Hedge fund heavyweight Brevan Howard’s macro fund performed well last year, with most of its gains derived from its interest rate positions.

Last year was no joke – fund managers had to wade through volatility from high inflation, soaring energy costs, shaky FX markets, and the war in Ukraine. Globally, hedge funds lost 4% for its investors last year, according to HFR data.

Last year was no joke – fund managers had to wade through volatility from high inflation, soaring energy costs, shaky FX markets, and the war in Ukraine. Globally, hedge funds lost 4% for its investors last year, according to HFR data.They anticipated it and according to its annual report posted on Wednesday it proved “favorable” for its core macro strategies.

For 2023, chair of the board Richard Horlick said their hopes for a soft landing from the Federal Reserve and the European Central Bank were dashed as the interest rate policymakers turned more hawkish on inflation.“Huge uncertainties remain as to whether global central banks will succeed in containing inflation without triggering severe recessions. Something always breaks during a rate-hiking cycle and there’s no such thing as a pain-free recession,” Horlick added.

“Global imbalances, both within individual economies as well as between them, in part due to economic de-synchronisation, are at generational extremes. As a consequence, the macro landscape looks set to remain extremely interesting,” he added.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Steve Cohen gave Justin Verlander hedge fund advice 3 years before Mets signingCohen, founder and owner of Point72 Asset Management, told The New York Times that a mutual friend acted as an intermediary sometime in early 2020.

Steve Cohen gave Justin Verlander hedge fund advice 3 years before Mets signingCohen, founder and owner of Point72 Asset Management, told The New York Times that a mutual friend acted as an intermediary sometime in early 2020.

Weiterlesen »

Column: Fearing credit crunch, hedge funds flee petroleumPortfolio investors sold oil-related futures and options contracts at the fastest rate for almost six years as traders prepared for the onset of a recession driven by tighter credit conditions in the aftermath of the banking crisis.

Column: Fearing credit crunch, hedge funds flee petroleumPortfolio investors sold oil-related futures and options contracts at the fastest rate for almost six years as traders prepared for the onset of a recession driven by tighter credit conditions in the aftermath of the banking crisis.

Weiterlesen »

Howard Beck on LeBron's return, Zion's future & NBA awards voting | Good Word with Goodwill

Howard Beck on LeBron's return, Zion's future & NBA awards voting | Good Word with Goodwill

Weiterlesen »

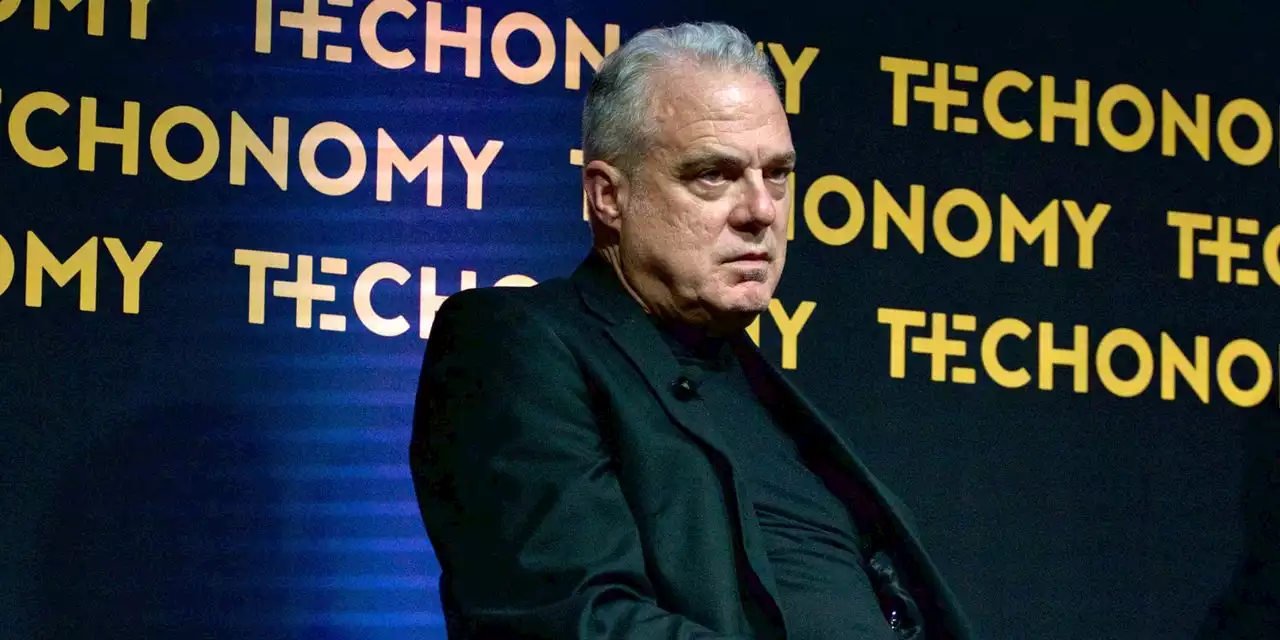

WSJ News Exclusive | Former Aetna CEO to Take Helm of Health Insurer OscarHealth insurer Oscar, which is trying to use tech to remake the industry but has yet to make a profit, is turning to an industry veteran to lead it: former Aetna Chief Executive Mark Bertolini

WSJ News Exclusive | Former Aetna CEO to Take Helm of Health Insurer OscarHealth insurer Oscar, which is trying to use tech to remake the industry but has yet to make a profit, is turning to an industry veteran to lead it: former Aetna Chief Executive Mark Bertolini

Weiterlesen »

How This Developer Is Tackling The Water Crisis —With Howard Buffett’s HelpSeveral years ago, I stood near a trailer park in downtown Las Vegas, listening to Zappos founder Tony Hsieh explain why the city didn’t really have a water problem.

How This Developer Is Tackling The Water Crisis —With Howard Buffett’s HelpSeveral years ago, I stood near a trailer park in downtown Las Vegas, listening to Zappos founder Tony Hsieh explain why the city didn’t really have a water problem.

Weiterlesen »

Hedge fund Standard General sues FCC over delay in Tegna dealStandard General said on Tuesday it had filed a lawsuit against the U.S. Federal Communications Commission (FCC) over its decision to hold hearings on the hedge fund's $5.4 billion plan to buy television station operator Tegna .

Hedge fund Standard General sues FCC over delay in Tegna dealStandard General said on Tuesday it had filed a lawsuit against the U.S. Federal Communications Commission (FCC) over its decision to hold hearings on the hedge fund's $5.4 billion plan to buy television station operator Tegna .

Weiterlesen »