The $12 billion Japanese bank’s net profit plunged 76% year-on-year to 7.4 billion yen ($55 million) in the three months ending March. That undoes a decent recovery trend and pushes the fiscal year’s earnings down by a third. Return on equity fell to a parlous 3.1%, far below the 8%-10% target. Like peers, it is feeling the pain of the Silicon Valley Bank crisis and Credit Suisse’s collapse. And Nomura , as with Goldman Sachs , is ill-positioned to benefit from rising lending rates as much as commercial banks are; both investment-banking firms posted a 5% decline in net revenue in the most recent quarter.

, is ill-positioned to benefit from rising lending rates as much as commercial banks are; both investment-banking firms posted a 5% decline in net revenue in the most recent quarter.

Wholesale revenue, dragged down by a 20% decline in investment banking, contracted for the quarter but remained up 10% for the year. Retail and investment management contracted compared to the prior quarter; that could be more than just seasonal if the global economy stays rickety. Shareholders might remind themselves that this particular external shock is not boss Kentaro Okuda’s fault - but they’re hyper-sensitive given Nomura’s history.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Breakingviews - Credit Suisse mess leaves scattered Swiss debrisSwiss government intervention to save Credit Suisse from collapse last month may have avoided a financial market storm. But Switzerland’s solution to its latest bank crisis – a $3 billion state-blessed sale to crosstown bank rival UBS – nonetheless creates headaches across the Alpine nation’s economic and political landscape.

Breakingviews - Credit Suisse mess leaves scattered Swiss debrisSwiss government intervention to save Credit Suisse from collapse last month may have avoided a financial market storm. But Switzerland’s solution to its latest bank crisis – a $3 billion state-blessed sale to crosstown bank rival UBS – nonetheless creates headaches across the Alpine nation’s economic and political landscape.

Weiterlesen »

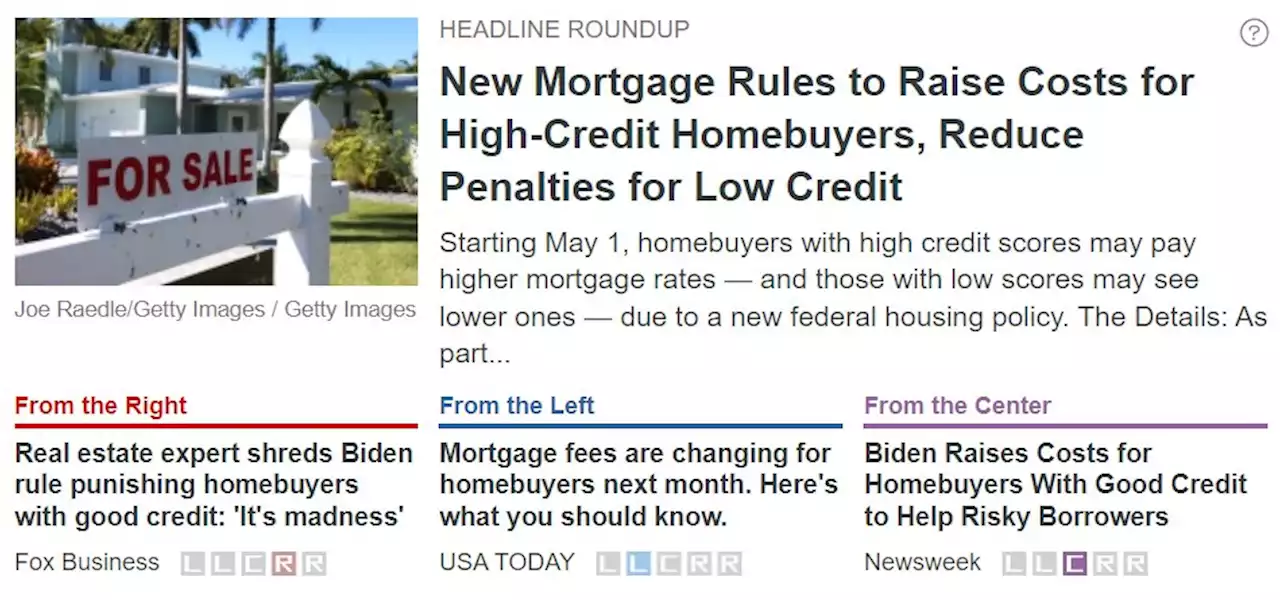

New Mortgage Rules to Raise Costs for High-Credit Homebuyers, Reduce Penalties for Low CreditHomebuyers with high credit scores may pay higher mortgage rates, and those with low scores may see lower ones, due to a new federal policy. See potential bias and similarities in coverage from FoxBusiness, USATODAY and Newsweek: Housing Mortgage

