment can create overvalued assets, setting the stage for a correction. On the flip side, extreme pessimism can signal overlooked buying opportunities. By analyzing crowd psychology, contrarians seek to profit from the collective misjudgments of the market.

This prevailing bearishness within the retail segment often serves as a contrarian signal. When sentiment skews towards one direction, the market tends to do the opposite. This bearish tilt often functions as a contrarian signal. Market behavior suggests that when sentiment becomes overwhelmingly skewed in one direction, it usually precedes a reversal. In light of this, GBP/JPY may be poised for further upside. Of course, market dynamics are complex, and sentiment shouldn't be the sole basis for trading decisions.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

– Analysis & Setups on GBP/USD, EUR/GBP and GBP/JPYThis article explores the technical outlook for several British pound currency pairs, including GBP/USD, EUR/GBP and GBP/JPY. Recent market sentiment dynamics and key levels to watch are also discussed.

– Analysis & Setups on GBP/USD, EUR/GBP and GBP/JPYThis article explores the technical outlook for several British pound currency pairs, including GBP/USD, EUR/GBP and GBP/JPY. Recent market sentiment dynamics and key levels to watch are also discussed.

Weiterlesen »

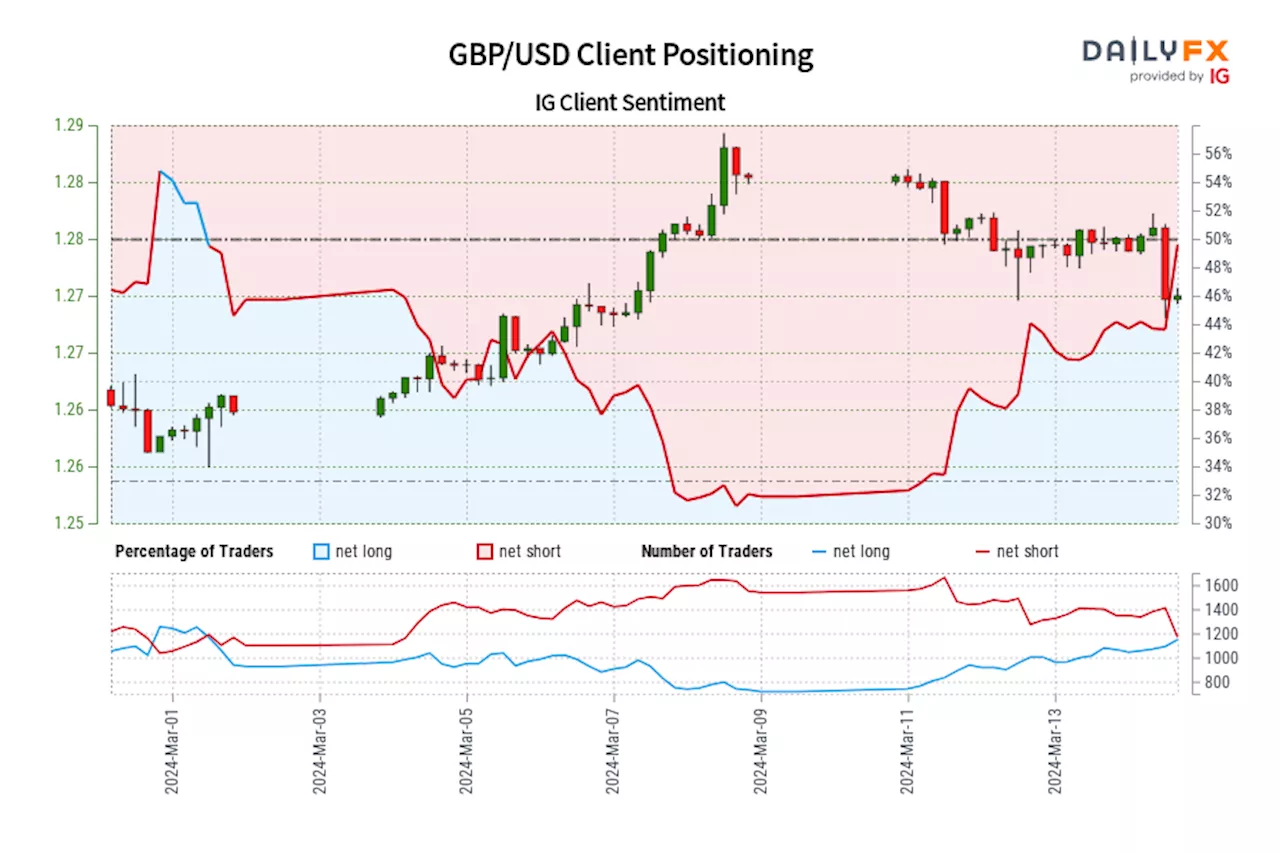

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Weiterlesen »

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

Weiterlesen »

EUR/GBP retreats further from weekly top after ECB Stournaras’ dovish commentsThe EUR/GBP cross comes under heavy selling pressure on Thursday and for now, seems to have snapped a three-day winning streak to the 0.8560 area, or the weekly top touched the previous day.

EUR/GBP retreats further from weekly top after ECB Stournaras’ dovish commentsThe EUR/GBP cross comes under heavy selling pressure on Thursday and for now, seems to have snapped a three-day winning streak to the 0.8560 area, or the weekly top touched the previous day.

Weiterlesen »

EUR/GBP will struggle to find direction into the CPI and BoE events next weekThe Bank of England will release its Inflation Attitudes Survey on Friday.

EUR/GBP will struggle to find direction into the CPI and BoE events next weekThe Bank of England will release its Inflation Attitudes Survey on Friday.

Weiterlesen »

EUR/GBP rebounds from 0.8530 despite hopes that BoE to reduce rate cuts later than ECBThe EUR/GBP pair bounces back strongly from 0.8530 in the European session on Friday.

EUR/GBP rebounds from 0.8530 despite hopes that BoE to reduce rate cuts later than ECBThe EUR/GBP pair bounces back strongly from 0.8530 in the European session on Friday.

Weiterlesen »