Over the past few years, credit card balances were paid down and delinquent accounts became less common, but those gains could evaporate with soaring inflation.

Over the past few years, credit card balances were paid down and delinquent accounts became less common. But two years after the COVID-19 pandemic began, those trends — spurred by increased savings and relief programs — could evaporate, especially as inflation soars.Over the past few years, credit card balances were paid down and delinquent accounts became less common.

It was the first time since at least 1999 that credit card balances were at 21% of their limits. They hit 20% in the first three quarters of 2021. Tap to View Those national balances rose in the third and fourth quarter of the past year, but the end of the year has come with credit card balance increases in each of the past five years, as spending rises toward the holiday season. When data for the first quarter of 2022 is released in coming weeks, it will indicate whether this most recent jump was seasonal or the start of a more sustained climb.

Fewer accounts moved into delinquency The share of newly delinquent credit card accounts began falling in the second quarter of 2020, when the pandemic was getting into its early full swing. This downward slope has continued since. As of the last quarter of 2021, it stood at 4.1%, the lowest in at least 18 years, according to the New York Fed.

What might reverse these positive trends Pandemic relief programs such as rental assistance, mortgage forbearances, advanced child tax credits and stimulus payments all contributed to Americans saving more. This increase in personal savings meant having more money to pay for goods and services outright, and more money to pay down debt. But as these programs have subsided, so has the personal saving rate.

Don’t spend more than you can pay off in a single month Paying off your balance each month keeps your credit healthy, perhaps even “excellent” according to the credit bureaus’ systems. The myth that you have to carry debt to keep improving your credit is just that, a myth.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Surging prices force consumers to ask: Can I live without it?Consumer spending habits are starting to shift as inflation rises and people emerge from the pandemic.

Surging prices force consumers to ask: Can I live without it?Consumer spending habits are starting to shift as inflation rises and people emerge from the pandemic.

Weiterlesen »

As Landlords Intensify Tenant Background Checks, Some Lawmakers Want New Limits On ScreeningDemands for high income, stellar credit and proof of payment during the pandemic have left many renters unable to find new housing.

As Landlords Intensify Tenant Background Checks, Some Lawmakers Want New Limits On ScreeningDemands for high income, stellar credit and proof of payment during the pandemic have left many renters unable to find new housing.

Weiterlesen »

White House shrugs off student debt cancellation inflation concernsThe White House downplayed concerns that President JoeBiden forgiving certain federal student loan debt will worsen inflation.

White House shrugs off student debt cancellation inflation concernsThe White House downplayed concerns that President JoeBiden forgiving certain federal student loan debt will worsen inflation.

Weiterlesen »

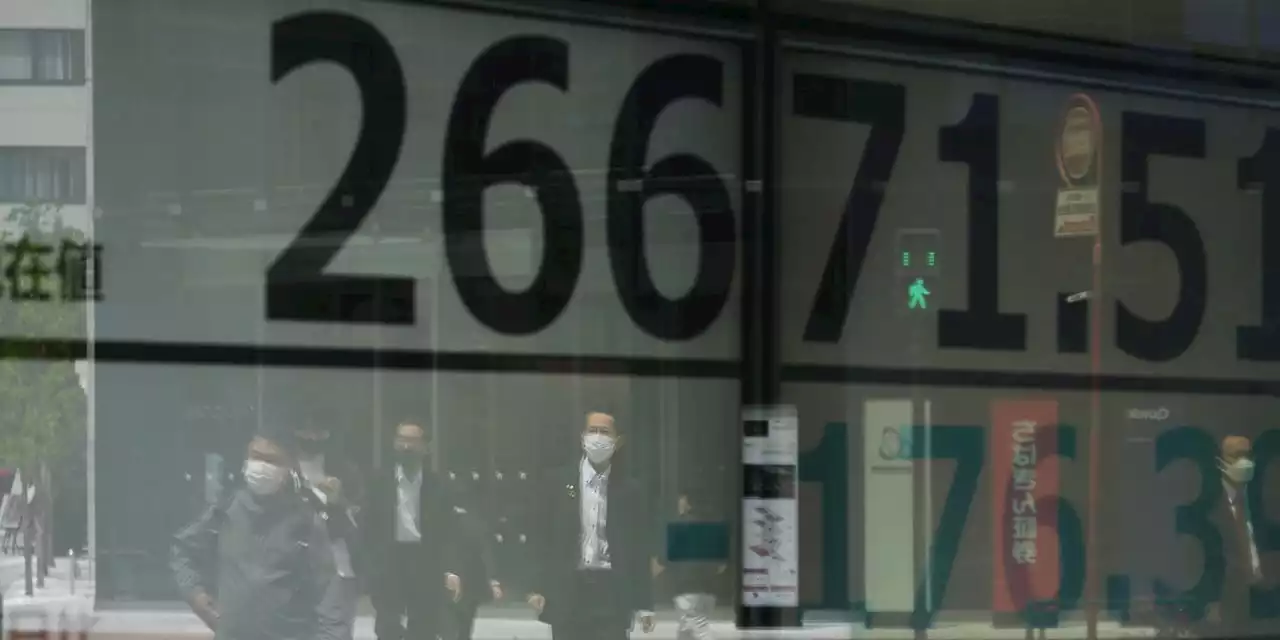

Asian markets fall in thin trading after last week's rout on Wall StreetAsian shares slipped Monday lower following a sell-off last week on Wall Street as investors fretted over the impact on regional economies from inflation,...

Asian markets fall in thin trading after last week's rout on Wall StreetAsian shares slipped Monday lower following a sell-off last week on Wall Street as investors fretted over the impact on regional economies from inflation,...

Weiterlesen »

Supreme Court Says Boston Should Have Allowed Christian Flag on City Property“Boston’s flag-raising program does not express government speech,” Justice Stephen Breyer wrote for the Supreme Court, which reversed a lower court’s judgment.

Supreme Court Says Boston Should Have Allowed Christian Flag on City Property“Boston’s flag-raising program does not express government speech,” Justice Stephen Breyer wrote for the Supreme Court, which reversed a lower court’s judgment.

Weiterlesen »

Real estate expert on whether home prices could come down amid Fed rate hikesFirst American Financial Corporation chief economist Mark Fleming discussed whether home prices could decrease amid expected rate hikes from the Federal Reserve as a way to tame surging inflation.

Real estate expert on whether home prices could come down amid Fed rate hikesFirst American Financial Corporation chief economist Mark Fleming discussed whether home prices could decrease amid expected rate hikes from the Federal Reserve as a way to tame surging inflation.

Weiterlesen »