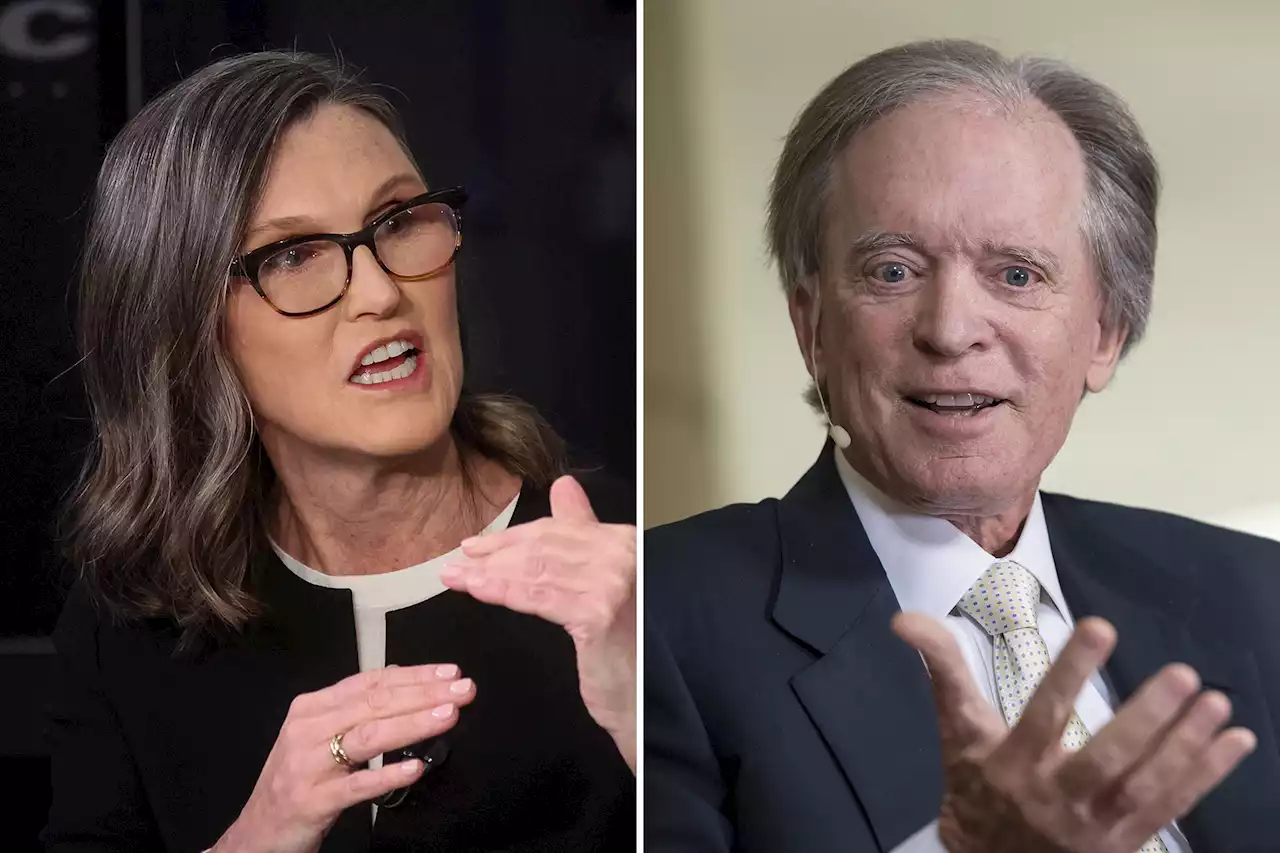

Gross called out the middling performance of Cathie Wood’s ARK Innovation ETF.

Billionaire “bond king” Bill Gross ripped CNBC and other business media outlets for their fawning coverage of tech investor Cathie Wood – despite her fund’s middling performance in the last few years.estimated fortune of $1.6 billion“CNBC/media idolatry of Cathie Wood is absurd,” Gross tweeted on Monday evening. “Over past 5 years QQQ has outperformed ARKK by nearly 100%.”

Meanwhile, Wood’s ARK Innovation ETF, the flagship fund offered by her firm ARK Investment Management, fell in value by more than 4% over the same period through Tuesday trading. Companies listed on Wood’s ETF include Tesla, its largest holding, as well as lesser-known tech firms such as Zoom, Roku, Coinbase and Shopify.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Billionaire investor Bill Gross slams the hype around Cathie WoodBillionaire investor Bill Gross slams the hype around Cathie Wood, with Ark's flagship fund lagging top tech stocks

Weiterlesen »

Stock picks: Cathie Wood's Ark Invest buys $9 million of CoinbaseCathie Wood's Ark Invest bought nearly $9 million of Coinbase stock as the crypto exchange pared gains on hot inflation data

Weiterlesen »

Cathie Wood: Bitcoin and Ethereum are ‘on the right track,’ despite collapse of several crypto companiesEther has been ushering in a financial services “revolution,” said Cathie Wood, chief executive at ARK Invest. Wood’s flagship Ark Innovation ETF fell more than 67% in 2022, but has regained about 24% so far this year.

Cathie Wood: Bitcoin and Ethereum are ‘on the right track,’ despite collapse of several crypto companiesEther has been ushering in a financial services “revolution,” said Cathie Wood, chief executive at ARK Invest. Wood’s flagship Ark Innovation ETF fell more than 67% in 2022, but has regained about 24% so far this year.

Weiterlesen »

Cathie Wood Bullish on Market Recovery, Here's WhyArk Invest CEO CathieDWood remains optimistic and believes that the most brutal interest rate increase in history is coming to an end

Cathie Wood Bullish on Market Recovery, Here's WhyArk Invest CEO CathieDWood remains optimistic and believes that the most brutal interest rate increase in history is coming to an end

Weiterlesen »

Billionaire 'Bond King' Jeffrey Gundlach Warns of 'Painful Outcomes' in Next Recession – Economics Bitcoin NewsBillionaire Jeffrey Gundlach, aka the 'Bond King,' has warned of 'painful outcomes that are coming in the next recession.'

Billionaire 'Bond King' Jeffrey Gundlach Warns of 'Painful Outcomes' in Next Recession – Economics Bitcoin NewsBillionaire Jeffrey Gundlach, aka the 'Bond King,' has warned of 'painful outcomes that are coming in the next recession.'

Weiterlesen »