Mortgage lenders anticipate rates will fall in 2024 and the price of homes will remain high.

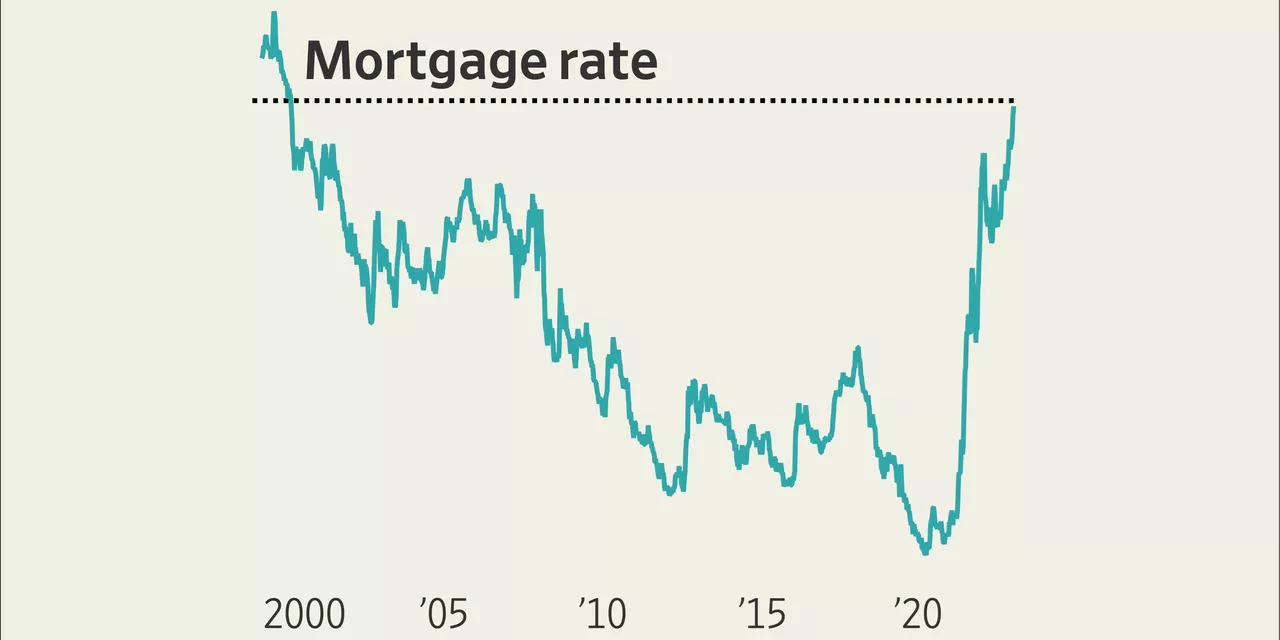

Mortgage rates will experience a significant drop by the end of 2024 but the dip will accompany a shortage of available homes, driving up sales prices for the next three years, the Mortgage Bankers Association said.The rates, which have hit two-decade highs, will fall substantially by the end of next year, lessened by a sluggish economy as moderating inflation and borrowing costs decline, the MBA said during the weekend.

'Lower rates should help boost both homebuyer demand and increase the inventory of existing homes, thereby supporting purchase origination volume in 2024,' he said.Lenders say first-time buyers will drive the demand for homes over the next year as a new generation of Americans hit homeowning age even as they will have to grapple low inventory, high prices and limited credit.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Mortgage bankers expect the 30-year rate to drop to 6.1% by the end of 2024‘The Fed’s hiking cycle is likely nearing an end,’ industry group says

Mortgage bankers expect the 30-year rate to drop to 6.1% by the end of 2024‘The Fed’s hiking cycle is likely nearing an end,’ industry group says

Weiterlesen »

IPOs Of The Smallest Companies Post Astonishing Failure Rates, But Bankers Still WinI'm a graduate of the University of Miami. Before joining Forbes I worked as a reporter and editor at Bloomberg where I covered everything from sports to how negative rates impacted the Black-Scholes model.

IPOs Of The Smallest Companies Post Astonishing Failure Rates, But Bankers Still WinI'm a graduate of the University of Miami. Before joining Forbes I worked as a reporter and editor at Bloomberg where I covered everything from sports to how negative rates impacted the Black-Scholes model.

Weiterlesen »

Today’s mortgage rates fall for 30-year terms, while 15-year rates riseMortgage rates fluctuate almost daily based on economic conditions. Here are today’s mortgage rates and what you need to know about getting the best rate.

Today’s mortgage rates fall for 30-year terms, while 15-year rates riseMortgage rates fluctuate almost daily based on economic conditions. Here are today’s mortgage rates and what you need to know about getting the best rate.

Weiterlesen »

More people turning to FHA loans amid rising mortgage ratesFHA loans are now making up a larger portion of mortgage originations than they were two years ago.

Weiterlesen »

Home Sales on Track for Slowest Year Since Housing BustResidential real-estate market hindered by mortgage rates, limited inventory

Home Sales on Track for Slowest Year Since Housing BustResidential real-estate market hindered by mortgage rates, limited inventory

Weiterlesen »

Goldman Sachs upgrades this homebuilder stock, says it can outperform despite higher mortgage ratesThis construction company's focus on sales volume could help push the stock higher as consumer affordability remains tight, Goldman Sachs says.

Goldman Sachs upgrades this homebuilder stock, says it can outperform despite higher mortgage ratesThis construction company's focus on sales volume could help push the stock higher as consumer affordability remains tight, Goldman Sachs says.

Weiterlesen »