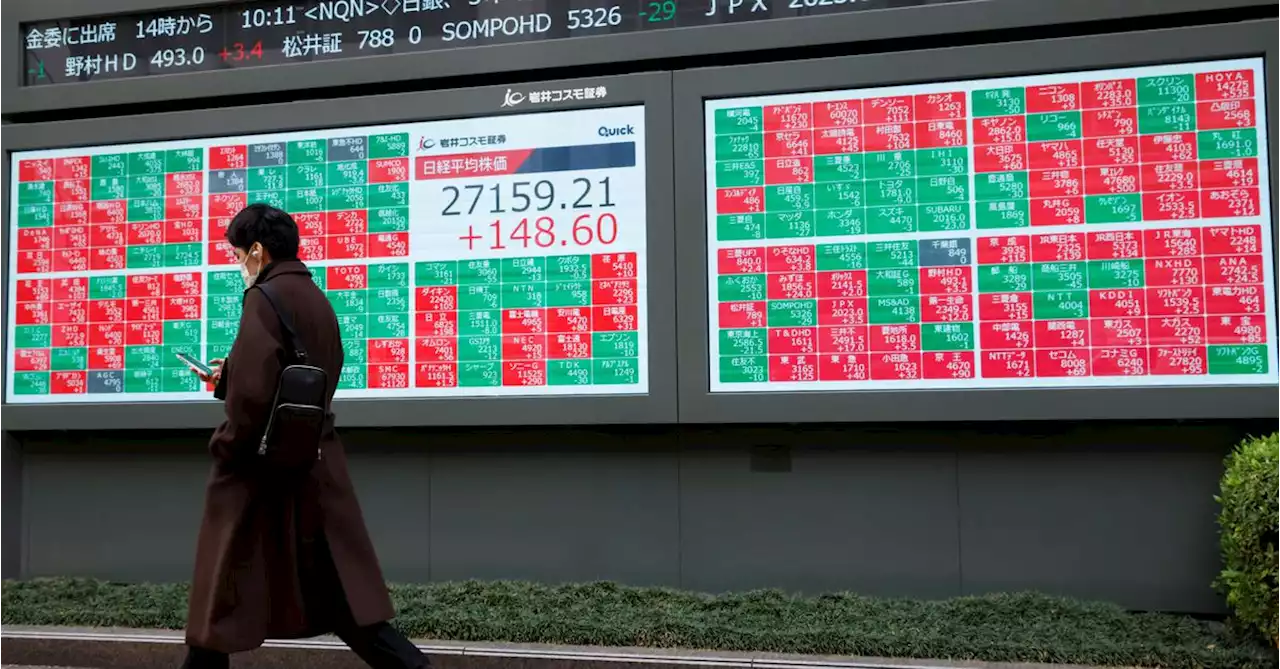

Trade nevertheless remained tense and volatile as contagion fears stalked financial shares.

In a little over a week, the fallout from the collapse of Silicon Valley Bank - which has roiled confidence in the banking system - has brought a globally systemic lender to its knees.for 3 billion francs and assume up to $5.4 billion in losses, in a shotgun merger engineered by Swiss authorities.

"The best we can say was there are certainly a lot of concerns about Credit Suisse contagion risk," said Rodrigo Catril, a senior currency strategist at National Australia Bank in Sydney.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Asia markets set to fall as UBS agrees to $3.2 billion takeover of Credit SuisseAsian markets trade lower as investors assess UBS' $3.2 billion purchase of Credit Suisse

Asia markets set to fall as UBS agrees to $3.2 billion takeover of Credit SuisseAsian markets trade lower as investors assess UBS' $3.2 billion purchase of Credit Suisse

Weiterlesen »

Asia markets mostly fall after UBS agrees to $3.2 billion takeover of Credit SuisseAsian markets trade lower as investors assess UBS' $3.2 billion purchase of Credit Suisse

Asia markets mostly fall after UBS agrees to $3.2 billion takeover of Credit SuisseAsian markets trade lower as investors assess UBS' $3.2 billion purchase of Credit Suisse

Weiterlesen »

U.S. stock-market futures edge higher after historic deal to rescue Credit SuisseU.S. stock-index futures opened with modest gains Sunday evening as investors assessed a historic deal to rescue troubled Swiss lender Credit Suisse as...

U.S. stock-market futures edge higher after historic deal to rescue Credit SuisseU.S. stock-index futures opened with modest gains Sunday evening as investors assessed a historic deal to rescue troubled Swiss lender Credit Suisse as...

Weiterlesen »

Stock futures nudge higher on Credit Suisse buyoutU.S. stock futures rose in Asian trade on Monday in relief at a weekend rescue deal for Credit Suisse, though the mood was nervous and financial shares remained under pressure from contagion fears, even with support from global central banks.

Stock futures nudge higher on Credit Suisse buyoutU.S. stock futures rose in Asian trade on Monday in relief at a weekend rescue deal for Credit Suisse, though the mood was nervous and financial shares remained under pressure from contagion fears, even with support from global central banks.

Weiterlesen »

Credit Suisse shares soar after central bank aid announcedCredit Suisse’s shares soared 30% on Thursday after it announced it will move to shore up its finances by borrowing up to nearly $54 billion from the Swiss central bank.

Credit Suisse shares soar after central bank aid announcedCredit Suisse’s shares soared 30% on Thursday after it announced it will move to shore up its finances by borrowing up to nearly $54 billion from the Swiss central bank.

Weiterlesen »

Near ‘cliff’s edge,’ Credit Suisse not seen as systemic riskLongtime troubles at Credit Suisse came to a head this week with a record stock plunge that spread fears of a banking crisis jumping from the U.S. to Europe. But the problems have been building for years at Switzerland’s second-largest bank, ranging from bad bets on hedge funds to a spying scandal involving rival lender UBS.

Near ‘cliff’s edge,’ Credit Suisse not seen as systemic riskLongtime troubles at Credit Suisse came to a head this week with a record stock plunge that spread fears of a banking crisis jumping from the U.S. to Europe. But the problems have been building for years at Switzerland’s second-largest bank, ranging from bad bets on hedge funds to a spying scandal involving rival lender UBS.

Weiterlesen »