New Mortgage Rules to Raise Costs for High-Credit Homebuyers, Reduce Penalties for Low CreditHomebuyers with high credit scores may pay higher mortgage rates, and those with low scores may see lower ones, due to a new federal policy. See potential bias and similarities in coverage from FoxBusiness, USATODAY and Newsweek: Housing Mortgage

Weiterlesen »

Breakingviews - Philips’ convalescence has way longer to runRoy Jakobs has applied ointment to Philips’ wounds, but they’re still sore. The 17 billion euro Dutch medical-kit company’s shares rose 11% on Monday morning after it reported first-quarter numbers boosted by cost-cutting measures including layoffs. Adjusted earnings before interest, taxes and amortisation of 359 million euros beat analysts’ average estimate of 226 million euros, per Visible Alpha data. The recall of faulty breathing devices and ventilators means Philips needs to set aside another 575 million euros for lawsuits on top of over 1 billion euros last year, but that’s less than Bernstein analysts’ expectation of 2.4 billion euros.

Breakingviews - Philips’ convalescence has way longer to runRoy Jakobs has applied ointment to Philips’ wounds, but they’re still sore. The 17 billion euro Dutch medical-kit company’s shares rose 11% on Monday morning after it reported first-quarter numbers boosted by cost-cutting measures including layoffs. Adjusted earnings before interest, taxes and amortisation of 359 million euros beat analysts’ average estimate of 226 million euros, per Visible Alpha data. The recall of faulty breathing devices and ventilators means Philips needs to set aside another 575 million euros for lawsuits on top of over 1 billion euros last year, but that’s less than Bernstein analysts’ expectation of 2.4 billion euros.

Weiterlesen »

Breakingviews - Thyssenkrupp gives investors wrong kind of breakupAn abrupt CEO departure adds yet more problems for Thyssenkrupp’s long-suffering investors. The 4 billion euro German steel-to-cars group’s shares fell as much as 13% after it said Martina Merz was leaving after just four years in the job, and several months after her mandate was renewed.

Breakingviews - Thyssenkrupp gives investors wrong kind of breakupAn abrupt CEO departure adds yet more problems for Thyssenkrupp’s long-suffering investors. The 4 billion euro German steel-to-cars group’s shares fell as much as 13% after it said Martina Merz was leaving after just four years in the job, and several months after her mandate was renewed.

Weiterlesen »

Breakingviews - Bob Iger’s stalling may be stiflingWalt Disney is making good on its promises. The $180 billion company run by Bob Iger is kicking off its second round of layoffs, according to Reuters, part of an effort to cut $5.5 billion in costs. That’s a solid effort to keep activist Nelson Peltz, who had griped about Disney’s margins, at bay for now. The tricky part is ensuring assets don’t lose even more value before Iger heads out the door.

Breakingviews - Bob Iger’s stalling may be stiflingWalt Disney is making good on its promises. The $180 billion company run by Bob Iger is kicking off its second round of layoffs, according to Reuters, part of an effort to cut $5.5 billion in costs. That’s a solid effort to keep activist Nelson Peltz, who had griped about Disney’s margins, at bay for now. The tricky part is ensuring assets don’t lose even more value before Iger heads out the door.

Weiterlesen »

Breakingviews - J&J carves itself up at a discountJohnson & Johnson is paying a price to dismember itself. The $422 billion healthcare giant is floating part of its consumer business, named Kenvue, which sells brands ranging from Listerine to Tylenol. It’s hoping to raise $3.5 billion or more, at a valuation of around $40 billion, according to the Wall Street Journal. That’s nearly a 20% discount to rival Haleon , the consumer business spun off from GSK last year.

Breakingviews - J&J carves itself up at a discountJohnson & Johnson is paying a price to dismember itself. The $422 billion healthcare giant is floating part of its consumer business, named Kenvue, which sells brands ranging from Listerine to Tylenol. It’s hoping to raise $3.5 billion or more, at a valuation of around $40 billion, according to the Wall Street Journal. That’s nearly a 20% discount to rival Haleon , the consumer business spun off from GSK last year.

Weiterlesen »