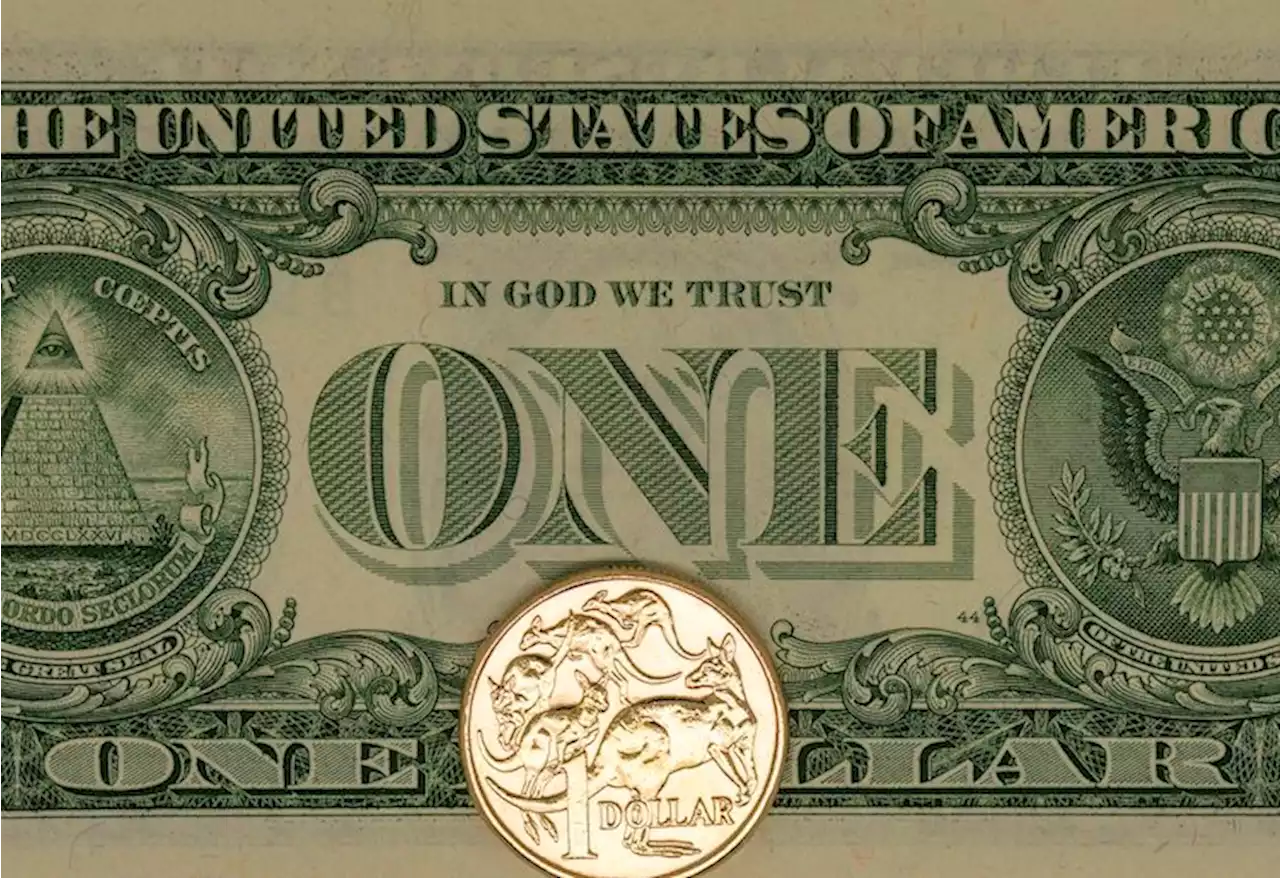

AUD/USD refreshes daily low, seems vulnerable near 0.6725-20 area amid bullish USD – by hareshmenghani AUDUSD Fed Bonds Recession Currencies

The pair is currently placed around the 0.6725-0.6720 region and remains well within the striking distance of its lowest level since early January touched the previous day.regains positive traction and reverses a part of the previous day's sharp retracement slide from a multi-week top, which, in turn, is seen as a key factor weighing on the AUD/USD pair. Growing acceptance that the Fed will stick to its hawkish stance for longer continues to push the US Treasury bond yields higher.

Meanwhile, the overnight optimism led by the upbeat Chinese PMI prints for February fades rather quickly amid looming recession risk. This is evident from a generally softer tone around the equity markets, which lends additional support to the USD and suggests that the path of least resistance for the AUD/USD pair is to the downside. That said, it will still be prudent to wait for sustained weakness below the 0.

Market participants now look forward to the release of the Weekly Initial Jobless Claims data from the US, due later during the early North American session. This, along with the US bond yields and the broader risk sentiment, should influence the USD price dynamics and provide some impetus to the AUD/USD pair.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

AUD/USD recovers further from YTD low, steadily climbs to 0.6775-80 zone amid weaker USDAUD/USD recovers further from YTD low, steadily climbs to 0.6775-80 zone amid weaker USD – by hareshmenghani AUDUSD China Fed Recession Currencies

AUD/USD recovers further from YTD low, steadily climbs to 0.6775-80 zone amid weaker USDAUD/USD recovers further from YTD low, steadily climbs to 0.6775-80 zone amid weaker USD – by hareshmenghani AUDUSD China Fed Recession Currencies

Weiterlesen »

AUD/USD defends 0.6730 as upside looks capped for USD Index, yields extend gainsThe AUD/USD pair has demonstrated a buying interest after dropping to near 0.6730 in the Asian session. The Aussie asset is expected to turn sideways

AUD/USD defends 0.6730 as upside looks capped for USD Index, yields extend gainsThe AUD/USD pair has demonstrated a buying interest after dropping to near 0.6730 in the Asian session. The Aussie asset is expected to turn sideways

Weiterlesen »

AUD/USD Price Analysis: Bulls eye daily trendline resistance and a confluence near 0.6800AUD/USD is making a positive effort for the initial balance of the week, moving up into shorts that built from a breakout below 0.7000 in the middle o

AUD/USD Price Analysis: Bulls eye daily trendline resistance and a confluence near 0.6800AUD/USD is making a positive effort for the initial balance of the week, moving up into shorts that built from a breakout below 0.7000 in the middle o

Weiterlesen »

AUD/USD Price Analysis: Bulls eye a run to test key daily structureAUD/USD is up high in the broadening range on the monthly chart which leaves the bias to the downside, longer term. However, in the meanwhile, there a

AUD/USD Price Analysis: Bulls eye a run to test key daily structureAUD/USD is up high in the broadening range on the monthly chart which leaves the bias to the downside, longer term. However, in the meanwhile, there a

Weiterlesen »

AUD/USD could extend its decline to the 0.6550 mark – SocGenAUD/USD continues its decline toward 0.6700. Further losses toward 0.6660 are on the cards, potentially to 0.6550, economists at Société Générale repo

AUD/USD could extend its decline to the 0.6550 mark – SocGenAUD/USD continues its decline toward 0.6700. Further losses toward 0.6660 are on the cards, potentially to 0.6550, economists at Société Générale repo

Weiterlesen »

AUD/USD Price Analysis: Flat-lines above 0.6700 mark, not out of the woods yetThe AUD/USD pair seesaws between tepid gains/minor losses, though manages to hold its neck above the 0.6700 mark heading into the North American sessi

AUD/USD Price Analysis: Flat-lines above 0.6700 mark, not out of the woods yetThe AUD/USD pair seesaws between tepid gains/minor losses, though manages to hold its neck above the 0.6700 mark heading into the North American sessi

Weiterlesen »